Facts for Questions 19-21 Gould Beverages Company ("GBC") began the month of March with 600 cases of soda in Inventory for which it paid $6.00 per case. The transactions set forth below occurred during the month of March. GBC sold each case of soda for $12.00. GBC uses a perpetual inventory system. March 4: GBC buys 360 cases of soda for a total cost of $2,106. March 7: GBC returns 40 defective cases of soda from the March 4" order. GBC sells 240 cases of soda for a total of $2,880. March 12: GBC sells 110 cases of soda for a total of $1,320. March 16: GBC sells 290 cases of soda for a total of $3,480. March 21: GBC buys 300 cases of soda for a total cost of $1,770. March 23: GBC sells 150 cases of soda for a total of $1,800. March 26: GBC sells 320 cases of soda for a total of $3,840. March 29: GBC buys 140 cases of soda for a total cost of $875. GBC undertook a physical inventory count on March 31 and determined it held 370 remaining cases of soda in Inventory. Question 19. If Gould Beverages Company ("GBC") uses the FIFO method, what is the value of GBC's COGS? (A) $6,593 (B) $5,203 (C) $8,117 (D) $6,727

Facts for Questions 19-21 Gould Beverages Company ("GBC") began the month of March with 600 cases of soda in Inventory for which it paid $6.00 per case. The transactions set forth below occurred during the month of March. GBC sold each case of soda for $12.00. GBC uses a perpetual inventory system. March 4: GBC buys 360 cases of soda for a total cost of $2,106. March 7: GBC returns 40 defective cases of soda from the March 4" order. GBC sells 240 cases of soda for a total of $2,880. March 12: GBC sells 110 cases of soda for a total of $1,320. March 16: GBC sells 290 cases of soda for a total of $3,480. March 21: GBC buys 300 cases of soda for a total cost of $1,770. March 23: GBC sells 150 cases of soda for a total of $1,800. March 26: GBC sells 320 cases of soda for a total of $3,840. March 29: GBC buys 140 cases of soda for a total cost of $875. GBC undertook a physical inventory count on March 31 and determined it held 370 remaining cases of soda in Inventory. Question 19. If Gould Beverages Company ("GBC") uses the FIFO method, what is the value of GBC's COGS? (A) $6,593 (B) $5,203 (C) $8,117 (D) $6,727

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

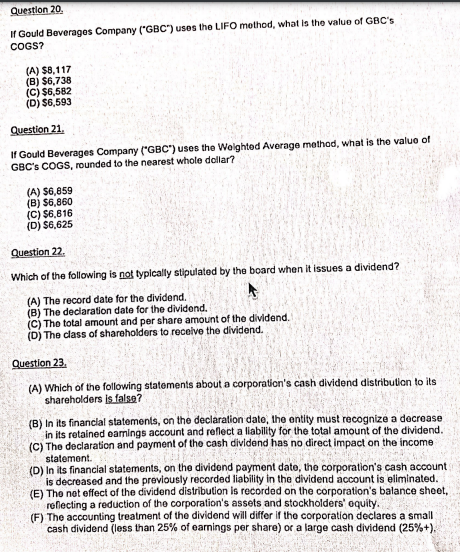

Transcribed Image Text:Question 20.

If Gould Beverages Company ("GBC") uses the LIFO method, what is the value of GBC's

COGS?

(A) $8,117

(B) $6,738

(C) $6,582

(D) $6,593

Question 21.

If Gould Beverages Company ("GBC") uses the Wolghted Average method, what is the valuo of

GBC's COGS, rounded to the nearest whole dollar?

(A) S6,859

(B) $6,860

(C) $6,816

(D) $6,625

Question 22.

Which of the following is not typlcally stipulated by the board when it issues a dividend?

(A) The record date for the dividend.

(B) The declaration date for the dividend.

(C) The total amount and per share amount of the dividend.

(D) The class of shareholders to receive the dividend.

Question 23.

(A) Which of the following statements about a corporation's cash dividend distribulion to its

shareholders is false?

(B) In its financlal statements, on the declaration date, the entity must recognize a decrease

in its retained eamings account and reflect a liability for the total amount of the dividend.

(C) The declaration and payment of the cash divldend has no direct impact on the income

statement.

(D) In its financilal statements, on the dividond payment date, the corporation's cash account

is decreased and the previously recorded liability in the dividend account is eliminated.

(E) The net effect of the dividend distribution is recorded on the corporation's balance sheet,

reflecting a reduction of the corporation's assets and stockholders' oquity.

(F) The accounting treatment of the dividend will differ if the corporation declares a small

cash dividend (less than 25% of earnings per share) or a large cash dividend (25%+).

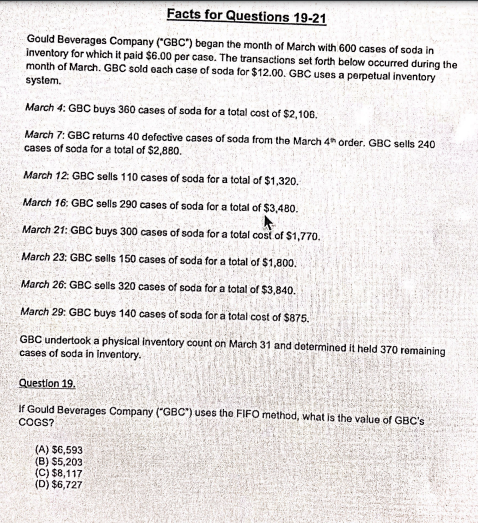

Transcribed Image Text:Facts for Questions 19-21

Gould Beverages Company ("GBC") began the month of March with 600 cases of soda in

inventory for which it paid $6.00 per case. The transactions set forth below occurred during the

month of March. GBC sold each case of soda for $12.00. GBC uses a perpetual inventory

system.

March 4: GBC buys 360 cases of soda for a total cost of $2,106.

March 7: GBC returns 40 defective cases of soda from the March 4h order. GBC sells 240

cases of soda for a total of $2,880.

March 12: GBC sells 110 cases of soda for a total of $1,320.

March 16: GBC sells 290 cases of soda for a total of $3,480.

March 21: GBC buys 300 cases of soda for a total cost of $1,770.

March 23: GBC sells 150 cases of soda for a total of $1,800.

March 26: GBC sells 320 cases of soda for a total of $3,840.

March 29: GBC buys 140 cases of soda for a total cost of $875.

GBC undertook a physical inventory count on March 31 and determined it held 370 romaining

cases of soda in inventory.

Questlon 19.

If Gould Beverages Company ("GBC") uses the FIFO method, what is the value of GBC's

COGS?

(A) 56,593

(B) $5,203

(C) $8,117

(D) $6,727

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education