financial factors that the firm should consider in the decision making process?

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 5TP: You own a construction company and have recently received a contract with the local school district...

Related questions

Question

Are there any qualitative or non - financial factors that the firm should consider in the decision making process?

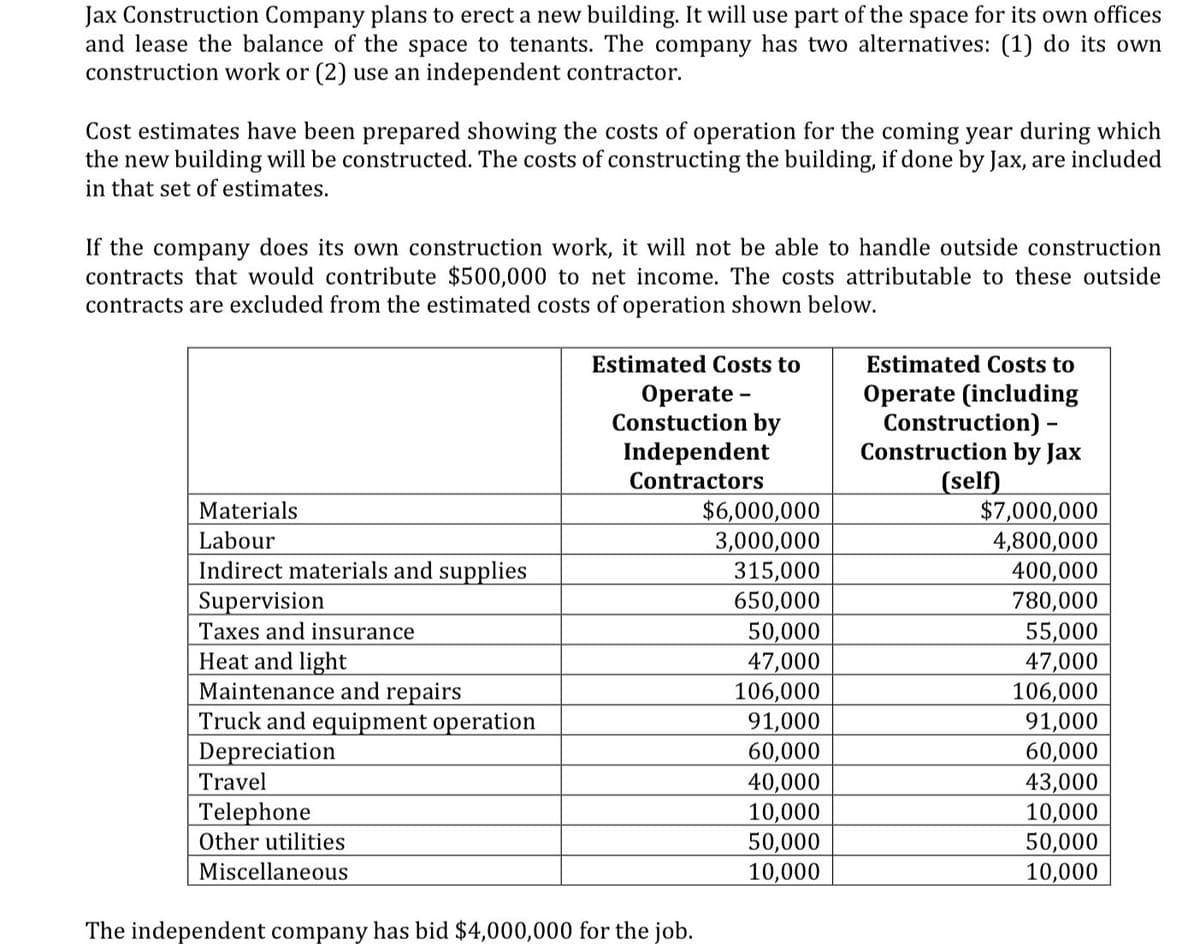

Transcribed Image Text:Jax Construction Company plans to erect a new building. It will use part of the space for its own offices

and lease the balance of the space to tenants. The company has two alternatives: (1) do its own

construction work or (2) use an independent contractor.

Cost estimates have been prepared showing the costs of operation for the coming year during which

the new building will be constructed. The costs of constructing the building, if done by Jax, are included

in that set of estimates.

If the company does its own construction work, it will not be able to handle outside construction

contracts that would contribute $500,000 to net income. The costs attributable to these outside

contracts are excluded from the estimated costs of operation shown below.

Estimated Costs to

Estimated Costs to

Operate -

Constuction by

Independent

Operate (including

Construction) -

Construction by Jax

Contractors

(self)

$6,000,000

3,000,000

315,000

650,000

50,000

47,000

106,000

91,000

60,000

40,000

10,000

50,000

10,000

$7,000,000

4,800,000

400,000

780,000

55,000

47,000

106,000

91,000

60,000

43,000

10,000

50,000

10,000

Materials

Labour

Indirect materials and supplies

Supervision

Taxes and insurance

Heat and light

Maintenance and repairs

Truck and equipment operation

Depreciation

Travel

Telephone

Other utilities

Miscellaneous

The independent company has bid $4,000,000 for the job.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT