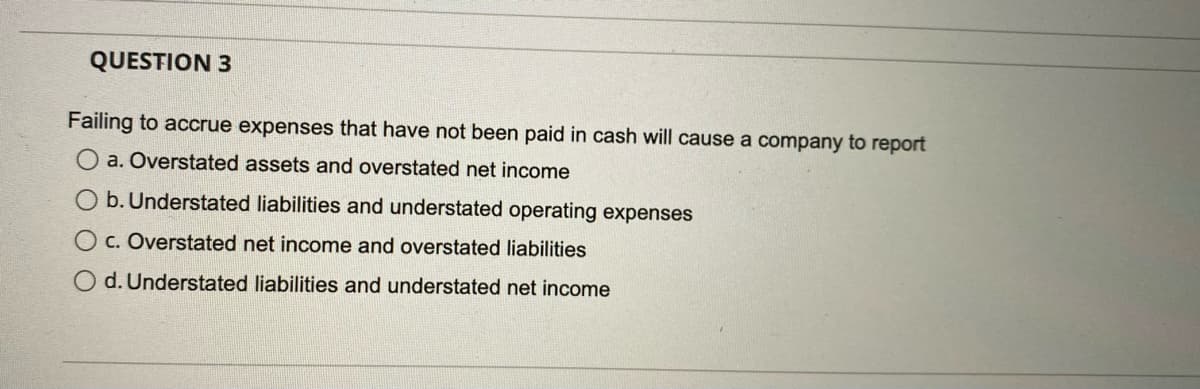

Failing to accrue expenses that have not been paid in cash will cause a company to report O a. Overstated assets and overstated net income b. Understated liabilities and understated operating expenses O c. Overstated net income and overstated liabilities O d. Understated liabilities and understated net income

Q: Rodger owns 100 percent of the shares in Trevor Incorporated a C corporation. Assume the following…

A: In this question, we will calculate that how much cash does Rodger have from the dividend after…

Q: TB TF Qu. 09-28 (Static) The amount of Federal Insurance Contributions Act (FICA) tax. The amount of…

A: In this question, we just ask that the statement is True or False.

Q: ng inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30…

A: As per the guidelines, only three subparts are allowed to be solved. Please resubmit the question…

Q: Young Inc. produces plastic bottles. Production of 16-ounce bottles has a standard unitquantity of…

A: Variance refers to the difference of budgeted and actual figures for items of revenues and expense.

Q: Pigot Corporation uses job costing and has two production departments, M and A. Budgeted…

A: Overhead rate = Factory overhead costs / Direct labor costs Applied Factory overhead costs = Direct…

Q: Wayne received dividend cheques from his brother's business totaling $32 but did not receive a T5…

A: Dividends: Dividends address the dissemination of corporate benefits to investors, in light of the…

Q: Debt Crisis Solutions: The sovereign debt crisis is a complex combination of failed sovereign state…

A: Debt Crisis Debt crisis which is described as the inefficiency of the country to meet the debt…

Q: Offenbach & Son has just made its sales forecasts and its marketing department estimates that the…

A: The production budget is prepared to record the estimated units to be produced during the period.

Q: Required information [The following information applies to the questions displayed below.] This year…

A: Cash Method Accounting- Cash accounting is a secretarial method where payment receipts are recorded…

Q: Why is it advantageous for a company to finance its receivables?

A: Company gets immediate access to cash without waiting a long period for the debtors/ receivables to…

Q: Halcrow Yolles purchased equipment for new highway construction in Manitoba, Canada, costing…

A: Depreciation is an accounting method for allocating the cost of a tangible or physical asset over…

Q: A company reports the following information for its direct labor. Actual hourn of direct labor used…

A: When actual hours/price is higher than standard then it is unfavorable and vice versa is favorable.

Q: On January 1, Whispering Corporation issues a $140,000, 10-year non-interest-bearing note to Camden…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: For each ratio listed, identify whether the change in ratio value from the Prior Year te favorable…

A: Financial ratios help in judging the profitability, solvency, and activity of a business…

Q: How much is the Justed capital saran on Jul 20167 2. How much cash will Matteo invest? 3. What is…

A: Sarah Balance sheet as on 30/06/2018 Liabilities Assets Sarah Capital 6400000 Cash 800000…

Q: k requested a projected income statement and cash budget for May. following information is…

A: A 1) Production Budget April May June Budgeted sales unit 600,000 500,000 600,000 ADD:…

Q: E20-4 Journal Entries for Unrestricted Current Fund The following are selected transactions of the…

A: Journal Entries For transaction in Unrestricted Current fund Date Particular Debit Credit 1…

Q: a. What is the minimum amount of income Stephanie should recognize for tax purposes this year if she…

A: Accrual Method of Accounting means that revenue should be recognized when it is earned but not when…

Q: Nicanor, a resident citizen residing in Sampaloc, Manila, deposited $2,000 in BPI, Morayta Branch, a…

A: Tax in the Philippines is governed by Section 28 of The Constitution of the Philippines and three…

Q: What was Sam's appraisal cost for quality last year? Annraisal

A: Appraisal costs are fees a company pays to detect defects in its products ahead of delivering them…

Q: 23. The Blue Plate Co. is operating at 50% capacity producing 100,000 units of ceramic plates a…

A: This is a question that requires anaysis of relevant cost of two different alternative that are…

Q: During April of the current year, Ronen purchased a warehouse that he used for business purposes.…

A: In the given case, as the asset is purchased in April month of the current year, it falls in the 4th…

Q: ROI and 2019 ROE

A: The data of WIPER INC Is given to determine ROI and ROE . ROI means return on investment. ROE means…

Q: traditional debt and alternative financing instruments

A: The finance is required by the company in order to fulfill its capital requirement. The funds are…

Q: Beginning inventory, purchases, and sales for Item Copper are as follows: Mar. 1 Inventory 450 units…

A: FIFO states that the inventory purchased first would be sold first by the company. Whereas, LIFO…

Q: variable costs by 25% on the net profit, if that increase was the result of

A: Answer

Q: For a construction job, a contractor can haul rock by means of an ordinary 10 cubic yard dump truck,…

A: Fixed Cost- Fixed costs do not alter in response to income fluctuations and stay constant. The…

Q: Operating profit is affected by changes in production under both the variable costing and absorption…

A: Operating profit is profit earned by the company from its primary or core purpose of the business.…

Q: Delaney Company is considering replacing equipment that originally cost $600,000 and has accumulated…

A: Sunk cost is the cost that has already been incurred and that does not affect the future course of…

Q: Required information Exercise 10-3A Record the issuance of common stock (LOo10-2) [The following…

A: Journal entries are used to record the transactions of business in a chronological order. Excess of…

Q: If an estimate of a contingent loss made in good faith turns out to be incorrect, the financial…

A: Contingent loss: It implies to a loss that may arise in the near future based on the happening or…

Q: If the cost of money is 14%, how much is the annual cost of the lowest ollel

A: Answer

Q: a. Determine the character of each gain and loss. b. Complete the Section 1231 netting process and…

A: Answer:

Q: chandise from Sabol Imports Co., $13,201, tern chandise from Saxon Co., $10,050, terms FOB was added…

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Bellie Merchandise manufactures two products. Product A has 800 units produced, require 200 material…

A: Using activity based costing, the overhead cost of different activities is applied to the products…

Q: Which of the following statements about the quality of earnings ratio is true? Multiple Choice…

A: Lets understand the basics. Quality of earning ratio indicates the cashflow from operating activity…

Q: Accounts Debit Credit (OMR) (OMR) Cash 120,000 Capital n00,000 Prepaid insurance 5600 Salary expense…

A: Lets understand the basics. Income statement is prepared by the business to know the net result of…

Q: ts. Before any year-enc oubtful Accounts had Accounts will be based

A: Calculation of balance of allowance for uncollectible accounts Days account outstanding amount…

Q: 21. Facts: Earnest and Old (EO), is partnership established under the laws of the Philippines.…

A: In the context of the given question, we are required to compute, whether the income of Mr. Nicanor…

Q: Shi Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the…

A: Given: Free cash retained - $26,200 Unpaid taxes claimed by the government - $7,000 Owed Salary to…

Q: Calculate the horizontal (trend) analysis, and horizontal % change for 2020, 2019, 2018 in excel.…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: t the net cash flows below, what is the value of x if the rate of return is 107 (select the losest…

A: Rate of return = 10% Year Net cash flow 0 -13000 1 -29000 2 -25000 3 X 4 -8000

Q: Maritza (which means "star of the sea") Joseph is preparing the 2022 budget for one of CK's kayaks.…

A: In this question, we will make : 1) production budget 2) sales Budget 3) Direct material Budget

Q: A Corporation owns 10 percent of D Corporation. D Corporation earns a total of $201.9 million before…

A: (Assuming marginal tax rate on non dividend income for both corporation A and D= 21% i.e 0.21) a)…

Q: fers two credit terms to YVONE as follows: Credit term number 1: 2/15, net 30 C

A: A term that helps in indicating when the amount of payment is due for the sales and made on credit…

Q: Find the percent markup based on selling price, if the percent markup based on the cost is 18%.

A: Solution... Markup on cost = 18% Markup on sales = ?

