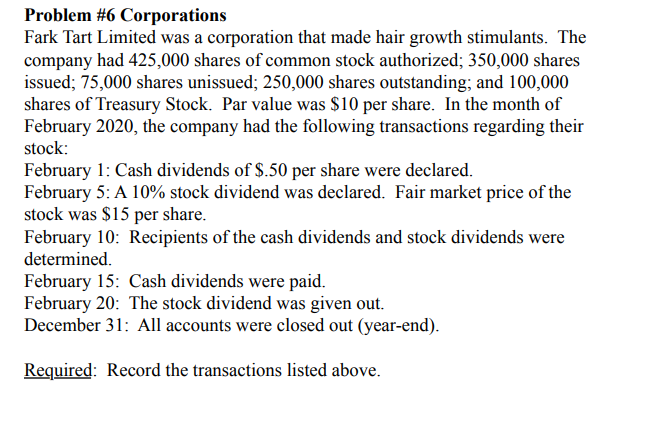

Fark Tart Limited was a corporation that made hair growth stimulants. The company had 425,000 shares of common stock authorized; 350,000 shares issued; 75,000 shares unissued; 250,000 shares outstanding; and 100,000 shares of Treasury Stock. Par value was $10 per share. In the month of February 2020, the company had the following transactions regarding their stock: February 1: Cash dividends of $.50 per share were declared. February 5: A 10% stock dividend was declared. Fair market price of the stock was $15 per share. February 10: Recipients of the cash dividends and stock dividends were determined. February 15: Cash dividends were paid. February 20: The stock dividend was given out. December 31: All accounts were closed out (year-end). Required: Record the transactions listed above.

Fark Tart Limited was a corporation that made hair growth stimulants. The company had 425,000 shares of common stock authorized; 350,000 shares issued; 75,000 shares unissued; 250,000 shares outstanding; and 100,000 shares of Treasury Stock. Par value was $10 per share. In the month of February 2020, the company had the following transactions regarding their stock: February 1: Cash dividends of $.50 per share were declared. February 5: A 10% stock dividend was declared. Fair market price of the stock was $15 per share. February 10: Recipients of the cash dividends and stock dividends were determined. February 15: Cash dividends were paid. February 20: The stock dividend was given out. December 31: All accounts were closed out (year-end). Required: Record the transactions listed above.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.13AMCP

Related questions

Question

help

Transcribed Image Text:Problem #6 Corporations

Fark Tart Limited was a corporation that made hair growth stimulants. The

company had 425,000 shares of common stock authorized; 350,000 shares

issued; 75,000 shares unissued; 250,000 shares outstanding; and 100,000

shares of Treasury Stock. Par value was $10 per share. In the month of

February 2020, the company had the following transactions regarding their

stock:

February 1: Cash dividends of $.50 per share were declared.

February 5: A 10% stock dividend was declared. Fair market price of the

stock was $15 per share.

February 10: Recipients of the cash dividends and stock dividends were

determined.

February 15: Cash dividends were paid.

February 20: The stock dividend was given out.

December 31: All accounts were closed out (year-end).

Required: Record the transactions listed above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning