1 st year 2nd year Scenario A Scenario B Scenario A Scenario B Sales (in units) 18,500 22,000 21,500 23,500 Variable cost per 1 2 2 3 unit (in €) Sales price per unit (in €) Administration & disposal costs (fixed) (in €) Working capital (in €) 7 7 8 1,500 2,100 2,000 2,300 10,000 10,000 12,000 12,000

Part A

A software company is considering launching a new product in the market. To record

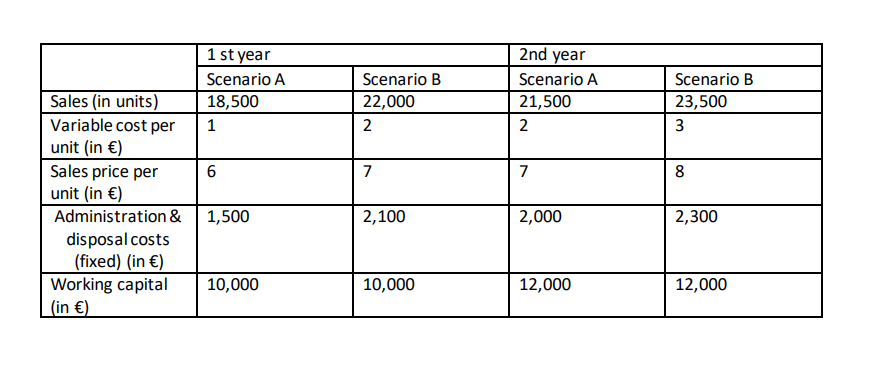

Table 1: Estimated financial data (PLEASE SEE THE IMAGE ATTACHED)

The tax rate is 25%. The company will finance the investment by 2/6 with new share capital, and by 4/6 with a new bond. The cost of share capital is 10% while the (pretax) cost of debt is 8%. Questions:

- a) Calculate the annual expected net cash flows of the project.

- b) Calculate the respective, per year, standard deviations, and coefficients of variation of the net cash flows, and comment on the findings.

- c) Calculate the Weighted Average Cost of Capital.

- d) Evaluate the investment using the

Net Present Value (NPV) method.

Part B

- Comment on the key differences between the Net Present Value (NPV) and the

Internal Rate of Return (IRR). - Should investment appraisal methods use real or nominal cash flows? Explain.

Step by step

Solved in 2 steps