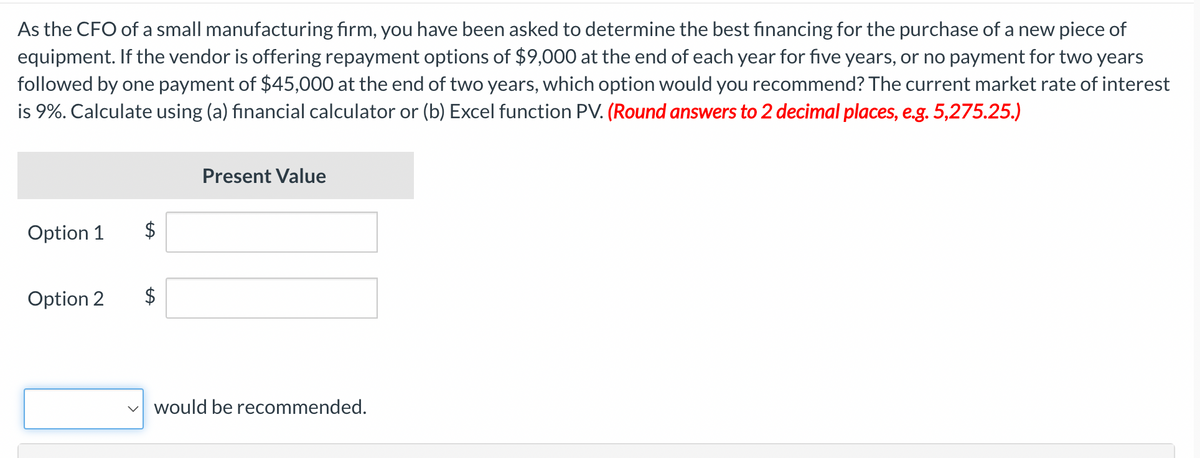

followed by one payment of $45,000 at the end of two years, which option would you recommend? The current market rate of interest is 9%. Calculate using (a) financial calculator or (b) Excel function PV. (Round answers to 2 decimal places, e.g. 5,275.25.)

Q: Mattress Comfort Corporation manufactures two types of mattresses, Dreamer and Sleeper. Dreamer has…

A: Cost accounting is one of the important field of accounting being used. This is used for recording…

Q: The shareholders' equity of XYZ Corporation is presented as follows: 10% Preference Share 2,000…

A: Introduction: Generally companies issues two types of shares - Preference shares and common shares.…

Q: Integrity Company uses standard costing for each specialized product. The following information is…

A: Material usage variance is a variance calculated in order to ascertain the quantity of material used…

Q: n January 1, 2021, Rapid Airlines issued $225 million of its 8% bonds for $207 million. The bonds…

A: Bond is a liability for the company n which a specified percentage of interest has to be paid until…

Q: The following balances appear on the books of Harvey Tilman Enterprises: Retained Earnings, $27,100;…

A: Retained Earnings, ending=Retained Earnings, beginning+Revenues-Expenses-Dividends

Q: Gross purchases of Coleen Company amounts to P298,400. Purchase discounts amount to P3,560 and…

A: Cost of goods sold (COGS) : Cost of goods sold shows the expenses incurred for producing a product.…

Q: you need $8,000 four years from now for a down payment on your future house. How much money must you…

A: The formula for compound interest: Final amount (A)=Initial principal balance (P)×1+ratetime

Q: Red Company has an equipment costing P700,000 with an estimated residual value of P70,000 and an…

A: Upgrading the machine costed P150,000. The cost of upgrading the machine will be capitalized and…

Q: INCOME STATEMENT 1. From the partial work sheet for Adams' Shoe Shine below, prepare an income…

A: Income Statement :— It is one of the financial statement that shows the profitability of company…

Q: A) Can the government tax its own agencies or instrumentalities? Explain.

A: Government agencies and instrumentalities are the extension of the government itself.…

Q: On August 1, 2019, XZY Corporation received subscription for 7,000 shares of Ordinary Share Capital…

A: Solution Shares represents ownership in a company . Persons who buy the shares in a company they…

Q: How much discount interest will there be if $12,500 is due at the end of 3 years with a 12% discount…

A: Concept of calculating the present value Calculation of Present Value Formula for Calculation of…

Q: On January 1, 2021, Green company issued P1,000,000, 12% bonds for P1,065,000, a price that yields…

A: Carrying value of the bonds payable is the value of the bonds on the books inculing the face value…

Q: Which of the following statements regarding liabilities is true? Liabilities arise through a…

A: Introduction:- Liability is someone legally responsible to pay another person or company.…

Q: What is the most this hardware store can pay per unit for these tools if it wants to move forward…

A: Variable costs are those type of costs which changes along with change in sales volume or activity.…

Q: Blue Corp., provides a noncontributory defined-benefit pension plan for its employees. The company's…

A: Pension Asset: The assets of a pension fund are defined as those assets that were purchased with the…

Q: On January 1, 2021, Red Company leased equipment by signing a four-year lease. Annual rentals of…

A: Right-of-use equipment shall be measured at cost upon its initial recognition. And its Cost includes…

Q: Accounting The warrant for a department for Item 2 for the first quarter of 2012 was GHC120,000 3rd…

A: In accounting for commitments (encumbrances), the vote book or ledger is used. •A typical vote…

Q: During 2019, Namnama Company introduced a new product carrying a two-year warranty against defects…

A: The price that a business expects to pay for the replacement or repair of goods that customers buy…

Q: Biblio Files Company is the chief competitor of Cover-to-Cover Company in the bookshelf business.…

A: Fixed cost are those cost which doesn't changes with the changing level of production or sales.…

Q: What types of investments generate interest income and how is interest income reported?

A: Ans. Interest income is the earnings received in return of the amount deposited as investments.

Q: how to manage cashflow during a project

A: Cash flow refers to the movement of cash from and in the business during a specific course of time…

Q: true or false.

A: The companies act is an act that is incorporated by the parliament of the country. The prime purpose…

Q: ntegrity Company manufactures two products, Alpha and Beta from a joint process. One production run…

A: Given: - Total unit of Alpha: -3,000 Total unit of Beta: -4,000 Further cost of Alpha: -10 per unit…

Q: The following information relates to the pension plan of Brown company. Defined benefit obligation,…

A: Retirement benefits are those benefits or expenses which are incurred for making payment to…

Q: How can a system ensure that those who benefit most from an accounting standard requiring certain…

A: Free-riders are those who utilise information once it is openly accessible.Information can be sold…

Q: A) Can the government tax its own agencies or instrumentalities? Explain.

A: Government tax refers to the tax amount which is a mandatory fee or the financial charge that is…

Q: Jordan Cough Drops operates two divisions. The following information pertains to each division for…

A: Residual income is the remaining income after distributing the profits to the shareholders. The…

Q: How much is the amount due at the end of 5 years if the proceeds are $12,000 and the discount rate…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: ow is materiality related to relevance base on IFRS Foundation?

A: Accounting Records - Accounting records are regarded as one of the most important sources of…

Q: Lee & Lim Company performed accounting services on account for P15,000. The transaction will…

A: Company performing any kind of service and/or providing any kind of goods generates revenues from…

Q: Integrity Co. had the following production data (in units) for the month of July 2022: Work in…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: Absorption costing does not distinguish between variable and fixed costs. All manufacturing costs…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: Grand Corporation reported pretax book income of $621,000. Tax depreciation exceeded book…

A: Income tax refers to the amount charged by the government to individuals and organizations on the…

Q: A plant engineer wishes to know which of two types of lightbulbs should be used to light a…

A: Given that, Duration of old bulb = 14,500 hours usage per day = 20 hours MARR (i) =…

Q: Capital balances in the WXY partnership are W. Capital P 60,000; X Capital P 50,000 and Y. Capital…

A: A partnership is an agreement between two or more partners where partners are agreed to work…

Q: If total assets increased by P175,000 during a specific period and liabilities decreased by P10,000…

A: Accounting equation is one of the fundamental concept being used in accounting. This concept says…

Q: The following balances appear on the books of Harvey Tilman Enterprises: Retained Earnings, $27,100;…

A: The closing entries are prepared to close the temporary accounts of the business at the end of the…

Q: XYZ Corporation reported the following in its statement of shareholders' equity on January 1 2021…

A: When the company declares the share split, then the no. of shares increases in the split ratio, and…

Q: On January 15, 2021, X Company bought merchandise from Y Company amounting to P30,000 (VAT…

A: FOB Shipping Point Free on Board up to the shipping point is referred to as FOB Shipping Point.…

Q: Question 6 of 15 View Policies Current Attempt in Progress Direct labor hours Boswell Company…

A: Total overhead cost = machining cost + assembly cost Total overhead cost = $7200000 ( $4800000 +…

Q: ntire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of…

A: Taxable income refers to the concept of determining the desired sum of tax an entity needs to pay to…

Q: Dawson Hair Stylists Adjusted Trial Balance December 31, 2024 Account Title Cash Accounts Receivable…

A: The financial statements of the business are prepared using the adjusted trial balance. The income…

Q: Integrity Company manufactures two products, Alpha and Beta from a joint process. One production…

A: Joint Process :— It is the process by which different products are obtained from only one common…

Q: partners sharing profits 6:4,

A: The capitals introduced by Z as a new partner shall be reduced from the capital balances of X and Y…

Q: Complete the missing amounts and labels in the T-accounts. Work-in-Process Inventory--Cutting…

A: Journal entries becomes the base for the purpose of preparation of the T- Accounts i.e. Ledger…

Q: The following transactions were completed during the month April .Invested $15,000 cash to start the…

A: Assets=Liabilities+Owner Equity

Q: ntegrity Company uses standard costing for each specialized product. The following information is…

A: Labor rate variance is used to measure the difference between standard rate and actual labor rate.…

Q: he following income statement items appeared on the adjusted trial balance of Schembri Manufacturing…

A: Income statement is one of the financial statement being prepared in business for review and…

Q: For the year ended December 31, 2021, White Company reported pretax financial income of P5,000,000,…

A: Solution: Temporary differences that results into future taxable amount creates deferred tax…

please ansert the following questions thanks

Step by step

Solved in 3 steps with 2 images

- Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of 50,000. First City has offered Hawley the alternatives listed here. Calculate the effective annual interest rate for each alternative. Which alternative has the lowest effective annual interest rate? a. A 12% annual rate on a simple interest loan, with no compensating balance required and interest due at the end of the year b. A 9% annual rate on a simple interest loan, with a 20% compensating balance required and interest due at the end of the year c. An 8.75% annual rate on a discounted loan, with a 15% compensating balance d. Interest figured as 8% of the 50,000 amount, payable at the end of the year, but with the loan amount repayable in monthly installments during the yearNow assume that it is several years later. The brothers are concerned about the firm’s current credit terms of net 30, which means that contractors buying building products from the firm are not offered a discount and are supposed to pay the full amount in 30 days. Gross sales are now running $1,000,000 a year, and 80% (by dollar volume) of the firm’s paying customers generally pay the full amount on Day 30; the other 20% pay, on average, on Day 40. Of the firm’s gross sales, 2% ends up as bad-debt losses. The brothers are now considering a change in the firm’s credit policy. The change would entail: (1) changing the credit terms to 2/10, net 20, (2) employing stricter credit standards before granting credit, and (3) enforcing collections with greater vigor than in the past. Thus, cash customers and those paying within 10 days would receive a 2% discount, but all others would have to pay the full amount after only 20 days. The brothers believe the discount would both attract additional customers and encourage some existing customers to purchase more from the firm—after all, the discount amounts to a price reduction. Of course, these customers would take the discount and hence would pay in only 10 days. The net expected result is for sales to increase to $1,100,000; for 60% of the paying customers to take the discount and pay on the 10th day; for 30% to pay the full amount on Day 20; for 10% to pay late on Day 30; and for bad-debt losses to fall from 2% to 1% of gross sales. The firm’s operating cost ratio will remain unchanged at 75%, and its cost of carrying receivables will remain unchanged at 12%. To begin the analysis, describe the four variables that make up a firm’s credit policy and explain how each of them affects sales and collections.As CFO of a small manufacturing firm, you have been asked to determine the best financing for the purchase of a new piece of equipment. The vendor is offering repayment options of $9,000 at the end of each year for five years, or no payment for two years followed by one payment of $41,500. The current market rate of interest is 11%. Calculate present value of both options. Present Value: Option 1=_________________ Option 2=_________________

- As CFO of a small manufacturing firm, you have been asked to determine the best financing for the purchase of a new piece of equipment. The vendor is offering repayment options of $9,000 at the end of each year for five years, or no payment for two years followed by one payment of $41,500. The current market rate of interest is 11%. Calculate present value of both options. Pv option 1= option 2=RKE & Associates is considering the purchase of a building it currently leases for $30,000 per year. The owner of the building put it up for sale at a price of $170,000, but because the firm has been a good tenant, the owner offered to sell it to RKE for a cash price of $160,000 now. If purchased now, how long will it be before the company recovers its investment at an interest rate of 15% per year? Solve by speadsheet function or factor.Roger Sterling has decided to buy an ad agency and is going to finance the purchase with seller financing-that is, a loan from the current owners of the agency. The loan will be for 2,100,000 financed at an APR of 8 percent compounded monthly. This loan will be paid off over 7 years with end o month payments, along with a 600,000 balloon payment at the end of year 7. That is, the 2.1 million loan will be paid off with monthly payments, and there will also be a final payment of 600,000 at the end of the final month. How much will the monthly payments be?

- Meadow Company wants to invest its net profits of $69,000 for 6 years in either a credit union or a local bank. The credit union provides interest of 4.75% compounded monthly, while the local bank provides interest of 5.25% compounded semi-annually. a. What would be the maturity value of the investment under the credit union option? Round to the nearest cent b. What would be the maturity value of the investment under the local bank option? Round to the nearest cent c. Which of the two options will yield the highest return? a. Credit Union b. Local BankA prospective MBA student earns $55,000 per year in her current job and expects that amount to increase by 6% per year. She is considering leaving her job to attend business school for two years at a cost of $30,000 per year. She has been told that her starting salary after business school is likely to be $120,000 and that amount will increase by 15% per year. Consider a time horizon of 10 years, use a discount rate of 10%, and ignore all considerations not explicitly mentioned here. Assume all cash flows occur at the start of each year (i.e., immediate, one year from now, two years from now,..., nine years from now). Also assume that the choice can be implemented immediately so that for the MBA alternative the current year is the first year of business school. What is the net present value of the more attractive choice? Please round your answer to the nearest dollar. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.…Your company has determined it can and is willing to pay a monthly mortgage payment of $12,000 (per month) on a loan to buy its headquarters building. Assume that the lender is willing to lend 100% of the purchase price, so your company does need to put down any equity for the purchase. And, you have called the lender and they’ve told you they typically lend over 20 years at 4.75% per year interest. What is the maximum amount your company can afford to pay the seller for the building?