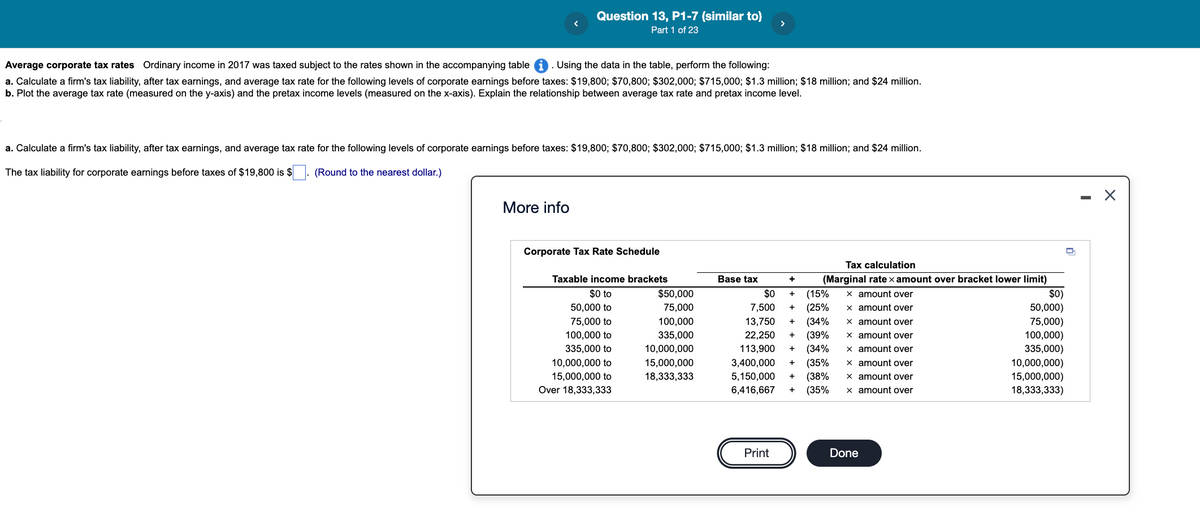

Average corporate tax rates Ordinary income in 2017 was taxed subject to the rates shown in the accompanying table 1. Using the data in the table, perform the following: a. Calculate a firm's tax liability, after tax earnings, and average tax rate for the following levels of corporate earnings before taxes: $19,800; $70,800; $302,000; $715,000; $1.3 million; $18 million; and $24 million. b. Plot the average tax rate (measured on the y-axis) and the pretax income levels (measured on the x-axis). Explain the relationship between average tax rate and pretax income level.

Average corporate tax rates Ordinary income in 2017 was taxed subject to the rates shown in the accompanying table 1. Using the data in the table, perform the following: a. Calculate a firm's tax liability, after tax earnings, and average tax rate for the following levels of corporate earnings before taxes: $19,800; $70,800; $302,000; $715,000; $1.3 million; $18 million; and $24 million. b. Plot the average tax rate (measured on the y-axis) and the pretax income levels (measured on the x-axis). Explain the relationship between average tax rate and pretax income level.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter12: Liabilities: Off-balance-sheet Financing, Retirement Benefits, And Income Taxes

Section: Chapter Questions

Problem 34P

Related questions

Question

Transcribed Image Text:Question 13, P1-7 (similar to)

Part 1 of 23

Average corporate tax rates Ordinary income in 2017 was taxed subject to the rates shown in the accompanying table

Using the data in the table, perform the following:

a. Calculate a firm's tax liability, after tax earnings, and average tax rate for the following levels of corporate earnings before taxes: $19,800; $70,800; $302,000; $715,000; $1.3 million; $18 million; and $24 million.

b. Plot the average tax rate (measured on the y-axis) and the pretax income levels (measured on the x-axis). Explain the relationship between average tax rate and pretax income level.

a. Calculate a firm's tax liability, after tax earnings, and average tax rate for the following levels of corporate earnings before taxes: $19,800; $70,800; $302,000; $715,000; $1.3 million; $18 million; and $24 million.

The tax liability for corporate earnings before taxes of $19,800 is $

(Round to the nearest dollar.)

More info

Corporate Tax Rate Schedule

Tax calculation

Taxable income brackets

Base tax

(Marginal ratex amount over bracket lower limit)

$0 to

$50,000

$0

(15%

(25%

(34%

(39%

(34%

(35%

(38%

(35%

x amount over

$0)

50,000)

50,000 to

75,000

7,500

x amount over

75,000 to

100,000

13,750

x amount over

75,000)

100,000)

335,000)

10,000,000)

15,000,000)

18,333,333)

+

335,000

10,000,000

22,250

113,900

100,000 to

x amount over

335,000 to

x amount over

3,400,000

5,150,000

10,000,000 to

15,000,000

x amount over

15,000,000 to

18,333,333

+

x amount over

Over 18,333,333

6,416,667

x amount over

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning