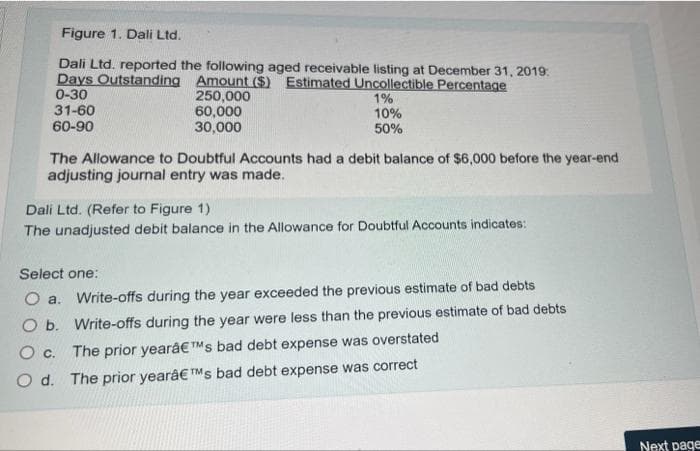

Figure 1. Dali Ltd. Dali Ltd. reported the following aged receivable listing at December 31, 2019: Days Outstanding Amount ($) Estimated Uncollectible Percentage 0-30 250,000 60,000 1% 31-60 60-90 10% 30,000 50% The Allowance to Doubtful Accounts had a debit balance of $6,000 before the year-end adjusting journal entry was made. Dali Ltd. (Refer to Figure 1) The unadjusted debit balance in the Allowance for Doubtful Accounts indicates: Select one: O a. Write-offs during the year exceeded the previous estimate of bad debts O b. Write-offs during the year were less than the previous estimate of bad debts O c. The prior yearâ€TMs bad debt expense was overstated. O d. The prior yearâ€TMs bad debt expense was correct

Figure 1. Dali Ltd. Dali Ltd. reported the following aged receivable listing at December 31, 2019: Days Outstanding Amount ($) Estimated Uncollectible Percentage 0-30 250,000 60,000 1% 31-60 60-90 10% 30,000 50% The Allowance to Doubtful Accounts had a debit balance of $6,000 before the year-end adjusting journal entry was made. Dali Ltd. (Refer to Figure 1) The unadjusted debit balance in the Allowance for Doubtful Accounts indicates: Select one: O a. Write-offs during the year exceeded the previous estimate of bad debts O b. Write-offs during the year were less than the previous estimate of bad debts O c. The prior yearâ€TMs bad debt expense was overstated. O d. The prior yearâ€TMs bad debt expense was correct

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 5SEA: UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current...

Related questions

Question

100%

Give me answer within 45 min please I will give you positive rating immediately its very urgent ..thankyou..

Transcribed Image Text:Figure 1. Dali Ltd.

Dali Ltd. reported the following aged receivable listing at December 31, 2019:

Days Outstanding Amount ($) Estimated Uncollectible Percentage

0-30

250,000

1%

31-60

10%

60,000

30,000

60-90

50%

The Allowance to Doubtful Accounts had a debit balance of $6,000 before the year-end

adjusting journal entry was made.

Dali Ltd. (Refer to Figure 1)

The unadjusted debit balance in the Allowance for Doubtful Accounts indicates:

Select one:

O a. Write-offs during the year exceeded the previous estimate of bad debts

O b. Write-offs during the year were less than the previous estimate of bad debts

O c. The prior yearâ€TMs bad debt expense was overstated

O d. The prior year’s bad debt expense was correct

Next page

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College