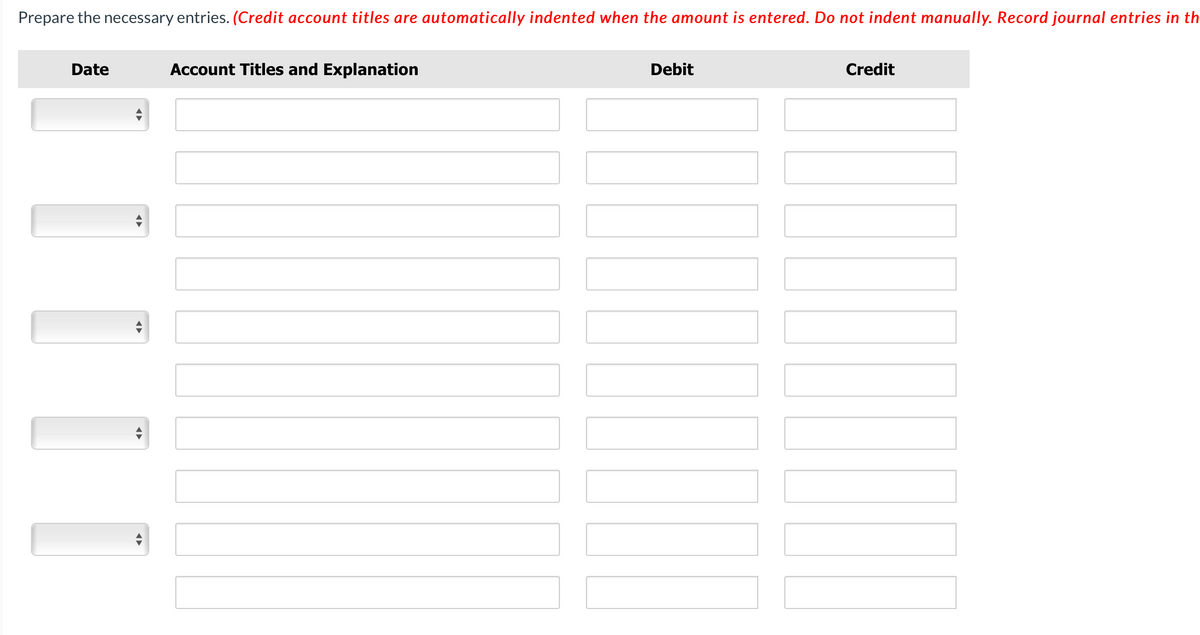

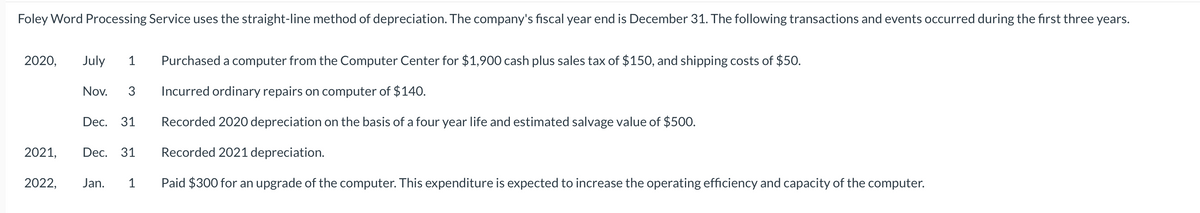

Foley Word Processing Service uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions and events occurred during the first three years. 2020, July 1 Purchased a computer from the Computer Center for $1,900 cash plus sales tax of $150, and shipping costs of $50. Nov. 3 Incurred ordinary repairs on computer of $140. Dec. 31 Recorded 2020 depreciation on the basis of a four year life and estimated salvage value of $500. 2021, Dec. 31 Recorded 2021 depreciation. 2022, Jan. 1 Paid $300 for an upgrade of the computer. This expenditure is expected to increase the operating efficiency and capacity of the computer. Prepare the necessary entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Foley Word Processing Service uses the straight-line method of

-

2020, July 1 Purchased a computer from the Computer Center for $1,900 cash plus sales tax of $150, and shipping costs of $50.

Nov. 3 Incurred ordinary repairs on computer of $140.

Dec. 31 Recorded 2020 depreciation on the basis of a four year life and estimated salvage value of $500. - 2021, Dec. 31 Recorded 2021 depreciation.

- 2022, Jan. 1 Paid $300 for an upgrade of the computer. This expenditure is expected to increase the operating efficiency and capacity of the computer.

Prepare the necessary entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record

Trending now

This is a popular solution!

Step by step

Solved in 2 steps