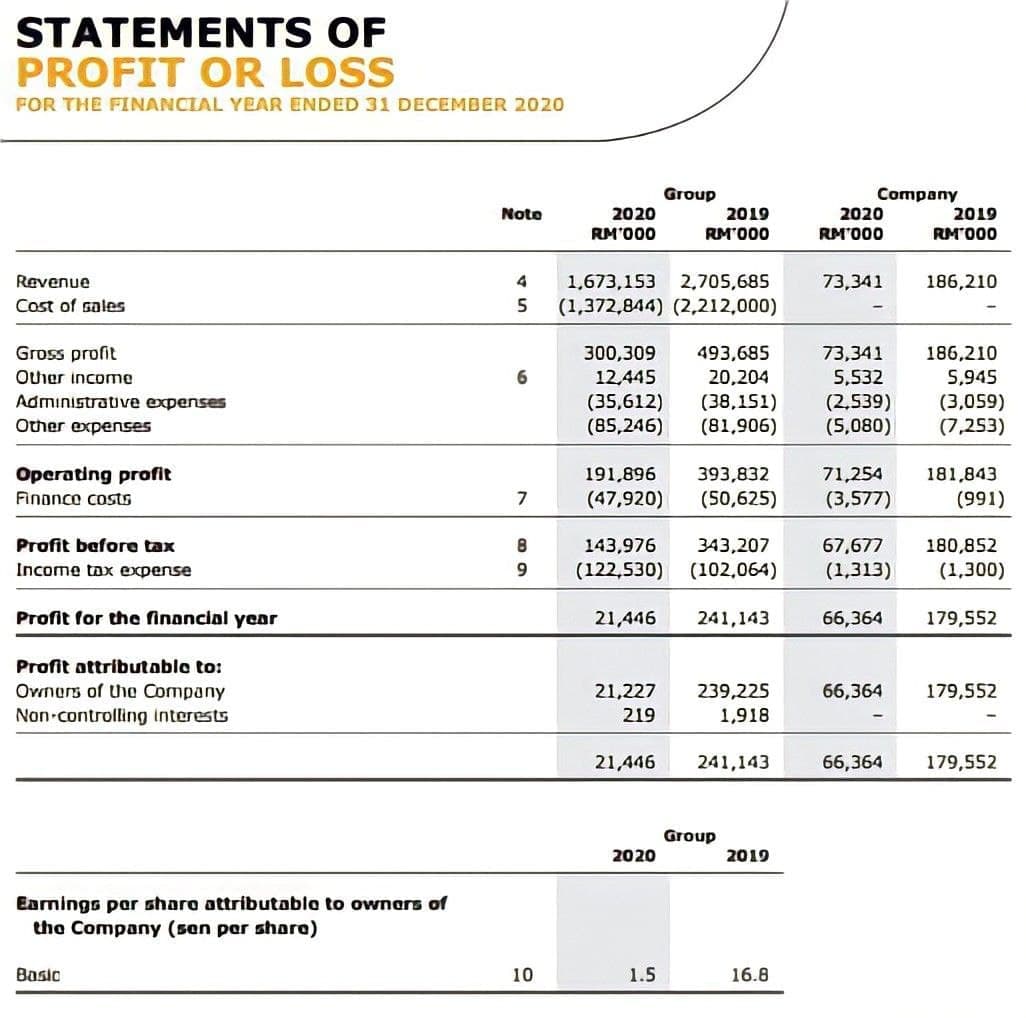

STATEMENTS OF PROFIT OR LOSS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020 Company 2019 RM'000 Group 2019 RM'000 Noto 2020 2020 RM'000 RM'000 Revenue 1,673,153 2,705,685 73,341 186,210 Cost of sales (1,372,844) (2,212,000) Gross profit OUier income 300,309 12,445 (35,612) (85,246) 493,685 20,204 (38,151) (81,906) 73,341 5,532 (2,539) (5,080) 186,210 5,945 Admınistrative expenses (3,059) (7,253) Other expenses Operating profit Finonce costs 191,896 393,832 71,254 181,843 (47,920) (50,625) (3,577) (991) Profit before tax 8 143,976 343,207 67,677 180,852 Income tax expense 9. (122,530) (102,064) (1,313) (1,300) Profit for the financial year 21,446 241,143 66,364 179,552 Profit ottributoble to: Ovnurs of Uhe Company 21,227 239,225 66,364 179,552 Non controlling interests 219 1,918 21,446 241,143 66,364 179,552 Group 2020 2019 Earnings por sharo attributablo to ownars of the Company (san par shoro) Basic 10 1.5 16.8 FIVE YEARS FINANCIAL HIGHLIGHTS 2020 2019 2010 2017 2016 RM'000 RM'000 RM'000 RM'000 RM'000 ASSETS Non-current assets Proporty, plant and equipment Right-of-use assets Invastment proparties Investment secunties 65,743 17,731 62,612 15,703 65,093 63,993 60,354 546 370,454 2,738,317 2,738,332 2,738,347 2,738,362 2,738,377 11,529 3,226,845 3,224,608 3,185,969 3,066,607 3,059,503 569,995 533 540 53 580 398,985 398,730 256,062 249,052 Intangible assets Deferred tax 06sets 5,536 8,691 7,637 11,140 Curront assets 349,096 378,797 465,793 573,355 TOTAL ASSETS 3,575,941 3,603,405 3,755,964 3,532,400 3,632,858 EQUITY AND LIABILITIES Equity attributable to owners of the Company Shore copital Reserves 2,154,357 2,154,357 2,154,357 2,154,357 1,437,749 327,796 238,549 353,112 355,796 1,008,510 Treasury shares (1,163) (30,205) (30,205) (30,205) (30,188) Sharaholdars' fund 2,391,743 2,477,264 2,451,948 2,479,948 2,416,071 40,722 Non-controlling interests 22,862 22,645 40,416 40,093 Total aquity 2,414,605 2,499,909 2,492,670 2,520,364 2,456,164 765,570 395,766 Non-currant llabilities 679,707 714,737 548,557 598,873 774,695 Currant liabilitics 423,789 413,163 401,999 Total llabilities 1,161,336 1,103,496 1,263,294 1,012,036 1,176,694 TOTAL EQUITY AND LIABILITIES 3,575,941 3,603,405 3,755,964 3,532,400 3,632,858 GROUP RESULTS Revenuo 1,673,153 2,705,685 2,704,254 2,649,207 2,659,344 Profit bafore tox 143,976 343,207 313,333 306,626 284,490 Income tox expense (122,530) (102,064) (205,287) (97,319) (91,568) Profit for the finoncial year 21,446 (219) 241,143 108,046 209,307 192,922 Non controlling intorests (1,918) (2,657) (2,837) (3,266) Profit attributoble to owners of tho Company 21,227 239,225 105,389 206,470 189,656 SELECTED RATIOS Bosic cornings per shore (sen) Not assats per share (RM) Dividend par share (sen) Return on oquity (%) 1.5 16.8 7.4 14.5 13.3 1.70 13.0 1.66 1.72 15.0 4.30 1.74 1.74 8.5 0.89 16.0 9.66 11.0 8.33 7.85

STATEMENTS OF PROFIT OR LOSS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020 Company 2019 RM'000 Group 2019 RM'000 Noto 2020 2020 RM'000 RM'000 Revenue 1,673,153 2,705,685 73,341 186,210 Cost of sales (1,372,844) (2,212,000) Gross profit OUier income 300,309 12,445 (35,612) (85,246) 493,685 20,204 (38,151) (81,906) 73,341 5,532 (2,539) (5,080) 186,210 5,945 Admınistrative expenses (3,059) (7,253) Other expenses Operating profit Finonce costs 191,896 393,832 71,254 181,843 (47,920) (50,625) (3,577) (991) Profit before tax 8 143,976 343,207 67,677 180,852 Income tax expense 9. (122,530) (102,064) (1,313) (1,300) Profit for the financial year 21,446 241,143 66,364 179,552 Profit ottributoble to: Ovnurs of Uhe Company 21,227 239,225 66,364 179,552 Non controlling interests 219 1,918 21,446 241,143 66,364 179,552 Group 2020 2019 Earnings por sharo attributablo to ownars of the Company (san par shoro) Basic 10 1.5 16.8 FIVE YEARS FINANCIAL HIGHLIGHTS 2020 2019 2010 2017 2016 RM'000 RM'000 RM'000 RM'000 RM'000 ASSETS Non-current assets Proporty, plant and equipment Right-of-use assets Invastment proparties Investment secunties 65,743 17,731 62,612 15,703 65,093 63,993 60,354 546 370,454 2,738,317 2,738,332 2,738,347 2,738,362 2,738,377 11,529 3,226,845 3,224,608 3,185,969 3,066,607 3,059,503 569,995 533 540 53 580 398,985 398,730 256,062 249,052 Intangible assets Deferred tax 06sets 5,536 8,691 7,637 11,140 Curront assets 349,096 378,797 465,793 573,355 TOTAL ASSETS 3,575,941 3,603,405 3,755,964 3,532,400 3,632,858 EQUITY AND LIABILITIES Equity attributable to owners of the Company Shore copital Reserves 2,154,357 2,154,357 2,154,357 2,154,357 1,437,749 327,796 238,549 353,112 355,796 1,008,510 Treasury shares (1,163) (30,205) (30,205) (30,205) (30,188) Sharaholdars' fund 2,391,743 2,477,264 2,451,948 2,479,948 2,416,071 40,722 Non-controlling interests 22,862 22,645 40,416 40,093 Total aquity 2,414,605 2,499,909 2,492,670 2,520,364 2,456,164 765,570 395,766 Non-currant llabilities 679,707 714,737 548,557 598,873 774,695 Currant liabilitics 423,789 413,163 401,999 Total llabilities 1,161,336 1,103,496 1,263,294 1,012,036 1,176,694 TOTAL EQUITY AND LIABILITIES 3,575,941 3,603,405 3,755,964 3,532,400 3,632,858 GROUP RESULTS Revenuo 1,673,153 2,705,685 2,704,254 2,649,207 2,659,344 Profit bafore tox 143,976 343,207 313,333 306,626 284,490 Income tox expense (122,530) (102,064) (205,287) (97,319) (91,568) Profit for the finoncial year 21,446 (219) 241,143 108,046 209,307 192,922 Non controlling intorests (1,918) (2,657) (2,837) (3,266) Profit attributoble to owners of tho Company 21,227 239,225 105,389 206,470 189,656 SELECTED RATIOS Bosic cornings per shore (sen) Not assats per share (RM) Dividend par share (sen) Return on oquity (%) 1.5 16.8 7.4 14.5 13.3 1.70 13.0 1.66 1.72 15.0 4.30 1.74 1.74 8.5 0.89 16.0 9.66 11.0 8.33 7.85

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.17E: Profitability metrics The following selected data were taken from the financial statements of The...

Related questions

Question

calculate the interest expenses for the last 5 years (2016, 207, 2018, 2019 & 2020)

Transcribed Image Text:STATEMENTS OF

PROFIT OR LOSS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

Company

2019

RM'000

Group

2019

RM'000

Noto

2020

2020

RM'000

RM'000

Revenue

1,673,153 2,705,685

73,341

186,210

Cost of sales

(1,372,844) (2,212,000)

Gross profit

OUier income

300,309

12,445

(35,612)

(85,246)

493,685

20,204

(38,151)

(81,906)

73,341

5,532

(2,539)

(5,080)

186,210

5,945

Admınistrative expenses

(3,059)

(7,253)

Other expenses

Operating profit

Finonce costs

191,896

393,832

71,254

181,843

(47,920)

(50,625)

(3,577)

(991)

Profit before tax

8

143,976

343,207

67,677

180,852

Income tax expense

9.

(122,530)

(102,064)

(1,313)

(1,300)

Profit for the financial year

21,446

241,143

66,364

179,552

Profit ottributoble to:

Ovnurs of Uhe Company

21,227

239,225

66,364

179,552

Non controlling interests

219

1,918

21,446

241,143

66,364

179,552

Group

2020

2019

Earnings por sharo attributablo to ownars of

the Company (san par shoro)

Basic

10

1.5

16.8

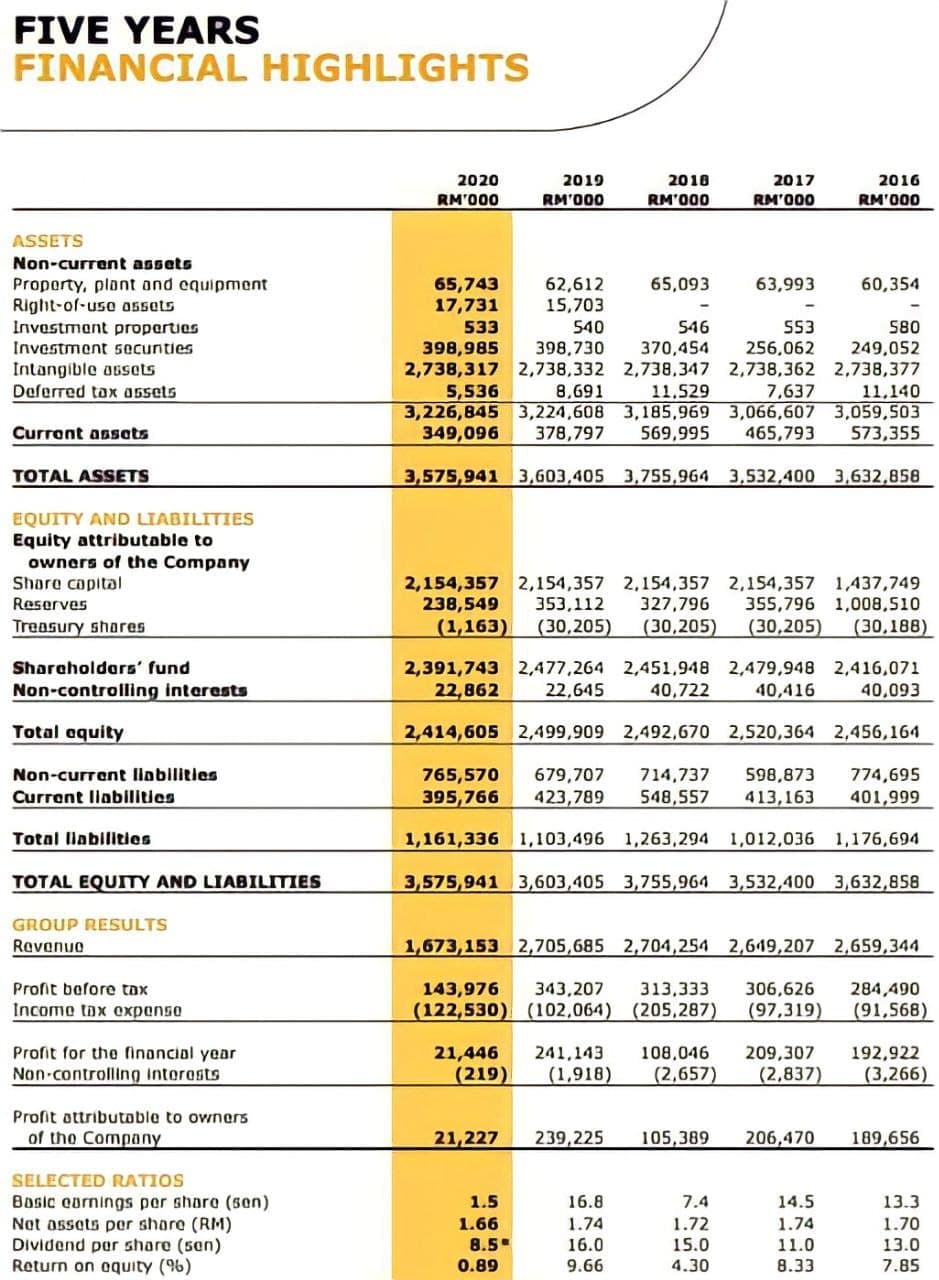

Transcribed Image Text:FIVE YEARS

FINANCIAL HIGHLIGHTS

2020

2019

2010

2017

2016

RM'000

RM'000

RM'000

RM'000

RM'000

ASSETS

Non-current assets

Proporty, plant and equipment

Right-of-use assets

Invastment proparties

Investment secunties

65,743

17,731

62,612

15,703

65,093

63,993

60,354

546

370,454

2,738,317 2,738,332 2,738,347 2,738,362 2,738,377

11,529

3,226,845 3,224,608 3,185,969 3,066,607 3,059,503

569,995

533

540

53

580

398,985

398,730

256,062

249,052

Intangible assets

Deferred tax 06sets

5,536

8,691

7,637

11,140

Curront assets

349,096

378,797

465,793

573,355

TOTAL ASSETS

3,575,941 3,603,405 3,755,964 3,532,400 3,632,858

EQUITY AND LIABILITIES

Equity attributable to

owners of the Company

Shore copital

Reserves

2,154,357 2,154,357 2,154,357 2,154,357 1,437,749

327,796

238,549

353,112

355,796 1,008,510

Treasury shares

(1,163)

(30,205)

(30,205)

(30,205)

(30,188)

Sharaholdars' fund

2,391,743 2,477,264 2,451,948 2,479,948 2,416,071

40,722

Non-controlling interests

22,862

22,645

40,416

40,093

Total aquity

2,414,605 2,499,909 2,492,670 2,520,364 2,456,164

765,570

395,766

Non-currant llabilities

679,707

714,737

548,557

598,873

774,695

Currant liabilitics

423,789

413,163

401,999

Total llabilities

1,161,336 1,103,496 1,263,294 1,012,036 1,176,694

TOTAL EQUITY AND LIABILITIES

3,575,941 3,603,405 3,755,964 3,532,400 3,632,858

GROUP RESULTS

Revenuo

1,673,153 2,705,685 2,704,254 2,649,207 2,659,344

Profit bafore tox

143,976

343,207

313,333

306,626

284,490

Income tox expense

(122,530) (102,064) (205,287)

(97,319)

(91,568)

Profit for the finoncial year

21,446

(219)

241,143

108,046

209,307

192,922

Non controlling intorests

(1,918)

(2,657)

(2,837)

(3,266)

Profit attributoble to owners

of tho Company

21,227

239,225

105,389

206,470

189,656

SELECTED RATIOS

Bosic cornings per shore (sen)

Not assats per share (RM)

Dividend par share (sen)

Return on oquity (%)

1.5

16.8

7.4

14.5

13.3

1.70

13.0

1.66

1.72

15.0

4.30

1.74

1.74

8.5

0.89

16.0

9.66

11.0

8.33

7.85

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning