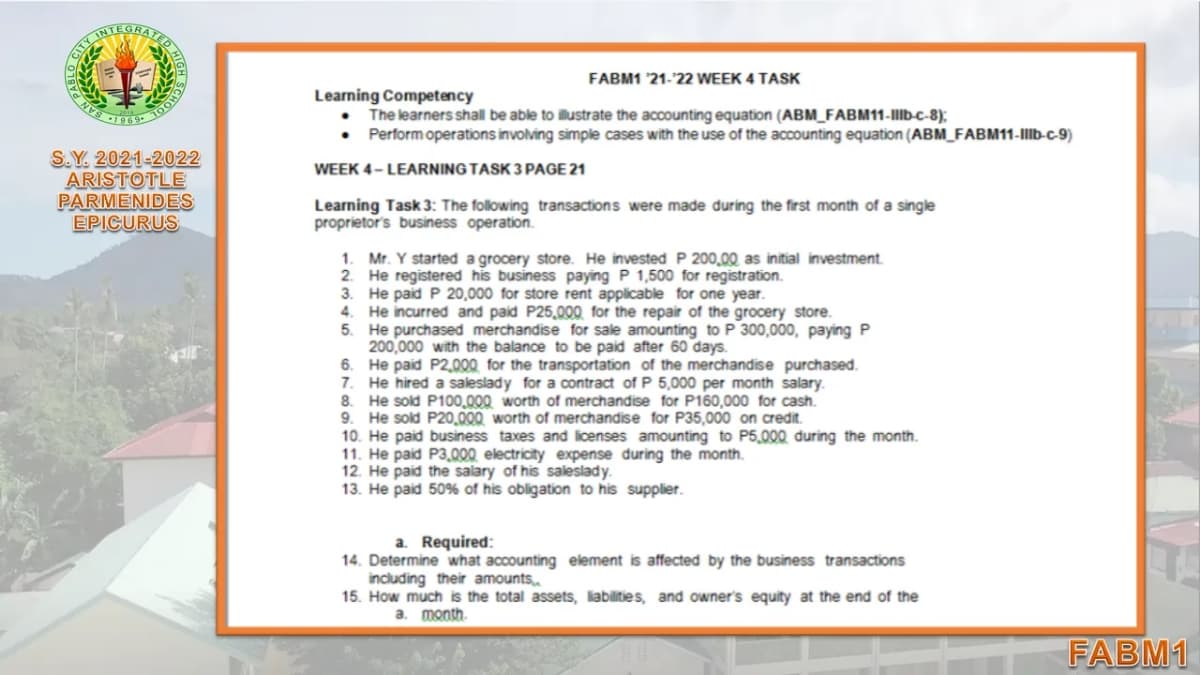

FABM1 '21-'22 WEEK 4 TASK Learning Competency The learners shall be able to ilustrate the accounting equation (ABM_FABM11-lb-c-8); • Perform operations involving simple cases with the use of the accounting equation (ABM_FABM11-Ib-C-9) WEEK 4- LEARNING TASK 3 PAGE 21 Learning Task 3: The following transactions were made during the first month of a single proprietor's business operation. 1. Mr. Y started a grocery store. He invested P 200,00 as initial investment. 2. He registered his business paying P 1,500 for registration. 3. He paid P 20,000 for store rent applicable for one year. 4. He incurred and paid P25,.000 for the repair of the grocery store. 5. He purchased merchandise for sale amounting to P 300,000, paying P 200,000 with the balance to be paid after 60 days. 6. He paid P2,000 for the transportation of the merchandise purchased. 7. He hired a saleslady for a contract of P 5,000 per month salary. 8. He sold P100,000 worth of merchandise for P160,000 for cash. 9. He sold P20,000 worth of merchandise for P35,000 on credit. 10. He paid business taxes and licenses amounting to P5,000 during the month. 11. He paid P3,000 electricity expense during the month. 12. He paid the salary of his saleslady. 13. He paid 50% of his obligation to his supplier. a. Required: 14. Determine what accounting element is affected by the business transactions including their amounts 15. How much is the total assets, labilities, and owner's equity at the end of the month

FABM1 '21-'22 WEEK 4 TASK Learning Competency The learners shall be able to ilustrate the accounting equation (ABM_FABM11-lb-c-8); • Perform operations involving simple cases with the use of the accounting equation (ABM_FABM11-Ib-C-9) WEEK 4- LEARNING TASK 3 PAGE 21 Learning Task 3: The following transactions were made during the first month of a single proprietor's business operation. 1. Mr. Y started a grocery store. He invested P 200,00 as initial investment. 2. He registered his business paying P 1,500 for registration. 3. He paid P 20,000 for store rent applicable for one year. 4. He incurred and paid P25,.000 for the repair of the grocery store. 5. He purchased merchandise for sale amounting to P 300,000, paying P 200,000 with the balance to be paid after 60 days. 6. He paid P2,000 for the transportation of the merchandise purchased. 7. He hired a saleslady for a contract of P 5,000 per month salary. 8. He sold P100,000 worth of merchandise for P160,000 for cash. 9. He sold P20,000 worth of merchandise for P35,000 on credit. 10. He paid business taxes and licenses amounting to P5,000 during the month. 11. He paid P3,000 electricity expense during the month. 12. He paid the salary of his saleslady. 13. He paid 50% of his obligation to his supplier. a. Required: 14. Determine what accounting element is affected by the business transactions including their amounts 15. How much is the total assets, labilities, and owner's equity at the end of the month

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:NTEGRATE

FABM1 21-22 WEEK 4 TASK

Learning Competency

• The learners shall be able to illustrate the accounting equation (ABM_FABM11-llb-c-8);

Perform operations involving simple cases with the use of the accounting equation (ABM_FABM11-Illb-c-9)

S.Y. 2021-2022

ARISTOTLE

PARMENIDES

EPICURUS

WEEK 4- LEARNING TASK 3 PAGE 21

Learning Task 3: The following transactions were made during the first month of a single

proprietor's business operation.

1. Mr. Y started a grocery store. He invested P 200,00 as initial investment.

2. He registered his business paying P 1,500 for registration.

3. He paid P 20,000 for store rent applicable for one year.

4. He incurred and paid P25,000 for the repair of the grocery store.

5. He purchased merchandise for sale amounting to P 300,000, paying P

200,000 with the balance to be paid after 60 days.

6. He paid P2,000 for the transportation of the merchandise purchased.

7. He hired a saleslady for a contract of P 5,000 per month salary.

8. He sold P100,000 worth of merchandise for P160,000 for cash.

9. He sold P20,000 worth of merchandise for P35,000 on credit.

10. He paid business taxes and licenses amounting to P5,000 during the month.

11. He paid P3,000, electricity expense during the month.

12. He paid the salary of his saleslady.

13. He paid 50% of his obligation to his supplier.

a. Required:

14. Determine what accounting element is affected by the business transactions

including their amounts

15. How much is the total assets, liabilities, and owner's equity at the end of the

a. month.

FABM1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education