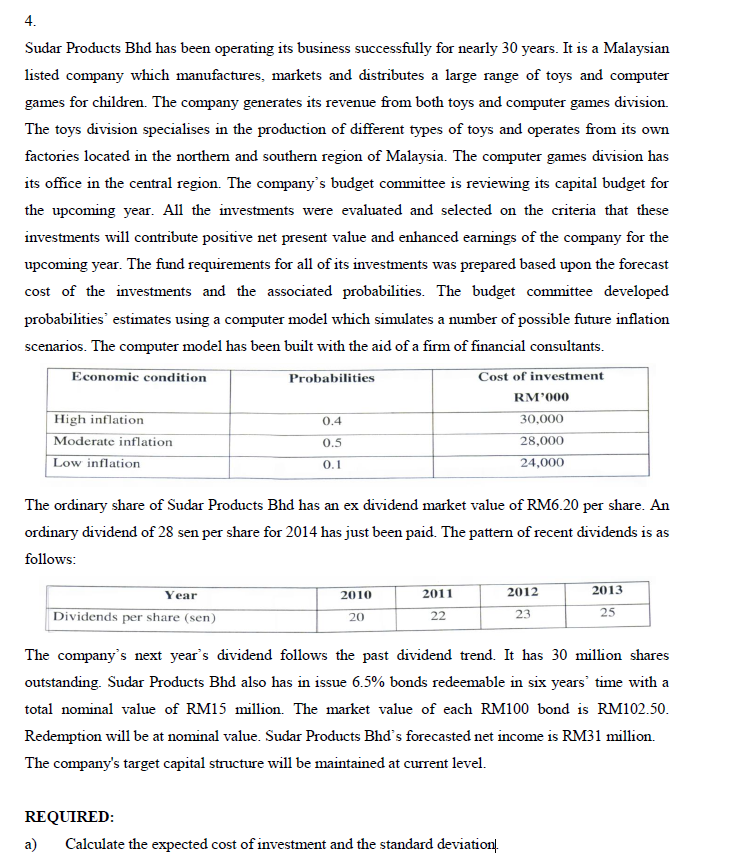

4. Sudar Products Bhd has been operating its business successfully for nearly 30 years. It is a Malaysian listed company which manufactures, markets and distributes a large range of toys and computer games for children. The company generates its revenue from both toys and computer games division. The toys division specialises in the production of different types of toys and operates from its own factories located in the northem and southern region of Malaysia. The computer games division has its office in the central region. The company's budget committee is reviewing its capital budget for the upcoming year. All the investments were evaluated and selected on the criteria that these investments will contribute positive net present value and enhanced earnings of the company for the upcoming year. The fund requirements for all of its investments was prepared based upon the forecast cost of the investments and the associated probabilities. The budget committee developed probabilities' estimates using a computer model which simulates a number of possible future inflation scenarios. The computer model has been built with the aid of a firm of financial consultants. Economic condition Probabilities Cost of investment RM'000 High inflation 0.4 30,000 Moderate inflation 0.5 28,000 Low inflation 24,000 0.1 The ordinary share of Sudar Products Bhd has an ex dividend market value of RM6.20 per share. An ordinary dividend of 28 sen per share for 2014 has just been paid. The pattern of recent dividends is as follows: Year 2010 2011 2012 2013 25 Dividends per share (sen) 23 20 22 The company's next year's dividend follows the past dividend trend. It has 30 million shares outstanding. Sudar Products Bhd also has in issue 6.5% bonds redeemable in six years' time with a total nominal value of RM15 million. The market value of each RM100 bond is RM102.50. Redemption will be at nominal value. Sudar Products Bhd's forecasted net income is RM31 million. The company's target capital structure will be maintained at current level. REQUIRED: a) Calculate the expected cost of investment and the standard deviation. b) If Sudar Products Bhd follows the residual distributions model: (i) Calculate dividend per share. (11) How much retained earnings and external finance will it need to fund its capital budget for the upcoming year?

4. Sudar Products Bhd has been operating its business successfully for nearly 30 years. It is a Malaysian listed company which manufactures, markets and distributes a large range of toys and computer games for children. The company generates its revenue from both toys and computer games division. The toys division specialises in the production of different types of toys and operates from its own factories located in the northem and southern region of Malaysia. The computer games division has its office in the central region. The company's budget committee is reviewing its capital budget for the upcoming year. All the investments were evaluated and selected on the criteria that these investments will contribute positive net present value and enhanced earnings of the company for the upcoming year. The fund requirements for all of its investments was prepared based upon the forecast cost of the investments and the associated probabilities. The budget committee developed probabilities' estimates using a computer model which simulates a number of possible future inflation scenarios. The computer model has been built with the aid of a firm of financial consultants. Economic condition Probabilities Cost of investment RM'000 High inflation 0.4 30,000 Moderate inflation 0.5 28,000 Low inflation 24,000 0.1 The ordinary share of Sudar Products Bhd has an ex dividend market value of RM6.20 per share. An ordinary dividend of 28 sen per share for 2014 has just been paid. The pattern of recent dividends is as follows: Year 2010 2011 2012 2013 25 Dividends per share (sen) 23 20 22 The company's next year's dividend follows the past dividend trend. It has 30 million shares outstanding. Sudar Products Bhd also has in issue 6.5% bonds redeemable in six years' time with a total nominal value of RM15 million. The market value of each RM100 bond is RM102.50. Redemption will be at nominal value. Sudar Products Bhd's forecasted net income is RM31 million. The company's target capital structure will be maintained at current level. REQUIRED: a) Calculate the expected cost of investment and the standard deviation. b) If Sudar Products Bhd follows the residual distributions model: (i) Calculate dividend per share. (11) How much retained earnings and external finance will it need to fund its capital budget for the upcoming year?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter10: Forecasting Financial Statement

Section: Chapter Questions

Problem 13PC

Related questions

Question

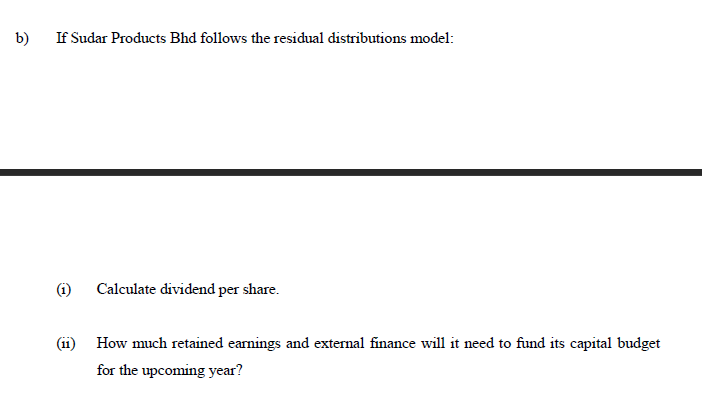

If Sudar Products Bhd follows the residual distributions model:

(ii) How much

Transcribed Image Text:4.

Sudar Products Bhd has been operating its business successfully for nearly 30 years. It is a Malaysian

listed company which manufactures, markets and distributes a large range of toys and computer

games for children. The company generates its revenue from both toys and computer games division.

The toys division specialises in the production of different types of toys and operates from its own

factories located in the northem and southern region of Malaysia. The computer games division has

its office in the central region. The company's budget committee is reviewing its capital budget for

the upcoming year. All the investments were evaluated and selected on the criteria that these

investments will contribute positive net present value and enhanced earnings of the company for the

upcoming year. The fund requirements for all of its investments was prepared based upon the forecast

cost of the investments and the associated probabilities. The budget committee developed

probabilities' estimates using a computer model which simulates a number of possible future inflation

scenarios. The computer model has been built with the aid of a firm of financial consultants.

Economic condition

Probabilities

Cost of investment

RM'000

High inflation

0.4

30,000

Moderate inflation

0.5

28,000

Low inflation

24,000

0.1

The ordinary share of Sudar Products Bhd has an ex dividend market value of RM6.20 per share. An

ordinary dividend of 28 sen per share for 2014 has just been paid. The pattern of recent dividends is as

follows:

Year

2010

2011

2012

2013

25

Dividends per share (sen)

23

20

22

The company's next year's dividend follows the past dividend trend. It has 30 million shares

outstanding. Sudar Products Bhd also has in issue 6.5% bonds redeemable in six years' time with a

total nominal value of RM15 million. The market value of each RM100 bond is RM102.50.

Redemption will be at nominal value. Sudar Products Bhd's forecasted net income is RM31 million.

The company's target capital structure will be maintained at current level.

REQUIRED:

a)

Calculate the expected cost of investment and the standard deviation.

Transcribed Image Text:b)

If Sudar Products Bhd follows the residual distributions model:

(i)

Calculate dividend per share.

(11)

How much retained earnings and external finance will it need to fund its capital budget

for the upcoming year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning