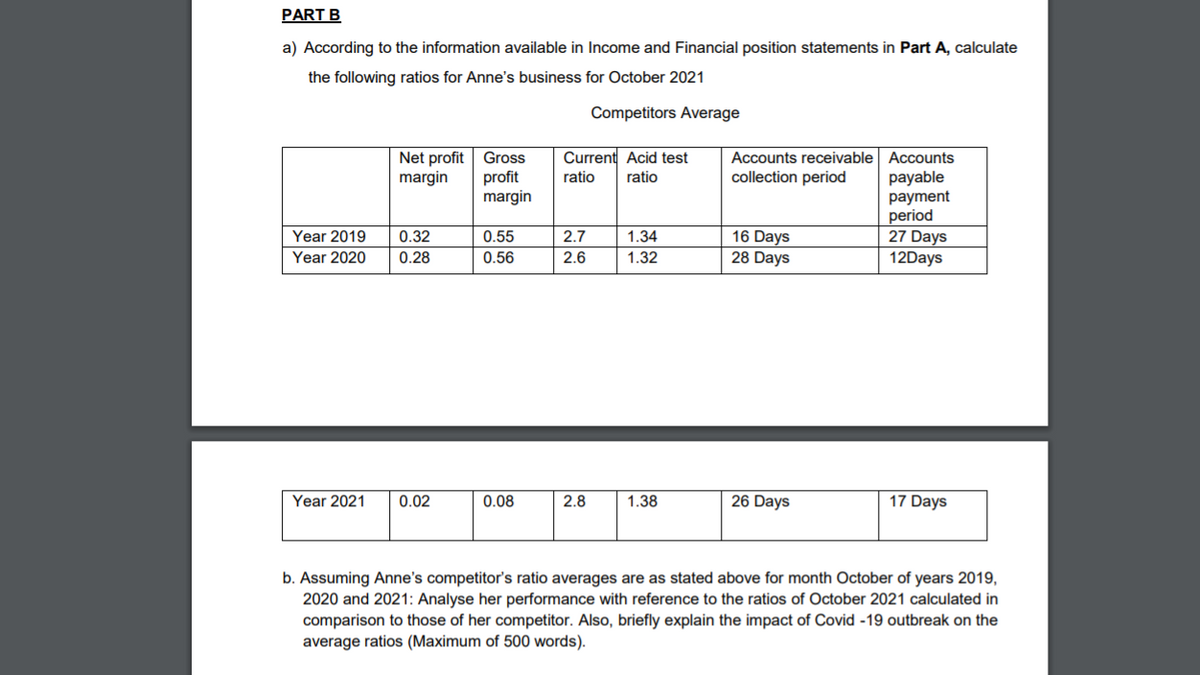

PART B a) According to the information available in Income and Financial position statements in Part A, calculate the following ratios for Anne's business for October 2021 Competitors Average Current Acid test Net profit margin Accounts receivable Accounts collection period Gross profit margin ratio ratio payable 16 Days 28 Days рayment period 27 Days 12Days Year 2019 0.32 0.55 2.7 1.34 Year 2020 0.28 0.56 2.6 1.32 Year 2021 0.02 0.08 2.8 1.38 26 Days 17 Days b. Assuming Anne's competitor's ratio averages are as stated above for month October of years 2019, 2020 and 2021: Analyse her performance with reference to the ratios of October 2021 calculated in comparison to those of her competitor. Also, briefly explain the impact of Covid -19 outbreak on the average ratios (Maximum of 500 words).

Help me only with question b)

Financial statements:

|

Income Statement For the Month Ended October 31, 2021 |

|||

|

Revenue |

|

||

|

Sales |

|

5,600 |

|

|

Less: Cost of Goods Sold Purchases Less: Purchase Return Inventory, October 31, 2021 |

5,400 (250) (320) |

(4,830) |

|

|

Gross Profit |

|

|

770 |

|

Rent Revenue |

|

|

800 |

|

Total Revenue |

|

|

1,570 |

|

Expenses: |

|

|

|

|

Repairs Expense Wages Expense Rent Expense |

|

110 820 850 |

(1,780) |

|

Net Income (Loss) |

|

|

(210) |

|

October 31, 2021 |

||

|

ASSETS |

||

|

Current Assets Cash Cash in Bank Inventory, October 31, 2021 Total Current Assets |

7,340 8,030 150 320 |

15,840 |

|

Non-Current Assets Office Equipment Flat Car Total Non-Current Assets |

2,700 45,000 12,000 |

59,700 |

|

TOTAL ASSETS |

|

75,540 |

|

|

|

|

|

TOTAL LIABILITIES AND OWNER'S EQUITY |

|

|

|

Liabilities: Accounts Payable Total Liabilities |

5,150 |

5,150 |

|

Owner's Equity: York, Capital Less: York, Drawings Net Income (Loss) Total Owner's Equity |

71,800 (1,200) (210) |

70,390 |

|

TOTAL LIABILITIES & OWNER'S EQUITY |

|

75,540 |

Step by step

Solved in 2 steps