Find the following: •Sales revenue •Cost of Good Sold •Insurance Expense •Income before Tax •Income after Tax

Find the following: •Sales revenue •Cost of Good Sold •Insurance Expense •Income before Tax •Income after Tax

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 5E: Fava Company began operations in 2018 and used the LIFO inventory method for both financial...

Related questions

Question

Find the following:

•Sales revenue

•Cost of Good Sold

•Insurance Expense

•Income before Tax

•Income after Tax

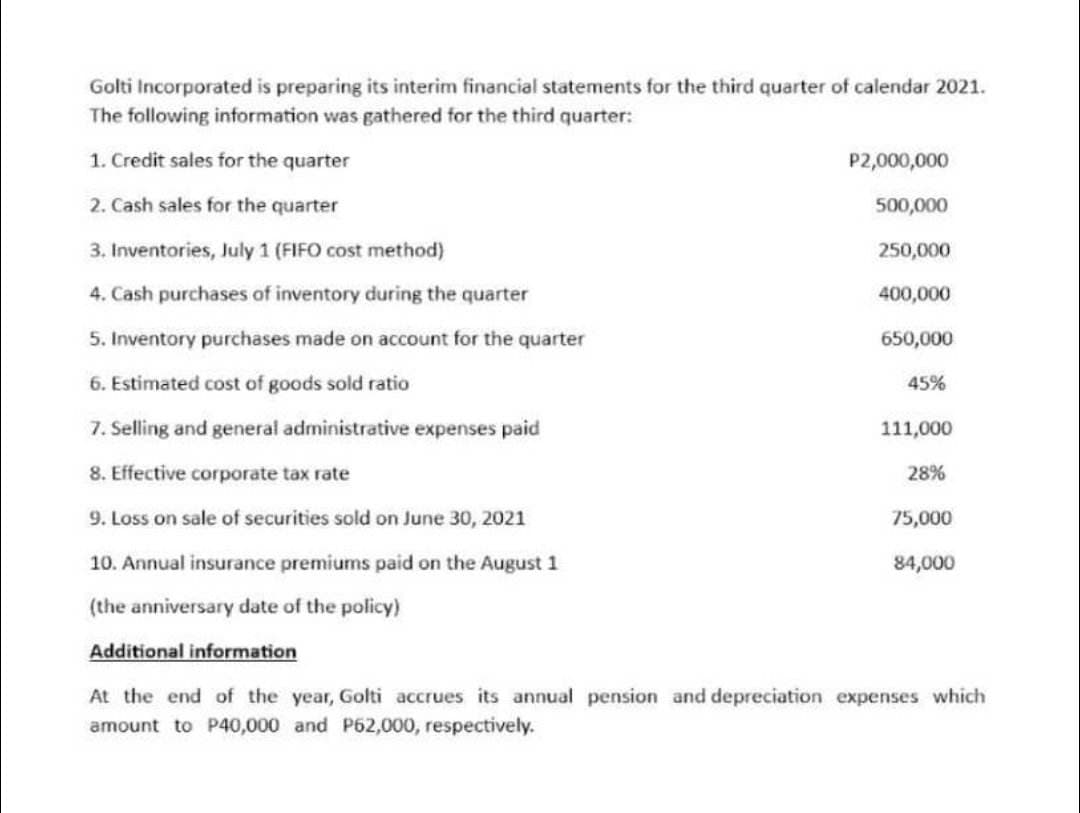

Transcribed Image Text:Golti Incorporated is preparing its interim financial statements for the third quarter of calendar 2021.

The following information was gathered for the third quarter:

1. Credit sales for the quarter

2. Cash sales for the quarter

P2,000,000

500,000

250,000

400,000

650,000

45%

3. Inventories, July 1 (FIFO cost method)

4. Cash purchases of inventory during the quarter

5. Inventory purchases made on account for the quarter

6. Estimated cost of goods sold ratio

7. Selling and general administrative expenses paid

8. Effective corporate tax rate

9. Loss on sale of securities sold on June 30, 2021

10. Annual insurance premiums paid on the August 1

(the anniversary date of the policy)

Additional information

At the end of the year, Golti accrues its annual pension and depreciation expenses which

amount to P40,000 and P62,000, respectively.

111,000

28%

75,000

84,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning