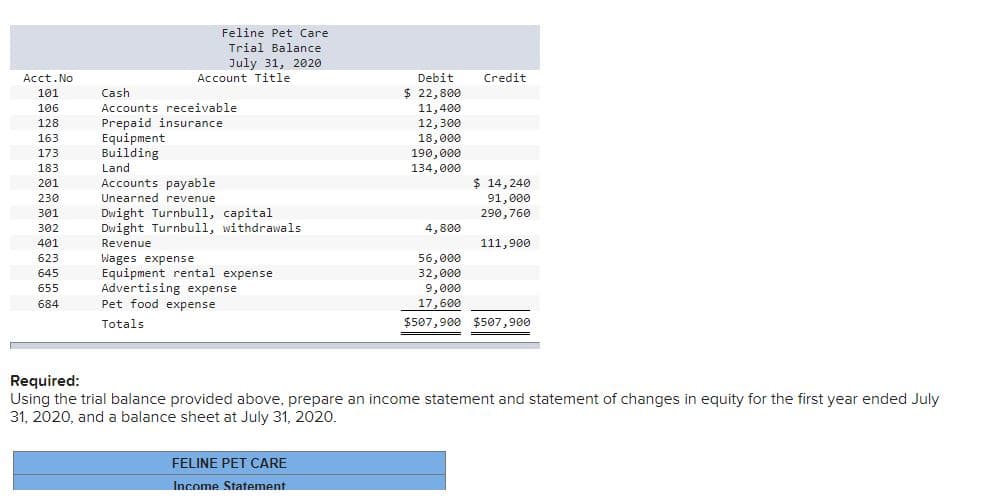

Feline Pet Care Trial Balance Acct. No July 31, 2020 Account Title Debit $ 22,800 Credit 101 Cash Accounts receivable Prepaid insurance Equipment Building Land 106 11,400 12,300 18,000 190,000 134,000 128 163 173 183 Accounts payable Unearned revenue $ 14, 240 91,000 290,760 201 230 Dwight Turnbull, capita1 Dwight Turnbull, withdrawals Revenue 301 302 4,800 401 111,900 Wages expense Equipment rental expense Advertising expense Pet food expense 56,000 32,000 9,000 17,600 623 645 655 684 Totals $507,900 $507,900 Required: Using the trial balance provided above, prepare an income statement and statement of changes in equity for the first year ended July 31, 2020, and a balance sheet at July 31, 2020. FELINE PET CARE Income Statement

Feline Pet Care Trial Balance Acct. No July 31, 2020 Account Title Debit $ 22,800 Credit 101 Cash Accounts receivable Prepaid insurance Equipment Building Land 106 11,400 12,300 18,000 190,000 134,000 128 163 173 183 Accounts payable Unearned revenue $ 14, 240 91,000 290,760 201 230 Dwight Turnbull, capita1 Dwight Turnbull, withdrawals Revenue 301 302 4,800 401 111,900 Wages expense Equipment rental expense Advertising expense Pet food expense 56,000 32,000 9,000 17,600 623 645 655 684 Totals $507,900 $507,900 Required: Using the trial balance provided above, prepare an income statement and statement of changes in equity for the first year ended July 31, 2020, and a balance sheet at July 31, 2020. FELINE PET CARE Income Statement

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter12: Liabilities: Off-balance-sheet Financing, Retirement Benefits, And Income Taxes

Section: Chapter Questions

Problem 22E

Related questions

Question

only 7b photo thanks

Transcribed Image Text:Feline Pet Care

Trial Balance

July 31, 2020

Acct.No

Account Title

Debit

Credit

101

Cash

$ 22,800

106

Accounts receivable

Prepaid insurance

Equipment

Building

Land

Accounts payable

Unearned revenue

11,400

12,300

18,000

190,000

134,000

128

163

173

183

201

$ 14, 240

230

91,000

Dwight Turnbull, capital

Dwight Turnbull, withdrawals

301

290,760

302

4,800

401

Revenue

111,900

56,000

32,000

9,000

17,600

623

Wages expense

Equipment rental expense

Advertising expense

Pet food expense

645

655

684

Totals

$507,900 $507,900

Required:

Using the trial balance provided above, prepare an income statement and statement of changes in equity for the first year ended July

31, 2020, and a balance sheet at July 31, 2020.

FELINE PET CARE

Income Statement

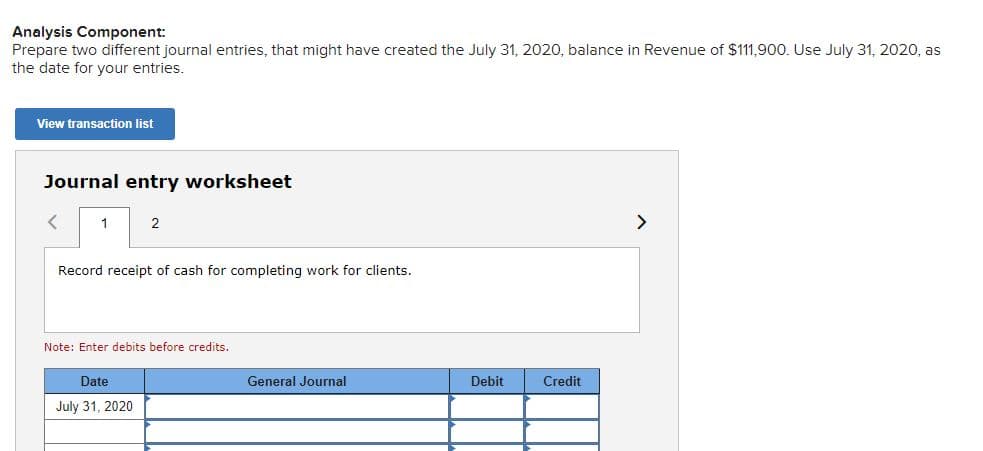

Transcribed Image Text:Analysis Component:

Prepare two different journal entries, that might have created the July 31, 2020, balance in Revenue of $111,900. Use July 31, 2020, as

the date for your entries.

View transaction list

Journal entry worksheet

1

2

>

Record receipt of cash for completing work for clients.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

July 31, 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you