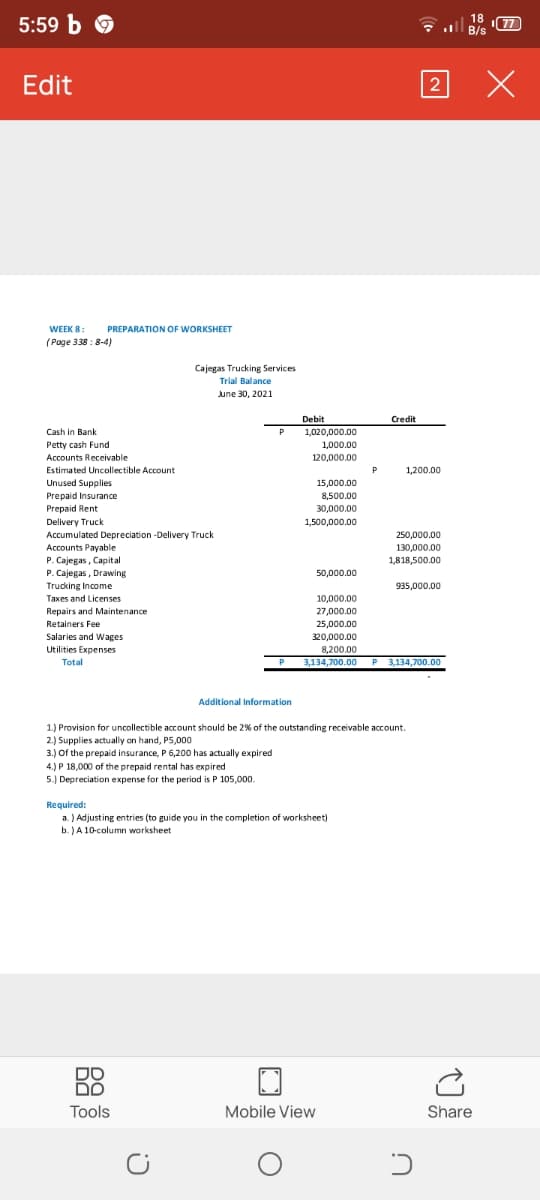

WEEK 8: PREPARATION OF WORKSHEET (Page 338 : 8-4) Cajegas Trucking Services Trial Balance June 30, 2021 Debit Credit Cash in Bank P 1,020,000.00 Petty cash Fund 1,000.00 Accounts Receivable 120,000.00 Estimated Uncollectible Account P 1,200.00 Unused Supplies 15,000.00 8,500.00 Prepaid Insurance Prepaid Rent Delivery Truck 30,000.00 1,500,000.00 Accumulated Depreciation -Delivery Truck 250,000.00 Accounts Payable 130,000.00 P. Cajegas, Capital P. Cajegas , Drawing Trucking Income Taxes and Licenses 1,818,500.00 50,000.00 935,000.00 10,000.00 Repairs and Maintenance 27,000.00 25,000.00 Retainers Fee Salaries and Wages 320,000.00 Utilities Expenses 8,200.00 Total 3,134,700.00 P 3,134,700.00 Additional Information 1.) Provision for uncollectible account should be 2% of the outstanding receivable account. 2.) Supplies actually on hand, P5,000 3.) Of the prepaid insurance, P 6,200 has actually expired 4.) P 18,000 of the prepaid rental has expired 5.) Depreciation expense for the period is P 105,000. Required: a. ) Adjusting entries (to guide you in the completion of worksheet) b. )A 10-column worksheet

WEEK 8: PREPARATION OF WORKSHEET (Page 338 : 8-4) Cajegas Trucking Services Trial Balance June 30, 2021 Debit Credit Cash in Bank P 1,020,000.00 Petty cash Fund 1,000.00 Accounts Receivable 120,000.00 Estimated Uncollectible Account P 1,200.00 Unused Supplies 15,000.00 8,500.00 Prepaid Insurance Prepaid Rent Delivery Truck 30,000.00 1,500,000.00 Accumulated Depreciation -Delivery Truck 250,000.00 Accounts Payable 130,000.00 P. Cajegas, Capital P. Cajegas , Drawing Trucking Income Taxes and Licenses 1,818,500.00 50,000.00 935,000.00 10,000.00 Repairs and Maintenance 27,000.00 25,000.00 Retainers Fee Salaries and Wages 320,000.00 Utilities Expenses 8,200.00 Total 3,134,700.00 P 3,134,700.00 Additional Information 1.) Provision for uncollectible account should be 2% of the outstanding receivable account. 2.) Supplies actually on hand, P5,000 3.) Of the prepaid insurance, P 6,200 has actually expired 4.) P 18,000 of the prepaid rental has expired 5.) Depreciation expense for the period is P 105,000. Required: a. ) Adjusting entries (to guide you in the completion of worksheet) b. )A 10-column worksheet

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 1MC

Related questions

Question

Transcribed Image Text:5:59 b

18

77

* l B/s

Edit

2

WEEK 8:

PREPARATION OF WORKSHEET

(Page 338 : 8-4)

Cajegas Trucking Services

Trial Balance

June 30, 2021

Debit

Credit

1,020,000.00

Cash in Bank

Petty cash Fund

Accounts Receivable

P

1,000.00

120,000.00

Estimated Uncollectible Account

1,200.00

Unused Supplies

Prepaid Insurance

Prepaid Rent

15,000.00

8,500.00

30,000.00

Delivery Truck

Accumulated Depreciation -Delivery Truck

Accounts Payable

P. Cajegas, Capital

P. Cajegas , Drawing

1,500,000.00

250,000.00

130,000.00

1,818,500.00

50,000.00

Trucking Income

Taxes and Licenses

935,000.00

10,000.00

Repairs and Maintenance

27,000.00

Retainers Fee

25,000.00

Salaries and Wages

Utilities Expenses

320,000.00

8,200.00

Total

3.134,700.00

P 3.134.70o0.00

Additional Information

1.) Provision for uncollectible account should be 2% of the outstanding receivable account.

2.) Supplies actually on hand, P5,000

3.) Of the prepaid insurance, P 6,200 has actually expired

4.) P 18,000 of the prepaid rental has expired

5.) Depreciation expense for the period is P 105,000.

Required:

a. ) Adjusting entries (to guide you in the completion of worksheet)

b. ) A 10-column worksheet

DO

Tools

Mobile View

Share

Transcribed Image Text:5:59 b

104 1

B/s

77

Edit

2

Export PDF as long image without

watermark

Export

Which would be the best option for him if he is willing to leave his money in this bank for

1 year?

Name:

Course Code:

Year and Set:

Facilitator:

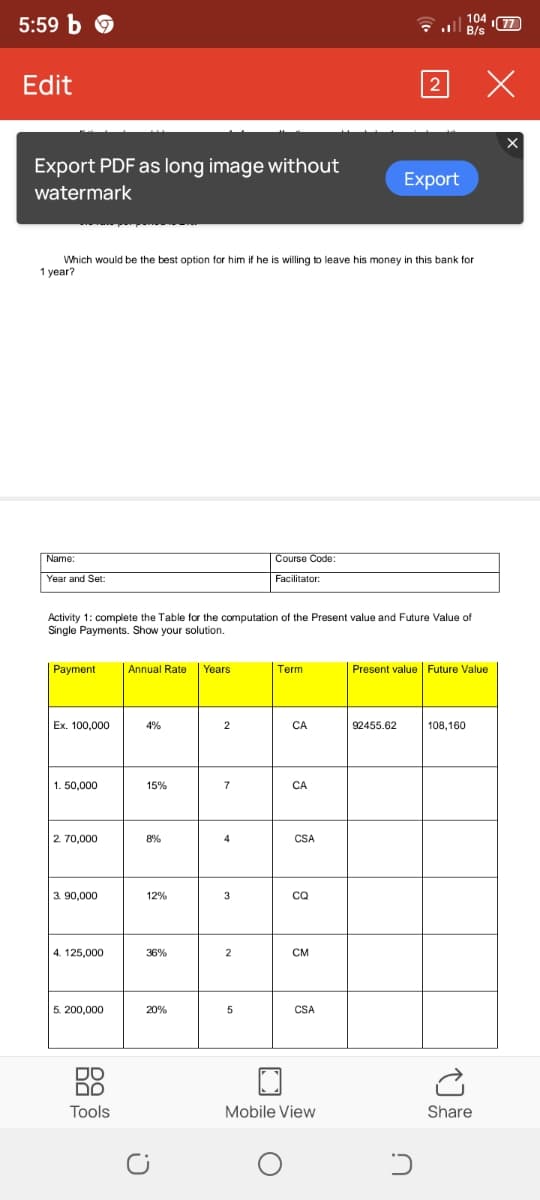

Activity 1: complete the Table for the computation of the Present value and Future Value of

Single Payments. Show your solution.

Раyment

Annual Rate

Years

Term

Present value Future Value

Ex. 100,000

4%

2

CA

92455.62

108,160

1. 50,000

15%

7

CA

2. 70,000

8%

CSA

3. 90,000

12%

3

CQ

4. 125,000

36%

2

CM

5. 200.000

20%

5

CSA

DO

Dם

Tools

Mobile View

Share

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning