Financial information of ABC Company for the year ended December 31, 2021. Description Debit Credit Cash on hand 40,000.00 Cash in bank 900,000.00 Petty cash fund 10,000.00 BSP Treasury bill, purchased on December 1, 2021 and due March 1, 2022 150,000.00 Financial assets at fair value 200,000.00 Financial assets at amortized cost 3,000,000.00 Investment in associate at equity method 1,000,000.00 Accounts receivable 580,000.00 Trade Notes receivable 100,000.00 Accrued interest on notes receivable 10,000.00 Advances to employees, collectible currently 30,000.00 Merchandise Inventory 1,500,000.00 Store supplies 50,000.00 Office supplies unused 30,000.00 Prepaid insurance 20,000.00 Land 1,500,000.00 Building 4,500,000.00 Equipment 1,000,000.00 Furniture and fixtures 400,000.00 Allowance for doubtful accounts 20,000.00 Accumulated depreciation - Building 1,900,000.00 Accumulated depreciation - Equipment 350,000.00 Accumulated depreciation - Furniture and fixtures 150,000.00 Expansion fund 2,000,000.00 Cash surrender value 100,000.00 Trademark 2,000,000.00 Long-term refundable deposit 20,000.00 Long-term advances to officers 80,000.00 Accounts payable 350,000.00 Income tax payable 50,000.00 Dividends payable 100,000.00 Accured expenses 85,000.00 Trade Notes payable 150,000.00 Note payable - short-term debt 400,000.00 Note payable - due July 1, 2023 600,000.00 Accured interest on note payable 15,000.00 Current portion of bonds payable 200,000.00 Bonds payable - remaining portion 1,800,000.00 Warranty liability 50,000.00 Deferred tax liability 100,000.00 Share capital 5,000,000.00 Share premium 2,000,000.00 Retained earnings appropriated for contingencies 1,150,000.00 Retained earnings 3,650,000.00 Gross Sales 9,300,000.00 Interest income 180,000.00 Dividend income 120,000.00 Gain from expropriation 500,000.00 Rent income 100,000.00 Foreign currency translation gain 150,000.00 Share in net income from associate 500,000.00 Sales discount 200,000.00 Sales return and allowances 100,000.00 Advertising 100,000.00 Bonuses 100,000.00 Casualty loss from earthquake 170,000.00 Delivery expense 250,000.00 Depreciation - office equipment 90,000.00 Depreciation - store equipment 150,000.00 Doubtful accounts 40,000.00 Freight-in 300,000.00 Gross Purchases 6,000,000.00 Income tax expense 580,000.00 Interest expense on bank loan 50,000.00 Interest expense on bonds payable 150,000.00 Loss on sale of investment 30,000.00 Loss on sale of property 120,000.00 Office salaries 650,000.00 Office supplies expense 70,000.00 Purchase discount 250,000.00 Purchase return and allowances 150,000.00 Sales commission 180,000.00 Sales Salaries 600,000.00 SSS and Philhealth - Office 30,000.00 SSS and Philhealth - Sales 20,000.00 Store supplies expense 50,000.00 Taxes and licenses 20,000.00 Unrealized loss on derivative contract designated as cash flow hedge 100,000.00 Total 29,370,000.00 29,370,000.00 Ending merchandise Inventory for the period is P2,000,000 PREPARE THE FINANCIAL STATEMENT OF POSITION AND STATEMENT OF COMPREHENSIVE INCOME. PLEASE

Financial information of ABC Company for the year ended December 31, 2021. Description Debit Credit Cash on hand 40,000.00 Cash in bank 900,000.00 Petty cash fund 10,000.00 BSP Treasury bill, purchased on December 1, 2021 and due March 1, 2022 150,000.00 Financial assets at fair value 200,000.00 Financial assets at amortized cost 3,000,000.00 Investment in associate at equity method 1,000,000.00 Accounts receivable 580,000.00 Trade Notes receivable 100,000.00 Accrued interest on notes receivable 10,000.00 Advances to employees, collectible currently 30,000.00 Merchandise Inventory 1,500,000.00 Store supplies 50,000.00 Office supplies unused 30,000.00 Prepaid insurance 20,000.00 Land 1,500,000.00 Building 4,500,000.00 Equipment 1,000,000.00 Furniture and fixtures 400,000.00 Allowance for doubtful accounts 20,000.00 Accumulated depreciation - Building 1,900,000.00 Accumulated depreciation - Equipment 350,000.00 Accumulated depreciation - Furniture and fixtures 150,000.00 Expansion fund 2,000,000.00 Cash surrender value 100,000.00 Trademark 2,000,000.00 Long-term refundable deposit 20,000.00 Long-term advances to officers 80,000.00 Accounts payable 350,000.00 Income tax payable 50,000.00 Dividends payable 100,000.00 Accured expenses 85,000.00 Trade Notes payable 150,000.00 Note payable - short-term debt 400,000.00 Note payable - due July 1, 2023 600,000.00 Accured interest on note payable 15,000.00 Current portion of bonds payable 200,000.00 Bonds payable - remaining portion 1,800,000.00 Warranty liability 50,000.00 Deferred tax liability 100,000.00 Share capital 5,000,000.00 Share premium 2,000,000.00 Retained earnings appropriated for contingencies 1,150,000.00 Retained earnings 3,650,000.00 Gross Sales 9,300,000.00 Interest income 180,000.00 Dividend income 120,000.00 Gain from expropriation 500,000.00 Rent income 100,000.00 Foreign currency translation gain 150,000.00 Share in net income from associate 500,000.00 Sales discount 200,000.00 Sales return and allowances 100,000.00 Advertising 100,000.00 Bonuses 100,000.00 Casualty loss from earthquake 170,000.00 Delivery expense 250,000.00 Depreciation - office equipment 90,000.00 Depreciation - store equipment 150,000.00 Doubtful accounts 40,000.00 Freight-in 300,000.00 Gross Purchases 6,000,000.00 Income tax expense 580,000.00 Interest expense on bank loan 50,000.00 Interest expense on bonds payable 150,000.00 Loss on sale of investment 30,000.00 Loss on sale of property 120,000.00 Office salaries 650,000.00 Office supplies expense 70,000.00 Purchase discount 250,000.00 Purchase return and allowances 150,000.00 Sales commission 180,000.00 Sales Salaries 600,000.00 SSS and Philhealth - Office 30,000.00 SSS and Philhealth - Sales 20,000.00 Store supplies expense 50,000.00 Taxes and licenses 20,000.00 Unrealized loss on derivative contract designated as cash flow hedge 100,000.00 Total 29,370,000.00 29,370,000.00 Ending merchandise Inventory for the period is P2,000,000 PREPARE THE FINANCIAL STATEMENT OF POSITION AND STATEMENT OF COMPREHENSIVE INCOME. PLEASE

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

100%

| Financial information of ABC Company for the year ended December 31, 2021. | ||

| Description | Debit | Credit |

| Cash on hand | 40,000.00 | |

| Cash in bank | 900,000.00 | |

| Petty cash fund | 10,000.00 | |

| BSP Treasury bill, purchased on December 1, 2021 and due March 1, 2022 | 150,000.00 | |

| Financial assets at fair value | 200,000.00 | |

| Financial assets at amortized cost | 3,000,000.00 | |

| Investment in associate at equity method | 1,000,000.00 | |

| Accounts receivable | 580,000.00 | |

| Trade Notes receivable | 100,000.00 | |

| Accrued interest on notes receivable | 10,000.00 | |

| Advances to employees, collectible currently | 30,000.00 | |

| Merchandise Inventory | 1,500,000.00 | |

| Store supplies | 50,000.00 | |

| Office supplies unused | 30,000.00 | |

| Prepaid insurance | 20,000.00 | |

| Land | 1,500,000.00 | |

| Building | 4,500,000.00 | |

| Equipment | 1,000,000.00 | |

| Furniture and fixtures | 400,000.00 | |

| Allowance for doubtful accounts | 20,000.00 | |

| Accumulated |

1,900,000.00 | |

| Accumulated depreciation - Equipment | 350,000.00 | |

| Accumulated depreciation - Furniture and fixtures | 150,000.00 | |

| Expansion fund | 2,000,000.00 | |

| Cash surrender value | 100,000.00 | |

| Trademark | 2,000,000.00 | |

| Long-term refundable deposit | 20,000.00 | |

| Long-term advances to officers | 80,000.00 | |

| Accounts payable | 350,000.00 | |

| Income tax payable | 50,000.00 | |

| Dividends payable | 100,000.00 | |

| Accured expenses | 85,000.00 | |

| Trade Notes payable | 150,000.00 | |

| Note payable - short-term debt | 400,000.00 | |

| Note payable - due July 1, 2023 | 600,000.00 | |

| Accured interest on note payable | 15,000.00 | |

| Current portion of bonds payable | 200,000.00 | |

| Bonds payable - remaining portion | 1,800,000.00 | |

| Warranty liability | 50,000.00 | |

| |

100,000.00 | |

| Share capital | 5,000,000.00 | |

| Share premium | 2,000,000.00 | |

| |

1,150,000.00 | |

| Retained earnings | 3,650,000.00 | |

| Gross Sales | 9,300,000.00 | |

| Interest income | 180,000.00 | |

| Dividend income | 120,000.00 | |

| Gain from expropriation | 500,000.00 | |

| Rent income | 100,000.00 | |

| Foreign currency translation gain | 150,000.00 | |

| Share in net income from associate | 500,000.00 | |

| Sales discount | 200,000.00 | |

| Sales return and allowances | 100,000.00 | |

| Advertising | 100,000.00 | |

| Bonuses | 100,000.00 | |

| Casualty loss from earthquake | 170,000.00 | |

| Delivery expense | 250,000.00 | |

| Depreciation - office equipment | 90,000.00 | |

| Depreciation - store equipment | 150,000.00 | |

| Doubtful accounts | 40,000.00 | |

| Freight-in | 300,000.00 | |

| Gross Purchases | 6,000,000.00 | |

| Income tax expense | 580,000.00 | |

| Interest expense on bank loan | 50,000.00 | |

| Interest expense on bonds payable | 150,000.00 | |

| Loss on sale of investment | 30,000.00 | |

| Loss on sale of property | 120,000.00 | |

| Office salaries | 650,000.00 | |

| Office supplies expense | 70,000.00 | |

| Purchase discount | 250,000.00 | |

| Purchase return and allowances | 150,000.00 | |

| Sales commission | 180,000.00 | |

| Sales Salaries | 600,000.00 | |

| SSS and Philhealth - Office | 30,000.00 | |

| SSS and Philhealth - Sales | 20,000.00 | |

| Store supplies expense | 50,000.00 | |

| Taxes and licenses | 20,000.00 | |

| Unrealized loss on derivative contract designated as |

100,000.00 | |

| Total | 29,370,000.00 | 29,370,000.00 |

| Ending merchandise Inventory for the period is P2,000,000 |

PREPARE THE FINANCIAL STATEMENT OF POSITION AND STATEMENT OF COMPREHENSIVE INCOME. PLEASE ASAP.

