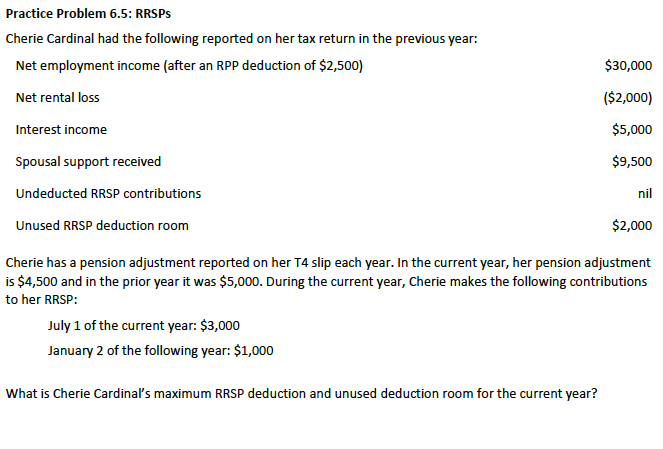

Practice Problem 6.5: RRSPS Cherie Cardinal had the following reported on her tax return in the previous year: Net employment income (after an RPP deduction of $2,500) $30,000 Net rental loss ($2,000) Interest income $5,000 Spousal support received $9,500 Undeducted RRSP contributions nil Unused RRSP deduction room $2,000 Cherie has a pension adjustment reported on her T4 slip each year. In the current year, her pension adjustment is $4,500 and in the prior year it was $5,000. During the current year, Cherie makes the following contributions to her RRSP: July 1 of the current year: $3,000 January 2 of the following year: $1,000 What is Cherie Cardinal's maximum RRSP deduction and unused deduction room for the current year?

Practice Problem 6.5: RRSPS Cherie Cardinal had the following reported on her tax return in the previous year: Net employment income (after an RPP deduction of $2,500) $30,000 Net rental loss ($2,000) Interest income $5,000 Spousal support received $9,500 Undeducted RRSP contributions nil Unused RRSP deduction room $2,000 Cherie has a pension adjustment reported on her T4 slip each year. In the current year, her pension adjustment is $4,500 and in the prior year it was $5,000. During the current year, Cherie makes the following contributions to her RRSP: July 1 of the current year: $3,000 January 2 of the following year: $1,000 What is Cherie Cardinal's maximum RRSP deduction and unused deduction room for the current year?

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Practice Problem 6.5: RRSPS

Cherie Cardinal had the following reported on her tax return in the previous year:

Net employment income (after an RPP deduction of $2,500)

$30,000

Net rental loss

($2,000)

Interest income

$5,000

Spousal support received

$9,500

Undeducted RRSP contributions

nil

Unused RRSP deduction room

$2,000

Cherie has a pension adjustment reported on her T4 slip each year. In the current year, her pension adjustment

is $4,500 and in the prior year it was $5,000. During the current year, Cherie makes the following contributions

to her RRSP:

July 1 of the current year: $3,000

January 2 of the following year: $1,000

What is Cherie Cardinal's maximum RRSP deduction and unused deduction room for the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning