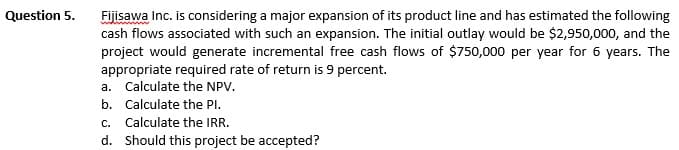

Fijisawa Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. The initial outlay would be $2,950,000, and the project would generate incremental free cash flows of $750,000 per year for 6 years. The appropriate required rate of return is 9 percent. A; Calculate the NPV. B; Calculate the PI. C; Calculate the IRR. D; Should this project be accepted

Fijisawa Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. The initial outlay would be $2,950,000, and the project would generate incremental free cash flows of $750,000 per year for 6 years. The appropriate required rate of return is 9 percent. A; Calculate the NPV. B; Calculate the PI. C; Calculate the IRR. D; Should this project be accepted

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 19EA: Redbird Company is considering a project with an initial investment of $265,000 in new equipment...

Related questions

Question

- Fijisawa Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. The initial outlay would be $2,950,000, and the project would generate incremental

free cash flows of $750,000 per year for 6 years. The appropriate requiredrate of return is 9 percent.

A; Calculate the NPV.

B; Calculate the PI.

C; Calculate the IRR.

D; Should this project be accepted?

Transcribed Image Text:Question 5.

Fijisawa Inc. is considering a major expansion of its product line and has estimated the following

cash flows associated with such an expansion. The initial outlay would be $2,950,000, and the

project would generate incremental free cash flows of $750,000 per year for 6 years. The

appropriate required rate of return is 9 percent.

a. Calculate the NPV.

b. Calculate the PI.

C.

Calculate the IRR.

d. Should this project be accepted?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub