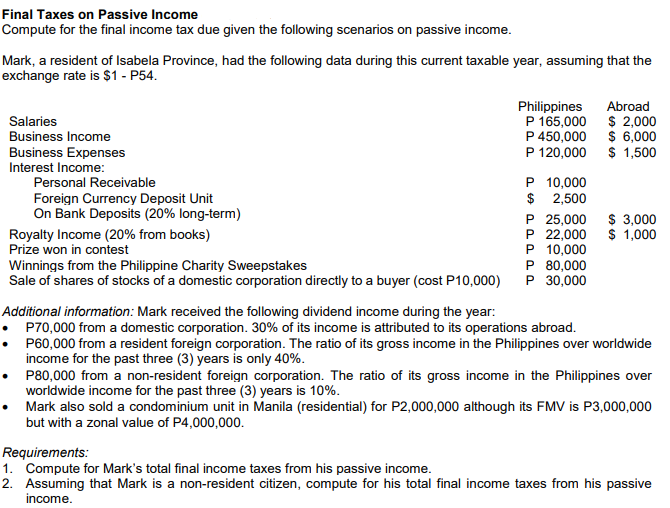

Final Taxes on Passive Income Compute for the final income tax due given the following scenarios on passive income. Mark, a resident of Isabela Province, had the following data during this current taxable year, assuming that the exchange rate is $1 - P54. Philippines P 165,000 Abroad Salaries Business Income $ 2,000 P 450,000 $ 6,000 P 120,000 Business Expenses Interest Income: $ 1,500 P 10,000 $ 2,500 P 25,000 P 22,000 P 10,000 P 80,000 P 30,000 Personal Receivable Foreign Currency Deposit Unit On Bank Deposits (20% long-term) Royalty Income (20% from books) $ 3,000 $ 1,000 Prize won in contest Winnings from the Philippine Charity Sweepstakes Sale of shares of stocks of a domestic corporation directly to a buyer (cost P10,000) Additional information: Mark received the following dividend income during the year: P70,000 from a domestic corporation. 30% of its income is attributed to its operations abroad. P60,000 from a resident foreign corporation. The ratio of its gross income in the Philippines over worldwide income for the past three (3) years is only 40%. P80,000 from a non-resident foreign corporation. The ratio of its gross income in the Philippines over worldwide income for the past three (3) years is 10%. Mark also sold a condominium unit in Manila (residential) for P2,000,000 although its FMV is P3,000,000 but with a zonal value of P4,000,000. Requirements: 1. Compute for Mark's total final income taxes from his passive income. 2. Assuming that Mark is a non-resident citizen, compute for his total final income taxes from his passive income.

Final Taxes on Passive Income Compute for the final income tax due given the following scenarios on passive income. Mark, a resident of Isabela Province, had the following data during this current taxable year, assuming that the exchange rate is $1 - P54. Philippines P 165,000 Abroad Salaries Business Income $ 2,000 P 450,000 $ 6,000 P 120,000 Business Expenses Interest Income: $ 1,500 P 10,000 $ 2,500 P 25,000 P 22,000 P 10,000 P 80,000 P 30,000 Personal Receivable Foreign Currency Deposit Unit On Bank Deposits (20% long-term) Royalty Income (20% from books) $ 3,000 $ 1,000 Prize won in contest Winnings from the Philippine Charity Sweepstakes Sale of shares of stocks of a domestic corporation directly to a buyer (cost P10,000) Additional information: Mark received the following dividend income during the year: P70,000 from a domestic corporation. 30% of its income is attributed to its operations abroad. P60,000 from a resident foreign corporation. The ratio of its gross income in the Philippines over worldwide income for the past three (3) years is only 40%. P80,000 from a non-resident foreign corporation. The ratio of its gross income in the Philippines over worldwide income for the past three (3) years is 10%. Mark also sold a condominium unit in Manila (residential) for P2,000,000 although its FMV is P3,000,000 but with a zonal value of P4,000,000. Requirements: 1. Compute for Mark's total final income taxes from his passive income. 2. Assuming that Mark is a non-resident citizen, compute for his total final income taxes from his passive income.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:Final Taxes on Passive Income

Compute for the final income tax due given the following scenarios on passive income.

Mark, a resident of Isabela Province, had the following data during this current taxable year, assuming that the

exchange rate is $1 - P54.

Philippines

P 165,000

Abroad

Salaries

Business Income

$ 2,000

P 450,000 $ 6,000

P 120,000

Business Expenses

$ 1,500

Interest Income:

P 10,000

$ 2,500

P 25,000

P 22,000

P 10,000

P 80,000

P 30,000

Personal Receivable

Foreign Currency Deposit Unit

On Bank Deposits (20% long-term)

$ 3,000

$ 1,000

Royalty Income (20% from books)

Prize won in contest

Winnings from the Philippine Charity Sweepstakes

Sale of shares of stocks of a domestic corporation directly to a buyer (cost P10,000)

Additional information: Mark received the following dividend income during the year:

P70,000 from a domestic corporation. 30% of its income is attributed to its operations abroad.

P60,000 from a resident foreign corporation. The ratio of its gross income in the Philippines over worldwide

income for the past three (3) years is only 40%.

P80,000 from a non-resident foreign corporation. The ratio of its gross income in the Philippines over

worldwide income for the past three (3) years is 10%.

Mark also sold a condominium unit in Manila (residential) for P2,000,000 although its FMV is P3,000,000

but with a zonal value of P4,000,000.

Requirements:

1. Compute for Mark's total final income taxes from his passive income.

2. Assuming that Mark is a non-resident citizen, compute for his total final income taxes from his passive

income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning