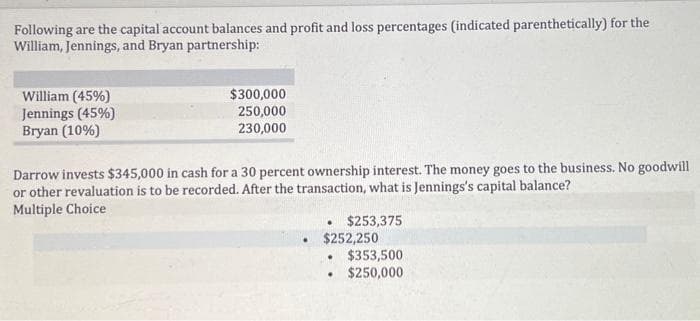

Following are the capital account balances and profit and loss percentages (indicated parenthetically) for the William, Jennings, and Bryan partnership: William (45%) Jennings (45%) Bryan (10%) $300,000 250,000 230,000 Darrow invests $345,000 in cash for a 30 percent ownership interest. The money goes to the business. No goodwill. or other revaluation is to be recorded. After the transaction, what is Jennings's capital balance? Multiple Choice $253,375 $252,250 . $353,500 $250,000

Following are the capital account balances and profit and loss percentages (indicated parenthetically) for the William, Jennings, and Bryan partnership: William (45%) Jennings (45%) Bryan (10%) $300,000 250,000 230,000 Darrow invests $345,000 in cash for a 30 percent ownership interest. The money goes to the business. No goodwill. or other revaluation is to be recorded. After the transaction, what is Jennings's capital balance? Multiple Choice $253,375 $252,250 . $353,500 $250,000

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 29CE

Related questions

Question

Rr.5.

Transcribed Image Text:Following are the capital account balances and profit and loss percentages (indicated parenthetically) for the

William, Jennings, and Bryan partnership:

William (45%)

Jennings (45%)

Bryan (10%)

$300,000

250,000

230,000

Darrow invests $345,000 in cash for a 30 percent ownership interest. The money goes to the business. No goodwill

or other revaluation is to be recorded. After the transaction, what is Jennings's capital balance?

Multiple Choice

.

$253,375

$252,250

$353,500

$250,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you