Q: Accounting Discuss the main types of auditing according to its objectives with giving examples for…

A: Audit is an independent examination of financial information of an entity weather profit-oriented or…

Q: Réquired Use the following information for the Exercises below. (Static) (The following information…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: Alpha Company is considering the purchase of Beta Company. Alpha has collected the following data…

A: A 1) Compute average earning per annum Particulars Amount Cumulative Earnings 850,000…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Answer both parts otherwise I will give down vote 1(a). A company can report a net income and negative cash flows from operations both at the same time. True or False? 1 (b) . Which of these accounts can be found in the post-closing trial balance? choices - Assets, liabilities, owner’s capital and their corresponding contra accounts - Income and expenses - Assets, liabilities, owner’s capital, and owner’s drawings - Assets and liabilitiesUnder accrual accounting: Group of answer choices a)Revenue cannot be recognized until cash is received from customers b)Net income must be the same as the change in cash during a period c)Revenues are recognized in the period in which goods and services are provide to customers d)Expense cannot be recognized until cash is paid for goods or servicesQUESTION 24 Which of the following is an incorrect statement? Income - Expenses = Operating Incom Current Assets - Current Liabilities = Net Working Capital Net Profit = EBT - Taxes Operating Income - Interest PMT = Gross Profit Expenses = CGS + Operating Expenses

- Multiple choice 1. The income statement debit column exceeds the income statement credit column on a worksheet. This indicates: A. a net income for the company B. a net loss for the company C. mistakes were made in the preparation of the worksheet D. the owner's capital account decreased during the period1. Which statement about accrual basis of accounting is incorrect? A. Accrual accounting adheres to the matching principle.B. Accrual accounting ignores the timing of cash flows in the business.C. Under accrual basis, a deferral is a transaction that impacts cash before impacting the income statement.D. none of the aboveCh2 Question 15: In which financial statement is the accounting equation displayed? Answer: A. Income statement B. Statement of owner's equity C. Balance sheet D. Statement of cash flows Question 16: When expenses exceed revenues, what is the name of the final figure in the income statement? Answer: A. Net Loss B. Withdrawals C. Ending Owner's Equity D. Net Income

- . RequiredState whether each item is reported:1. in the statement of financial position2. in profit or loss in the statement of profit or loss and other comprehensive income3. as other comprehensive income in the statement of profit or loss and other comprehensive income4. in the statement of changes in equity5. in the notes to the financial statements.Item How item is reported in financial statements(a) contingent liabilities(b) the effect on retained earnings of the correction of a prior period error(c) cash and cash equivalents(d) capital contributed during the year(e) revaluation gain on land (not reversing any previous revaluation)(f) judgements that management has made in classifying financial assets(g) income tax expense(h) Provisions1.Assets = Liabilities + (Owner, Capital - Owner, Withdrawal + Revenues - Expenses)2. What is a company's financial obligation that results in the company’s future sacrifices of economic benefits to other entities or businesses?3. What is considered as the residual claims on assets?4. What do you call the chronological record of all the financial transactions of a business which is also known as the book of original entry?5. TRUE or FALSE? Debit means increases while credit means decreases.6. What accounting principle dictates that companies recognize revenue as it is earned, and not when they receive payment?7. Which of the four accounts is NOT a liability? Unearned revenue; Accrued expense; Accounts payable; Accounts receivable8. The following accounts must be closed at the of the accounting period, EXCEPT: Equity, revenue, expense, income summary9. What inventory system continuously estimates the inventory based on the running electronic…Identify whether a Debit or a Credit. 1. Which contra-asset account is an accumulated depreciation? 2. Which account should be filled when a company’s cash account is increased? 3. Which is the normal balance for contra asset accounts? 4. Which account should be filled when a company’s capital is increased?

- 8. Cash a/c has a debit balance True False 9. Capital brought in by the proprietor is an example of Increase in Asset and increase in Liability Increase in Liability and decrease in Asset Increase in Asset & decrease in liability 10.Which of the following is correct about a company’s Balance sheet? d). It is unnecessary if both an Income statement and cash flow statements are available. a). It is an expansion of the basic accounting equation: Asset= Liabilities + equity b). It displays sources and uses of cash for the period c). It is sometimes referring to as a statement of change in financial positionQB) Choose the correct answer: 5. Temporary accounts would not include: Select one: a. Depreciation expense. b. Salaries payable. c. Cost of goods sold. d. Supplies expense. 6. Operating cash outflows would include: Select one: a. Purchases of inventory b. Purchase of equipment. c. Purchase of investments. d. Repayment of bank loan.Question: 1) Monetary concept states that: option: A. Both financial and non -financial information should be recorded in the Balance Sheet. B. a business should only record an accounting transaction if it can be expressed in terms of money. C. focus of accounting transactions is on qualitative information, rather than on quantitative information D. A and C required: please answer this question by choosing the right option.