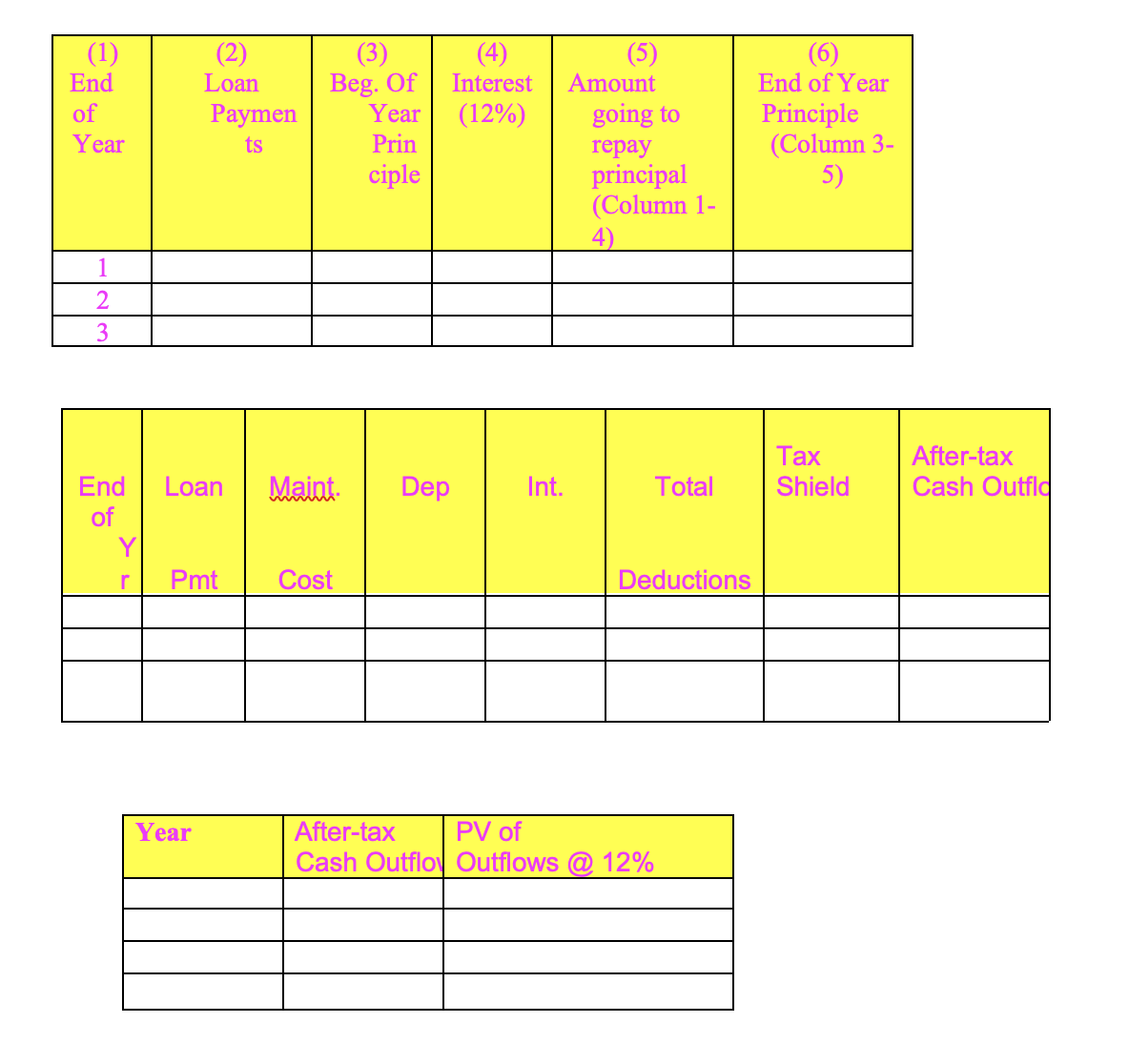

Floopy Co has decided to purchase new equipment. They are in the 38% tax bracket. The desired equipment costs $77,000 and it can be financed entirely with a 12% loan which requires annual end-of-year payments of $32,059 for 3 years. The firm will depreciate the equipment under MACRS using a 3-year recovery period (depreciation is 33% in year 1, 45% in year 2 and 15% in year 3). The firm will pay $2,000 per year for a maintenance contract. Calculate the present value of the cash outflows for the purchase alternative. Use these templates below.

Floopy Co has decided to purchase new equipment. They are in the 38% tax bracket. The desired equipment costs $77,000 and it can be financed entirely with a 12% loan which requires annual end-of-year payments of $32,059 for 3 years. The firm will depreciate the equipment under MACRS using a 3-year recovery period (depreciation is 33% in year 1, 45% in year 2 and 15% in year 3). The firm will pay $2,000 per year for a maintenance contract. Calculate the present value of the cash outflows for the purchase alternative. Use these templates below.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 87E: Cost of Debt Financing Stinson Corporations cost of debt financing is 6%. Its tax rate is 30%....

Related questions

Question

Floopy Co has decided to purchase new equipment. They are in the 38% tax bracket.

The desired equipment costs $77,000 and it can be financed entirely with a 12% loan which requires annual end-of-year payments of $32,059 for 3 years. The firm will

Transcribed Image Text:(1)

(3)

Beg. Of

Year

(4)

(2)

Loan

(5)

Amount

End

Interest

End of Year

(12%)

going to

Principle

(Column 3-

5)

of

Paymen

Year

ts

Prin

repay

principal

(Column 1-

4)

ciple

1

2

3

Tax

Shield

After-tax

End

Loan

Maint.

Dep

Int.

Total

Cash Outfld

of

Y

r

Pmt

Cost

Deductions

Year

After-tax

PV of

Cash Outflov Outflows @ 12%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning