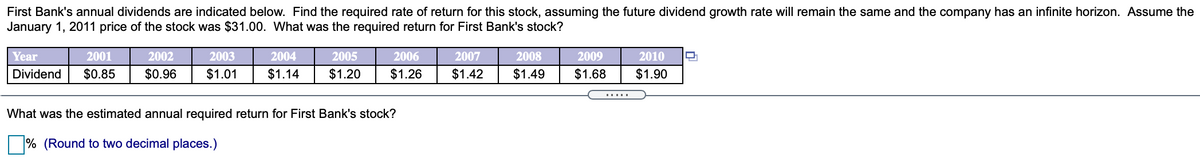

First Bank's annual dividends are indicated below. Find the required rate of return for this stock, assuming the future dividend growth rate will remain the same and the company has an infinite horizon. Assume the January 1, 2011 price of the stock was $31.00. What was the required return for First Bank's stock? Year 2001 2002 2003 2004 2006 2007 2008 2009 2010 Dividend $0.85 $0.96 $1.01 $1.14 $1.20 $1.26 $1.42 $1.49 $1.68 $1.90 What was the estimated annual required return for First Bank's stock?

First Bank's annual dividends are indicated below. Find the required rate of return for this stock, assuming the future dividend growth rate will remain the same and the company has an infinite horizon. Assume the January 1, 2011 price of the stock was $31.00. What was the required return for First Bank's stock? Year 2001 2002 2003 2004 2006 2007 2008 2009 2010 Dividend $0.85 $0.96 $1.01 $1.14 $1.20 $1.26 $1.42 $1.49 $1.68 $1.90 What was the estimated annual required return for First Bank's stock?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:First Bank's annual dividends are indicated below. Find the required rate of return for this stock, assuming the future dividend growth rate will remain the same and the company has an infinite horizon. Assume the

January 1, 2011 price of the stock was $31.00. What was the required return for First Bank's stock?

Year

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Dividend

$0.85

$0.96

$1.01

$1.14

$1.20

$1.26

$1.42

$1.49

$1.68

$1.90

.....

What was the estimated annual required return for First Bank's stock?

% (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning