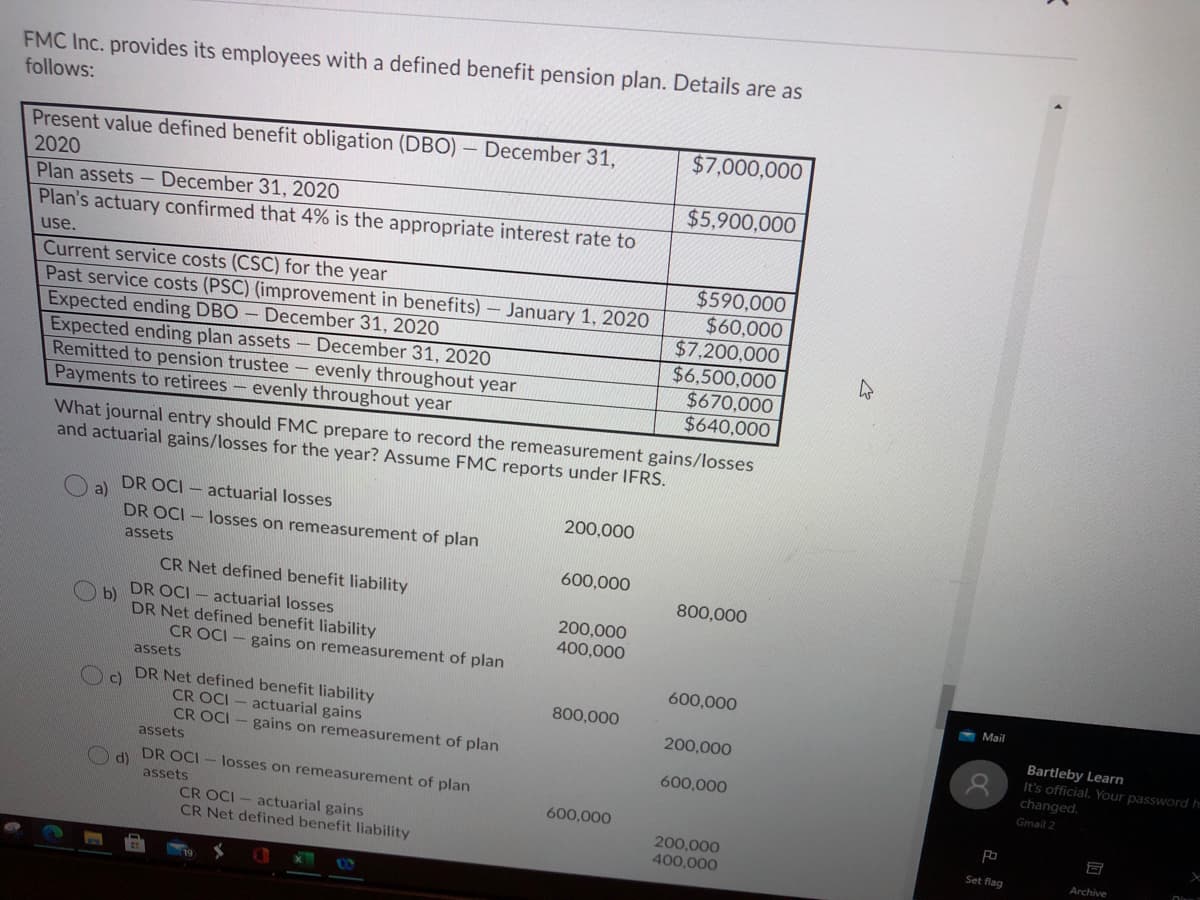

FMC Inc. provides its employees with a defined benefit pension plan. Details are as follows: Present value defined benefit obligation (DBO) - December 31, 2020 Plan assets - December 31, 2020 Plan's actuary confirmed that 4% is the appropriate interest rate to $7,000,000 $5,900,000 use. Current service costs (CSC) for the year Past service costs (PSC) (improvement in benefits) - January 1, 2020 Expected ending DBO- December 31, 2020 Expected ending plan assets - December 31, 2020 Remitted to pension trustee- evenly throughout year Payments to retirees- evenly throughout year $590,000 $60,000 $7,200,000 $6,500,000 $670,000 $640,000 What journal entry should FMC prepare to record the remeasurement gains/losses and actuarial gains/losses for the year? ASsume FMC reports under IFRS. a) DR OCI - actuarial losses 200,000 DR OCI - losses on remeasurement of plan assets 600,000 CR Net defined benefit liability 800,000 DR OCI- actuarial losses b) DR Net defined benefit liability 200,000 400,000 CR OCI - gains on remeasurement of plan assets 600,000 DR Net defined benefit liability CR OCI - actuarial gains CR OCI 800,000 200,000 gains on remeasurement of plan assets 600,000 O d) DR OCI losses on remeasurement of plan assets CR OCI CR Net defined benefit liability 600,000 actuarial gains 200,000 400,000

FMC Inc. provides its employees with a defined benefit pension plan. Details are as follows: Present value defined benefit obligation (DBO) - December 31, 2020 Plan assets - December 31, 2020 Plan's actuary confirmed that 4% is the appropriate interest rate to $7,000,000 $5,900,000 use. Current service costs (CSC) for the year Past service costs (PSC) (improvement in benefits) - January 1, 2020 Expected ending DBO- December 31, 2020 Expected ending plan assets - December 31, 2020 Remitted to pension trustee- evenly throughout year Payments to retirees- evenly throughout year $590,000 $60,000 $7,200,000 $6,500,000 $670,000 $640,000 What journal entry should FMC prepare to record the remeasurement gains/losses and actuarial gains/losses for the year? ASsume FMC reports under IFRS. a) DR OCI - actuarial losses 200,000 DR OCI - losses on remeasurement of plan assets 600,000 CR Net defined benefit liability 800,000 DR OCI- actuarial losses b) DR Net defined benefit liability 200,000 400,000 CR OCI - gains on remeasurement of plan assets 600,000 DR Net defined benefit liability CR OCI - actuarial gains CR OCI 800,000 200,000 gains on remeasurement of plan assets 600,000 O d) DR OCI losses on remeasurement of plan assets CR OCI CR Net defined benefit liability 600,000 actuarial gains 200,000 400,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:FMC Inc. provides its employees with a defined benefit pension plan. Details are as

follows:

$7,000,000

Present value defined benefit obligation (DBO) – December 31,

2020

$5,900,000

Plan assets - December 31, 2020

Plan's actuary confirmed that 4% is the appropriate interest rate to

use.

$590,000

Current service costs (CSC) for the year

Past service costs (PSC) (improvement in benefits)- January 1, 2020

Expected ending DBO – December 31, 2020

Expected ending plan assets

Remitted to pension trustee – evenly throughout year

Payments to retirees- evenly throughout year

$60,000

$7,200,000

$6,500,000

$670,000

$640,000

December 31, 2020

What journal entry should FMC prepare to record the remeasurement gains/losses

and actuarial gains/losses for the year? Assume FMC reports under IFRS.

DR OCI - actuarial losses

a)

DR OCI - losses on remeasurement of plan

200,000

assets

600,000

CR Net defined benefit liability

800,000

DR OCI - actuarial losses

b)

DR Net defined benefit liability

200,000

400,000

CR OCI - gains on remeasurement of plan

assets

600,000

Mail

DR Net defined benefit liability

c)

800,000

CR OCI

actuarial gains

Bartleby Learn

It's official. Your password h

changed.

200,000

CR OCI - gains on remeasurement of plan

assets

600,000

d)

assets

DR OCI - losses on remeasurement of plan

Gmail 2

600,000

CR OCI - actuarial gains

CR Net defined benefit liability

200,000

400,000

Set flag

Archive

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT