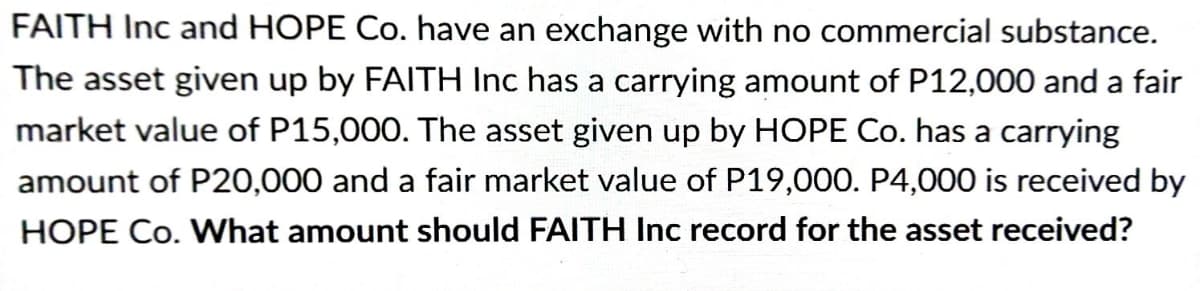

FAITH Inc and HOPE Co. have an exchange with no commercial substance. The asset given up by FAITH Inc has a carrying amount of P12,000 and a fair market value of P15,000. The asset given up by HOPE Co. has a carrying amount of P20,000 and a fair market value of P19,000. P4,000 is received by HOPE Co. What amount should FAITH Inc record for the asset received?

FAITH Inc and HOPE Co. have an exchange with no commercial substance. The asset given up by FAITH Inc has a carrying amount of P12,000 and a fair market value of P15,000. The asset given up by HOPE Co. has a carrying amount of P20,000 and a fair market value of P19,000. P4,000 is received by HOPE Co. What amount should FAITH Inc record for the asset received?

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 37CE

Related questions

Question

Transcribed Image Text:FAITH Inc and HOPE Co. have an exchange with no commercial substance.

The asset given up by FAITH Inc has a carrying amount of P12,000 and a fair

market value of P15,000. The asset given up by HOPE Co. has a carrying

amount of P20,000 and a fair market value of P19,000. P4,000 is received by

HOPE Co. What amount should FAITH Inc record for the asset received?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you