Find the future value of a quarterly annuity due of $4,800 for three years at 10% annual interest compounded quarterly. How much was invested? How much interest was earned? E Click the icon to view the Future Value of $1.00 Ordinary Annuity table. The future value is S - (Round to the nearest cent as needed.)

Find the future value of a quarterly annuity due of $4,800 for three years at 10% annual interest compounded quarterly. How much was invested? How much interest was earned? E Click the icon to view the Future Value of $1.00 Ordinary Annuity table. The future value is S - (Round to the nearest cent as needed.)

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter4: Managing Your Cash And Savings

Section: Chapter Questions

Problem 7FPE: Calculating interest earned and future value of savings account. If you put 6,000 in a savings...

Related questions

Question

Transcribed Image Text:Find the future value of a quarterly annuity due of $4,800 for three years at 10% annual interest compounded quarterly. How much was invested? How much interest

was earned?

E Click the icon to view the Future Value of $1.00 Ordinary Annuity table.

The future value is S

.(Round to the nearest cent as needed.)

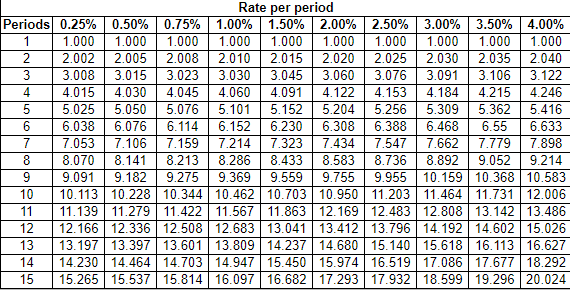

Transcribed Image Text:Rate per period

3.00% 3.50% 4.00%

1.000

2.035

3.106

Periods 0.25% 0.50% 0.75% 1.00% 1.50% 2.00% 2.50%

1.000

1

2.002

1.000

1.000

1.000

1.000

2.020

3.060

4.122

5.204

6.308

7.434

8.583

9.755

10.113 10.228 10.344 10.462 10.703 10.950 11.203 11.464 11.731 12.006

11.139 11.279 11.422 11.567 11.863 12.169 12.483 12.808 13.142 13.486

12.166 12.336 12.508 12.683 13.041 13.412 13.796 14.192 14.602 15.026

13.197 13.397 13.601 13.809 14.237 14.680 | 15.140 15.618 16.113 16.627

14.230 14.464 14.703 14.947 15.450 15.974 16.519 17.086 17.677 18.292

1.000

1.000

1.000

2.005

3.015

1.000

2.025

3.076

2.010| 2.015

3.030

4.060

5.101

6.152

7.214

8.286

9.369

2.008

3.023

2.030

2.040

3.008

3.045

3.091

3.122

4

4.015

4.030

4.045

4.091

4.153

5.256

4.184

4.215

4.246

5.309

5.362

6.55

7.779

9.052

9.955 10.159 10.368 10.583

5.025

5.050

6.076

7.106

8.141

9.182

5.076

5.152

5.416

6.

6.038

6.114

6.230

6.388

6.468

7.662

8.892

6.633

7.547

7.898

7

7.053

8.070

8

9.091

7.159

8.213

9.275

7.323

8.433

8.736

9.214

9.559

10

11

12

13

14

15

15.265 15.537 15.814 16.097 16.682 17.293 17.932 18.599 19.296 20.024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning