Q: List which of the following statement(s) concerning risk are correct? I. Nondiversifiable risk is…

A: Risk is a factor which arises due to uncertain future factors. It can be generated through external…

Q: Distinguish between different kinds of risk and the steps involved in the financial risk management…

A: The financial risk management process is the process that describes the framework for the…

Q: How the following risk can be mitigated and managed 1. Market risk 2. Liquidity risk 3. Insolvency…

A: Market risk is also known as systematic risk, that involves uncertainty with any investment…

Q: Describe the responsibili!es of a financial analyst

A: Financial Analyst: Someone whose job is to evaluate the financial state of a firm or asset in order…

Q: _______ is a measure of risk while _______ is a measure of risk and liquidity.

A: Capital budgeting is the process of distributing the resources(finance) of the organization in…

Q: question is related to FINANCIAL RISK MANAGEMENT

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Financial decisions require that you weigh alternatives in strictly monetary terms. 1. True p. False

A: Step 1 Managers make financial judgments when it comes to a company's money. These decisions might…

Q: ll business decisions have a on people. Oapplication O risk O effect recourse

A: Solution Concept Every business is operated on the society and it largely is affected by the society…

Q: liquidity risk? Define briefly with an appropriate example

A: Risk means uncertainties in the future. There is a high risk involved in every investment because…

Q: Distinguish between business and financial risk

A: Financial risk refers to the ability of a company to handle its debt and financial leverage, while…

Q: Define financial intermediary

A: A financial intermediary is a firm that goes about as an agent in a money related exchange between…

Q: Define corporate risk

A: Corporate risk is the risk related to the company’s normal course of activities. The corporate…

Q: Differentiate between interest rate risk and reinvestmentrate risk.

A: The major representation of the interest rate risk is the differentiation in the bond market price…

Q: Financial risk management encompasses the management of (a) operational risk, strategic risk, and…

A: Financial Risk management is a study to reduce the risk or possibility of loss related to an…

Q: Identify the incorrect statement abou financial planning:

A: Financial planning is a process of making decisions regarding selection of funds and how these funds…

Q: O liquidity risk

A: Risks: Risks are the difference between the expected gains and the actual gains. Risks are core…

Q: ncial market and identify

A: When the stability hamper in the financial market it may cause serious deviation in financial assets

Q: Define banker’s acceptance

A: The bill of exchange is a written document made by one person in the favor of another person for the…

Q: e financial manager's financing function?

A: First option is wrong because monitoring trends in operating expenses will help in determining the…

Q: 4.1)Evaluate the significance of financing and investment consideration in risk

A: Investment Risk: In the context of investments, investment risk may be described as the possibility…

Q: Discussion questions: What are the basic risks faced by financial intermediaries? Discuss each…

A: Financial intermediaries : Financial intermediaries can be described as institutions that act as the…

Q: How might you mitigate the risks that are mentioned? Market, Liquidity, and Operational.

A: Businesses face various types of risks that affect survival and growth of the company. Risks that a…

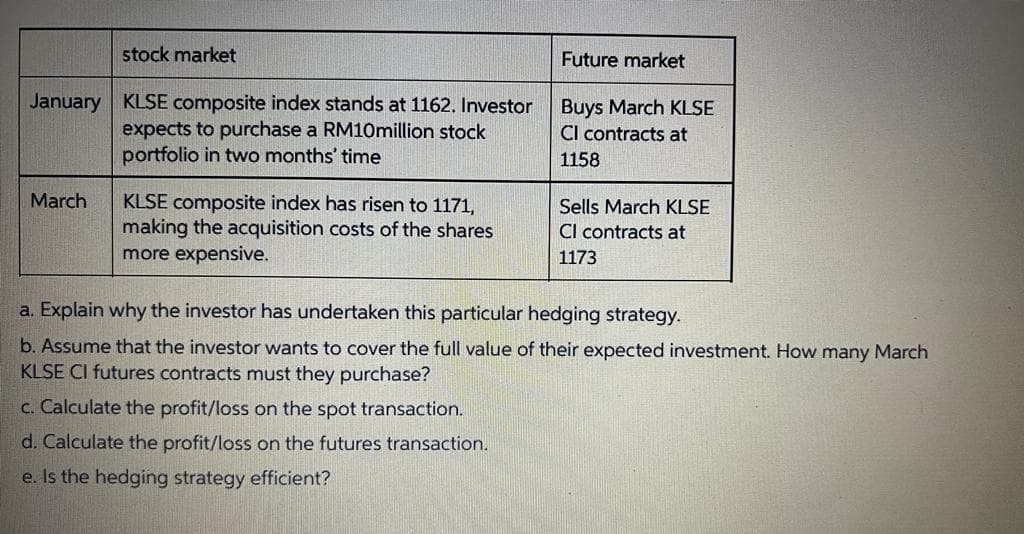

Q: financial risk management amswer question d only

A: Data given:: Future Market - Buys March KLSE CI contracts at 1158 Sells March KLSE CI contracts at…

Q: impact of covid 19 on financial market

A: Several years after the end of the Global Financial Crisis (GFC) and the recession followed by it,…

Q: Importance of Financial System

A: The financial system consists of insurance companies, banks, stock exchanges that facilitate the…

Q: escribe the role of a financial risk manager, how one would differentiate between pure and…

A: Financial risk management: It is a process of identifying potential risk of a company with respect…

Q: do you understand by the term "Liquidity Management". Why is important ?

A: in organisation company have large amount money held in different forms assets but it takes time to…

Q: 3- Which of the following statements is TRUE? Select one: a. Unsystematic risk is also kn

A: Explanation : In simple words, Unsystematic risk refers to an uncertainty that is peculiar to a…

Q: facilitates the comparison of financial noriod t moth

A: Option a is wrong because historical cost concept suggests to record of assets and liabilities at…

Q: Risks that are insurable because their probabilities can be calculated precisely enough for the risk…

A: An insurable risk, that might comprise possibility of loss that is unexpected and outside the…

Q: What is a financial risk management certificate?

A: Financial risk management course refers to the professional qualification which focus provides the…

Q: Management of current liabilities arises, in part, because of a concern over a. (profitability).…

A: Current liabilities are obligations on an entity that are to be compensated by the organization…

Q: . risk B. risk management C.hed

A: Step 1 The process of detecting, analyzing, and managing corporate finances and profits is known…

Q: What is financial advisor

A: A financial advisor may be a general term used for various financial professionals like insurance…

Q: plockchain financial transactions?

A: Blockchain helps in making transparency in the financing industry while users are considering the…

Q: Answer the following questions: a) How do you handle financial risk?

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: What is liquidity black holes?

A: Liquidity is when assets can be easily traded in the market with no compromise in the price of the…

Q: 5. Which of the following statements best describe risk in financial planning? A. The degree of…

A: Risk in Financial planning have following features 1. Uncertainty of success or failure of…

Q: ) Finance Which one is a financial risk? Select one: a. Uncertainty about demand b. uncertainty…

A: Meaning of Financial risk is diffrent for different category of person. In case of individual who is…

Q: What is financial risk?

A: Risk means the type of danger. Financial risk refers to the situation of losing money on an…

Q: finance?

A: Business is an activity carried out with the aim of earning profits. The main objective behind…

Q: escribes the relationship between risk and return.

A: Risk and return are directly related.

Q: Question 7 What is the other name for fim-specific risk? O Systematic risk O Market risk O Micro-cap…

A: Risk includes the likelihood of losing some or all of the original investment. Business risks refer…

Q: explain 3 types of financial risk. how to mitigate the risk

A: Financial risk is the risk related to the finance including financial transactions which includes…

amswer question a only

Step by step

Solved in 2 steps

- Suppose that the last sale of Company X stock was at a price of $50. Further suppose that an investor wishes to place a market order to purchase 25,000 shares of Company X stock. What is the volume weighted average price that the investor will trade at in each of the market? What if the investor purchase 120,000 shares instead 25,000? Market Depth - Market A vs B Market AMarket B#SharesOffer ($)#SharesOffer ($)30,00050.0010,00050.0040,00050.0210,00050.0110,00050.0570,00050.0320,00050.0680,00050.0430,00050.0760,00050.0510,00050.0940,00050.05Prediction Inc.'s perpetual preferred stock sells for $102.50 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? a. 9.33% b. 8.72% c. 7.26% d. 7.17% e. 8.64%Perpetual preferred stock from Franklin Inc. sells for $97.50 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? a. 9.44% b. 9.08% c. 9.82% d. 8.72% e. 10.22%

- Preferred stock valuation Jones Design wishes to estimate the value of its out-standing preferred stock. The preferred issue has an $80 par value and pays an annual dividend of $6.40 per share. Similar-risk preferred stocks are currently earning a 9.3% annual rate of return. a. What is the market value of the outstanding preferred stock? b. If an investor purchases the preferred stock at the value calculated in part a, how much does she gain or lose per share if she sells the stock when the required return on similar-risk preferred stocks has risen to 10.5%? Explain(a) Donald is considering the merits of two securities. He is interested in the common shares ofA Co. and B Inc. The expected monthly rate of return of securities is shown below:State of Affair Probability Stock A Stock BBoom 0.1 40% -20%Normal 0.5 20% 8%Recession 0.4 -10% 15%At the time of purchase, the market value is $70/share for A and $50/share for B. Donaldplans to invest 10,000 shares of Stock A and 6,000 shares in Stock B.(i) Compute the portfolio weights of Stock A and Stock B. (ii) Compute the expected returns of Stock A and Stock B. (iii) Assume that the covariance between Stock A and Stock B is -28%2(0.0028). Computethe expected rate of return and variance of rate of return of Donald’s portfolio.(iv) If the risk-free rate is 2%, the market risk premium is 18% and the beta of Stock A is0.75, estimate the required and expected rates of return of Stock A. Should Donaldinvest in Stock A? Show the calculations.Preferred stock valuation Jones Design wishes to estimate the value of its outstanding preferred stock. The preferred issue has a par value of $60 and pays an annual dividend of $6.80 per share. Similar-risk preferred stocks are currently earning an annual rate of return of 7.7%. a. What is the market value of the outstanding preferred stock? b. If an investor purchases the preferred stock at the value calculated in part a, how much does she gain or lose per share if she sells the stock when the required return on similar-risk preferred stocks has risen to 9.3%?

- Boeing (BA) shares currently sell for $330/share. BA expects to pay a $6.85/share dividend in 3-months. The 3-month risk-free rate, compounded continuously, is 2.25%. Using the principles of arbitrage, what is the lower bound for the price of a 3-month European put option for BA with a strike price $300? (pick the best answer) Group of answer choices -24.87≤ p -15≤ p 0≤ p 300≤ pFirm A is currently trading at $17.80 per share. Firm A announces that it will acquire Firm B at a ratio of 4:7 shares. Firm B shares rise from $8.45 to $9.73 immediately following the announcement while Firm A's stock price remains unchanged. What is the implied probability that the market thinks the deal will go through?Stout Inc.'s perpetual preferred stock sells for $65.00 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? a. 10.39% b. 13.62% c. 14.40% d. 14.28% e. 11.81%

- Perpetual preferred stock sells for $97.50 per share, and it pays an $6.85 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? a. 7.32% b.6.25% c. 8.01% d.5.18% e. 4.11%its urgent An investor currently holds 1,000 shares of QQQ, the Power Shares NASDAQ 100 ETF, priced at $105.78/share. The investor would like to hedge the risk associated with the position in the short-term. QQQ puts with a strike price of 102.50 and expiring in two months currently have a premium of $1.18. Call options with the same expiration and a strike price of 107 currently have a premium of $1.03. Explain how the investor could hedge the downside risk of QQQ by either purchasing the 102.50 put, or by creating a range forward (purchasing the 102.50 put and selling the 107 call). Compare and contrast the two alternative hedges. Remember, each option contract covers 100 shares, the investor would need 10 contracts to cover their position in QQQ.Conglomerate Inc. is trading at $80/share, and is about to announce its intent to acquire Tiny Corp. who is an all-equity firm with 20 million shares trading at $5/share. The projected synergies from the acquisition are $15 million. What is the maximum exchange ratio Conglomerate Inc. could offer in a stock swap and still have the deal be positive NPV? 18.4 1.43 11.24 1.66