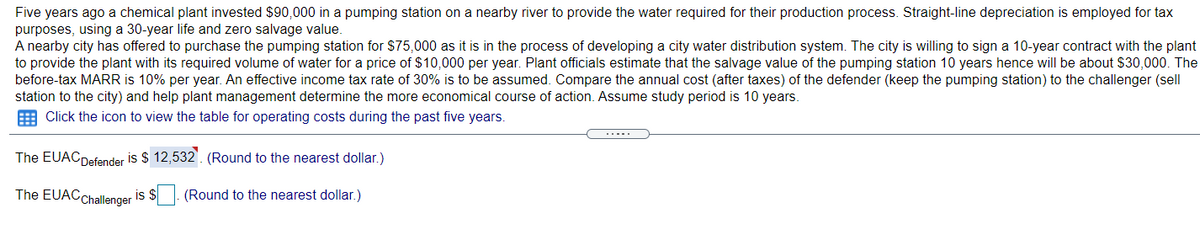

Five years ago a chemical plant invested $90,000 in a pumping station on a nearby river to provide the water required for their production process. Straight-line depreciation is employed for tax purposes, using a 30-year life and zero salvage value. A nearby city has offered to purchase the pumping station for $75,000 as it is in the process of developing a city water distribution system. The city is willing to sign a 10-year contract with the plant to provide the plant with its required volume of water for a price of $10,000 per year. Plant officials estimate that the salvage value of the pumping station 10 years hence will be about $30,000. The before-tax MARR is 10% per year. An effective income tax rate of 30% is to be assumed. Compare the annual cost (after taxes) of the defender (keep the pumping station) to the challenger (sell station to the city) and help plant management determine the more economical course of action. Assume study period is 10 years. Click the icon to view the table for operating costs during the past five years. The EUAC Defender is $ 12,532. (Round to the nearest dollar.) The EUAC Challenger is $ (Round to the nearest dollar.) Maintenance Power and labor $2,000 per year $4,500 per year Taxes and insurance $1,000 per year Total $7,500 per year

Five years ago a chemical plant invested $90,000 in a pumping station on a nearby river to provide the water required for their production process. Straight-line depreciation is employed for tax purposes, using a 30-year life and zero salvage value. A nearby city has offered to purchase the pumping station for $75,000 as it is in the process of developing a city water distribution system. The city is willing to sign a 10-year contract with the plant to provide the plant with its required volume of water for a price of $10,000 per year. Plant officials estimate that the salvage value of the pumping station 10 years hence will be about $30,000. The before-tax MARR is 10% per year. An effective income tax rate of 30% is to be assumed. Compare the annual cost (after taxes) of the defender (keep the pumping station) to the challenger (sell station to the city) and help plant management determine the more economical course of action. Assume study period is 10 years. Click the icon to view the table for operating costs during the past five years. The EUAC Defender is $ 12,532. (Round to the nearest dollar.) The EUAC Challenger is $ (Round to the nearest dollar.) Maintenance Power and labor $2,000 per year $4,500 per year Taxes and insurance $1,000 per year Total $7,500 per year

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 2RP

Related questions

Question

Transcribed Image Text:Five years ago a chemical plant invested $90,000 in a pumping station on a nearby river to provide the water required for their production process. Straight-line depreciation is employed for tax

purposes, using a 30-year life and zero salvage value.

A nearby city has offered to purchase the pumping station for $75,000 as it is in the process of developing a city water distribution system. The city is willing to sign a 10-year contract with the plant

to provide the plant with its required volume of water for a price of $10,000 per year. Plant officials estimate that the salvage value of the pumping station 10 years hence will be about $30,000. The

before-tax MARR is 10% per year. An effective income tax rate of 30% is to be assumed. Compare the annual cost (after taxes) of the defender (keep the pumping station) to the challenger (sell

station to the city) and help plant management determine the more economical course of action. Assume study period is 10 years.

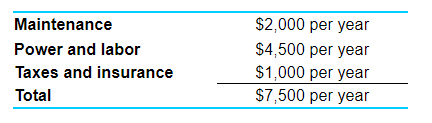

Click the icon to view the table for operating costs during the past five years.

The EUAC Defender is $ 12,532. (Round to the nearest dollar.)

The EUAC Challenger is $

(Round to the nearest dollar.)

Transcribed Image Text:Maintenance

Power and labor

$2,000 per year

$4,500 per year

Taxes and insurance

$1,000 per year

Total

$7,500 per year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College