fill in Xs' w/ given excell information thank you!!!!!

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

fill in Xs' w/ given excell information thank you!!!!!

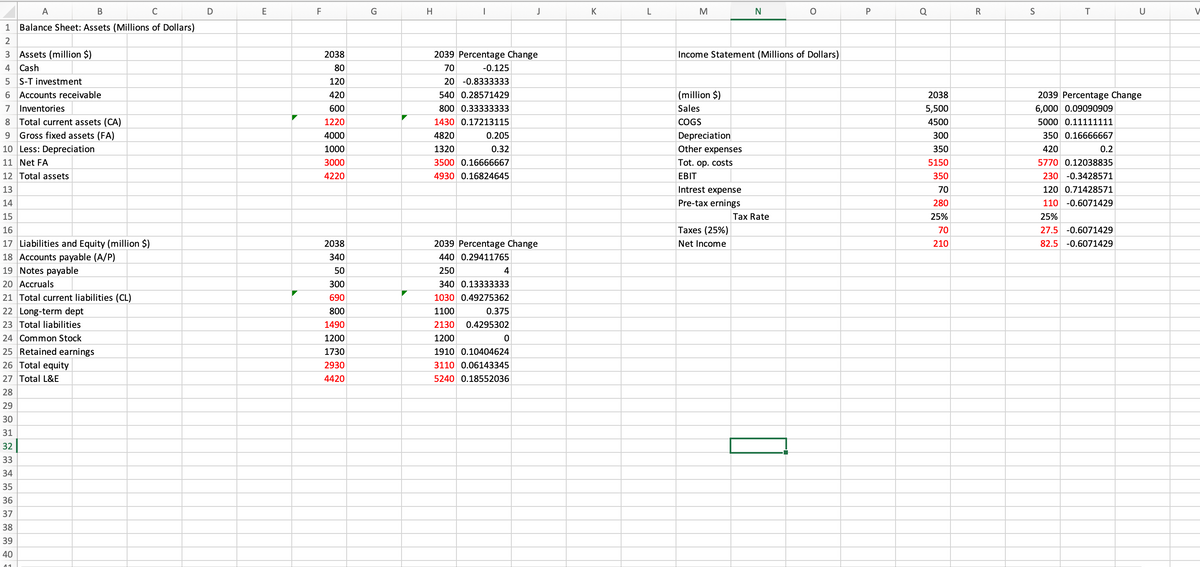

Transcribed Image Text:123456

A

B

C

Balance Sheet: Assets (Millions of Dollars)

3 Assets (million $)

4 Cash

5 S-T investment

Accounts receivable

7 Inventories

8 Total current assets (CA)

9 Gross fixed assets (FA)

10 Less: Depreciation

11 Net FA

12 Total assets

13

14

15

16

17 Liabilities and Equity (million $)

18 Accounts payable (A/P)

19 Notes payable

20 Accruals

21 Total current liabilities (CL)

22 Long-term dept

23 Total liabilities

24 Common Stock

25 Retained earnings

26 Total equity

27 Total L&E

28

29

30

31

32

33

34

35

36

37

38

39

40

11

D

E

F

2038

80

120

420

600

1220

4000

1000

3000

4220

2038

340

50

300

690

800

1490

1200

1730

2930

4420

G

H

1

2039 Percentage Change

70

-0.125

20 -0.8333333

540 0.28571429

800 0.33333333

1430 0.17213115

4820

1320

3500 0.16666667

4930 0.16824645

0.205

0.32

2039 Percentage Change

440 0.29411765

250

340 0.13333333

1030 0.49275362

4

1100

2130

1200

1910 0.10404624

3110 0.06143345

5240 0.18552036

J

0.375

0.4295302

0

K

L

M

(million $)

Sales

COGS

Income Statement (Millions of Dollars)

Depreciation

Other expenses

Tot. op. costs

EBIT

Intrest expense

Pre-tax ernings

N

Taxes (25%)

Net Income

O

Tax Rate

P

Q

2038

5,500

4500

300

350

5150

350

70

280

25%

70

210

R

S

T

2039 Percentage Change

6,000 0.09090909

5000 0.11111111

350 0.16666667

420

0.2

U

5770 0.12038835

230 -0.3428571

120 0.71428571

110 -0.6071429

25%

27.5 -0.6071429

82.5 -0.6071429

V

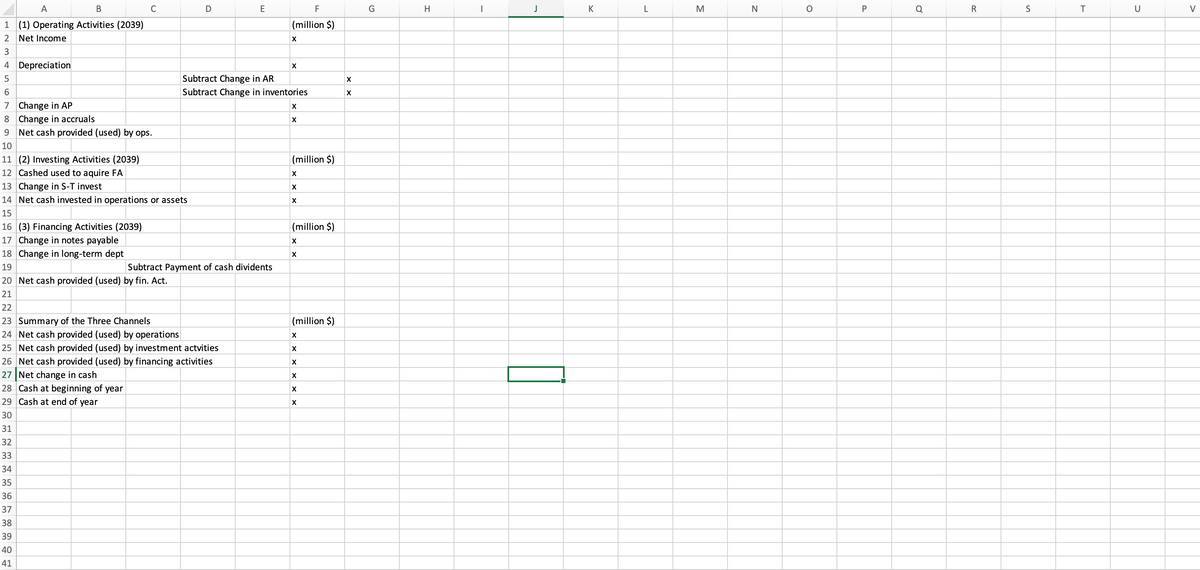

Transcribed Image Text:A

B

1 (1) Operating Activities (2039)

2 Net Income

3

456

4 Depreciation

7 Change in AP

8 Change in accruals

9

10

11 (2) Investing Activities (2039)

12 Cashed used to aquire FA

C

Net cash provided (used) by ops.

D

E

13 Change in S-T invest

14 Net cash invested in operations or assets

15

16 (3) Financing Activities (2039)

17 Change in notes payable

18 Change in long-term dept

19

20 Net cash provided (used) by fin. Act.

21

22

23 Summary of the Three Channels

24 Net cash provided (used) by operations

25 Net cash provided (used) by investment actvities

26 Net cash provided (used) by financing activities

27 Net change in cash

28 Cash at beginning of year

29 Cash at end of year

30

31

32

33

34

35

36

37

38

39

40

41

F

(million $)

Subtract Payment of cash dividents

X

Subtract Change in AR

Subtract Change in inventories

X

X

X

(million $)

X

X

X

(million $)

X

X

(million $)

X

X

X

X

X

X

X

X

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education