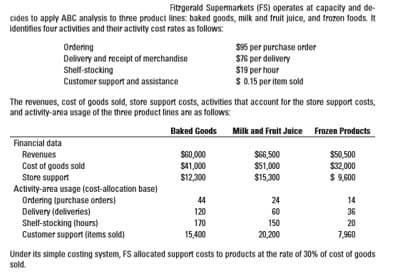

Fitzgerald Supermarkets (FS) operates at capacity and de- cides to apply ABC analysis to three product lines: baked goods, milk and fruit juice, and frozen foods. It identifies four activities and their activity cost rates as follows: $95 per purchase order S76 per delivery $19 per hour $0.15 per item sold Ordering Delivery and receipt of merchandise Shelf-stocking Customer support and assistance The revenues, cost of goods sold, store support costs, activities that account for the store support costs, and activity-area usage of the three product lines are as follows: Baked Goods Milk and Fruit Juice Frozen Products Financial data S66,500 $51,000 $15,300 S50,500 $32,000 $ 9,600 Revenues S60,000 S41,000 Cost of goods sold Store support Activity-area usage (cost-allocation base) Ordering (purchase orders) Delivery (deliveries) Shelf-stocking (hours) Customer support (items sold) $12,300 24 44 14 120 60 36 170 150 20 20,200 15,400 7,960 Under its simple costing system, FS allocated support costs to products at the rate of 30% of cost of goods sold.

Fitzgerald Supermarkets (FS) operates at capacity and de- cides to apply ABC analysis to three product lines: baked goods, milk and fruit juice, and frozen foods. It identifies four activities and their activity cost rates as follows: $95 per purchase order S76 per delivery $19 per hour $0.15 per item sold Ordering Delivery and receipt of merchandise Shelf-stocking Customer support and assistance The revenues, cost of goods sold, store support costs, activities that account for the store support costs, and activity-area usage of the three product lines are as follows: Baked Goods Milk and Fruit Juice Frozen Products Financial data S66,500 $51,000 $15,300 S50,500 $32,000 $ 9,600 Revenues S60,000 S41,000 Cost of goods sold Store support Activity-area usage (cost-allocation base) Ordering (purchase orders) Delivery (deliveries) Shelf-stocking (hours) Customer support (items sold) $12,300 24 44 14 120 60 36 170 150 20 20,200 15,400 7,960 Under its simple costing system, FS allocated support costs to products at the rate of 30% of cost of goods sold.

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 1.3C

Related questions

Question

Q1. Use the simple costing system to prepare a product-line profitability report for FS.

Transcribed Image Text:Fitzgerald Supermarkets (FS) operates at capacity and de-

cides to apply ABC analysis to three product lines: baked goods, milk and fruit juice, and frozen foods. It

identifies four activities and their activity cost rates as follows:

$95 per purchase order

S76 per delivery

$19 per hour

$0.15 per item sold

Ordering

Delivery and receipt of merchandise

Shelf-stocking

Customer support and assistance

The revenues, cost of goods sold, store support costs, activities that account for the store support costs,

and activity-area usage of the three product lines are as follows:

Baked Goods

Milk and Fruit Juice

Frozen Products

Financial data

S66,500

$51,000

$15,300

S50,500

$32,000

$ 9,600

Revenues

S60,000

S41,000

Cost of goods sold

Store support

Activity-area usage (cost-allocation base)

Ordering (purchase orders)

Delivery (deliveries)

Shelf-stocking (hours)

Customer support (items sold)

$12,300

24

44

14

120

60

36

170

150

20

20,200

15,400

7,960

Under its simple costing system, FS allocated support costs to products at the rate of 30% of cost of goods

sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College