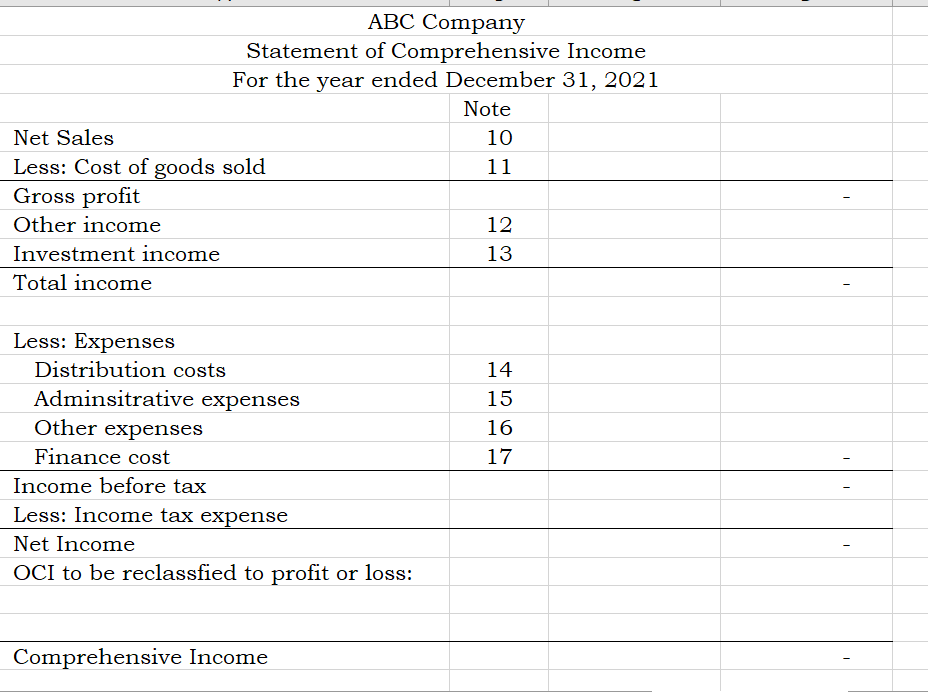

Transcribed Image Text:ABC Company

Statement of Comprehensive Income

For the year ended December 31, 2021

Note

Net Sales

10

Less: Cost of goods sold

Gross profit

11

Other income

12

Investment income

13

Total income

Less: Expenses

Distribution costs

14

Adminsitrative expenses

15

Other expenses

16

Finance cost

17

Income before tax

Less: Income tax expense

Net Income

OCI to be reclassfied to profit or loss:

Comprehensive Income

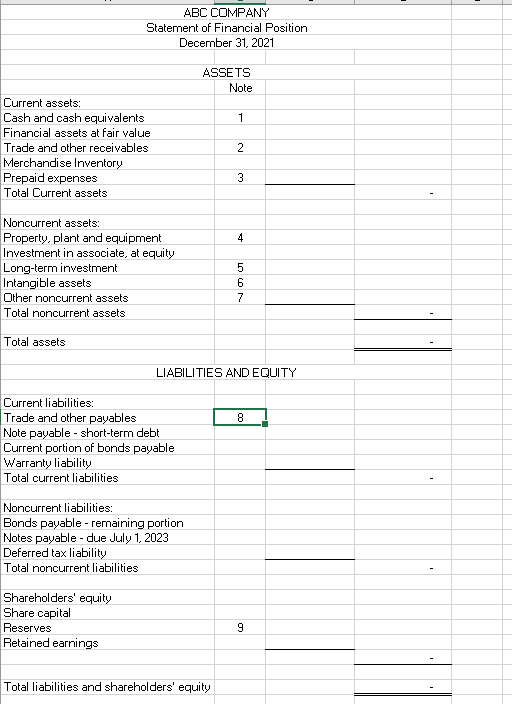

Transcribed Image Text:ABC COMPANY

Statement of Financial Position

December 31, 2021

ASSETS

Note

Current assets:

Cash and cash equivalents

1

Financial assets at fair value

Trade and other receivables

Merchandise Inventory

Prepaid expenses

Total Current assets

2

3

Noncurrent assets:

Property, plant and equipment

Investment in associate, at equity

Long-term investment

Intangible assets

Other noncurrent assets

4

6

7

Total noncurrent assets

Total assets

LIABILITIES AND EQUITY

Current liabilities:

Trade and other payables

Note payable - short-term debt

Current portion of bonds payable

Warranty liability

Total current liabilities

8

Noncurrent liabilities:

Bonds payable - remaining portion

Notes payable - due July 1, 2023

Deferred tax liability

Total noncurrent liabilities

Shareholders' equity

Share capital

Reserves

9

Retained earnings

Total liabilities and shareholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning