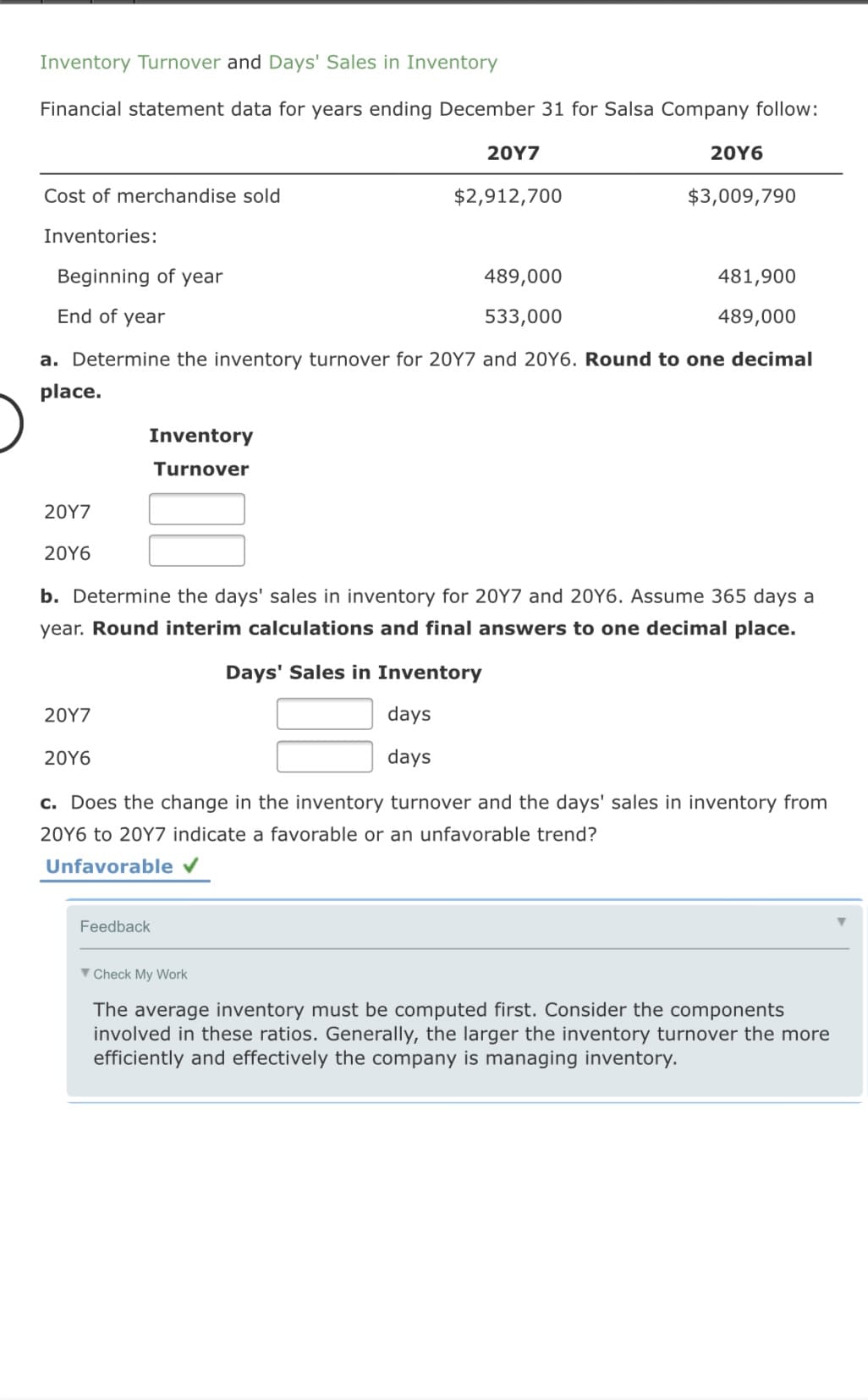

Financial statement data for years ending December 31 for Salsa Company follow: 20Υ7 20Υ6 Cost of merchandise sold $2,912,700 $3,009,790 Inventories: Beginning of year 489,000 481,900 End of year 533,000 489,000 a. Determine the inventory turnover for 20Y7 and 20Y6. Round to one decimal place. Inventory Turnover 20Υ7 20Y6 b. Determine the days' sales in inventory for 20Y7 and 20Y6. Assume 365 days a year. Round interim calculations and final answers to one decimal place. Days' Sales in Inventory 20Υ7 days 20Y6 days c. Does the change in the inventory turnover and the days' sales in inventory from 20Y6 to 20Y7 indicate a favorable or an unfavorable trend? Unfavorable v

Financial statement data for years ending December 31 for Salsa Company follow: 20Υ7 20Υ6 Cost of merchandise sold $2,912,700 $3,009,790 Inventories: Beginning of year 489,000 481,900 End of year 533,000 489,000 a. Determine the inventory turnover for 20Y7 and 20Y6. Round to one decimal place. Inventory Turnover 20Υ7 20Y6 b. Determine the days' sales in inventory for 20Y7 and 20Y6. Assume 365 days a year. Round interim calculations and final answers to one decimal place. Days' Sales in Inventory 20Υ7 days 20Y6 days c. Does the change in the inventory turnover and the days' sales in inventory from 20Y6 to 20Y7 indicate a favorable or an unfavorable trend? Unfavorable v

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 8PEB: Financial statement data for years ending December 31 for Tango Company follow: a. Determine the...

Related questions

Topic Video

Question

Transcribed Image Text:Inventory Turnover and Days' Sales in Inventory

Financial statement data for years ending December 31 for Salsa Company follow:

20Y7

20Υ6

Cost of merchandise sold

$2,912,700

$3,009,790

Inventories:

Beginning of year

489,000

481,900

End of year

533,000

489,000

a. Determine the inventory turnover for 20Y7 and 20Y6. Round to one decimal

place.

Inventory

Turnover

20Υ7

20Υ6

b. Determine the days' sales in inventory for 20Y7 and 20Y6. Assume 365 days a

year. Round interim calculations and final answers to one decimal place.

Days' Sales in Inventory

20Υ7

days

20Y6

days

c. Does the change in the inventory turnover and the days' sales in inventory from

20Y6 to 20Y7 indicate a favorable or an unfavorable trend?

Unfavorable v

Feedback

V Check My Work

The average inventory must be computed first. Consider the components

involved in these ratios. Generally, the larger the inventory turnover the more

efficiently and effectively the company is managing inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub