Following are the transactions of Sustain Company. June 1 T. James, owner, invested $21,000 cash in Sustain Company in exchange for common stock. June 2 The company purchased $14,000 of furniture made from reclaimed wood on credit. June 3 The company paid $2,600 cash for a 12-month prepaid insurance policy on the reclaimed furniture. June 4 The company billed a customer $13,000 for sustainability services provided. June 12 The company paid $14,000 cash toward the payable from the June 2 furniture purchase. June 20 The company collected $13,000 cash for services billed on June 4. June 21 T. James invested an additional $20,000 cash in Sustain Company in exchange for common stock. June 30 The company received $15,000 cash in advance of providing sustainability services to a customer. Prepare general journal entries for the above transactions.

Following are the transactions of Sustain Company. June 1 T. James, owner, invested $21,000 cash in Sustain Company in exchange for common stock. June 2 The company purchased $14,000 of furniture made from reclaimed wood on credit. June 3 The company paid $2,600 cash for a 12-month prepaid insurance policy on the reclaimed furniture. June 4 The company billed a customer $13,000 for sustainability services provided. June 12 The company paid $14,000 cash toward the payable from the June 2 furniture purchase. June 20 The company collected $13,000 cash for services billed on June 4. June 21 T. James invested an additional $20,000 cash in Sustain Company in exchange for common stock. June 30 The company received $15,000 cash in advance of providing sustainability services to a customer. Prepare general journal entries for the above transactions.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

Question 1

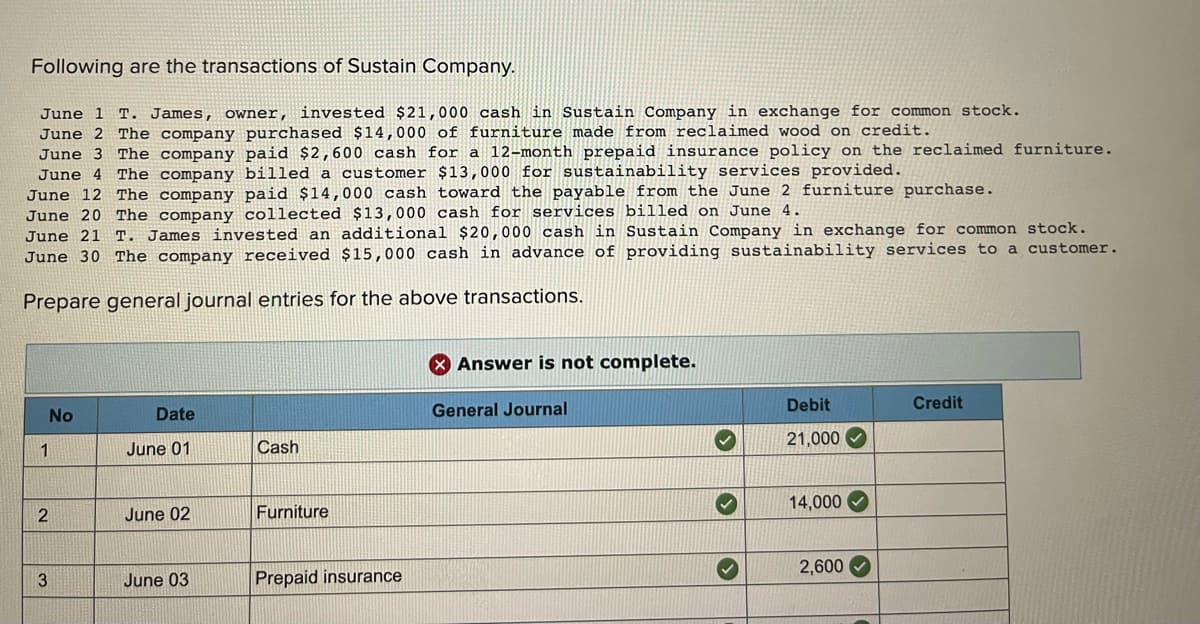

Transcribed Image Text:Following are the transactions of Sustain Company.

June 1 T. James, owner, invested $21,000 cash in Sustain Company in exchange for common stock.

June 2 The company purchased $14,000 of furniture made from reclaimed wood on credit.

June 3 The company paid $2,600 cash for a 12-month prepaid insurance policy on the reclaimed furniture.

June 4 The company billed a customer $13,000 for sustainability services provided.

June 12 The company paid $14,000 cash toward the payable from the June 2 furniture purchase.

June 20 The company collected $13,000 cash for services billed on June 4.

June 21 T. James invested an additional $20,000 cash in Sustain Company in exchange for common stock.

June 30 The company received $15,000 cash in advance of providing sustainability services to a customer.

Prepare general journal entries for the above transactions.

Answer is not complete.

Debit

Credit

No

Date

General Journal

Cash

21,000 O

June 01

14,000

2

June 02

Furniture

2,600

3

June 03

Prepaid insurance

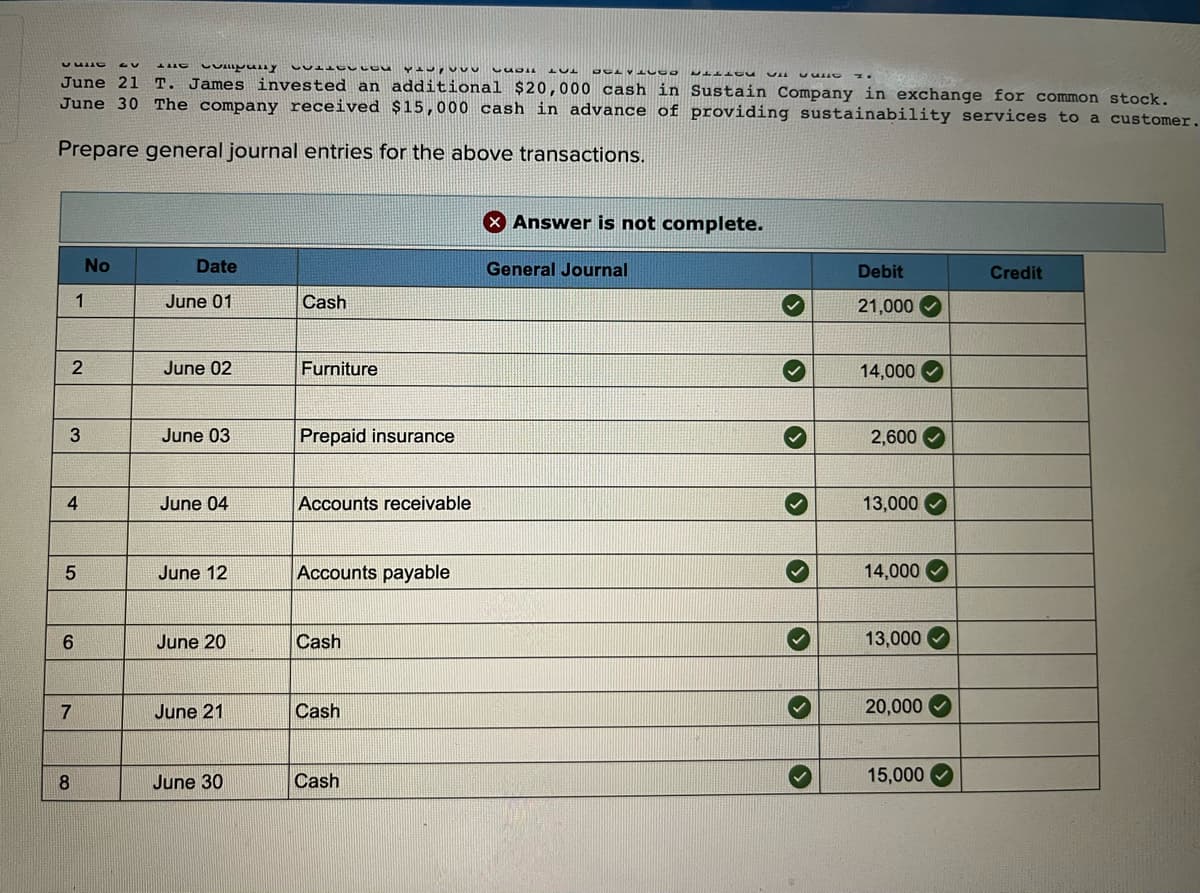

Transcribed Image Text:June 21 T. James invested an additional $20,000 cash in Sustain Company in exchange for common stock.

June 30 The company received $15,000 cash in advance of providing sustainability services to a customer.

Prepare general journal entries for the above transactions.

X Answer is not complete.

No

Date

General Journal

Debit

Credit

June 01

Cash

21,000 O

June 02

Furniture

14,000

June 03

Prepaid insurance

2,600 O

4

June 04

Accounts receivable

13,000

June 12

Accounts payable

14,000

June 20

Cash

13,000

7

June 21

Cash

20,000

8

June 30

Cash

15,000

Expert Solution

Step 1

Introduction:

Journals:

Recording of a business transactions in a chronological order.

First step in the preparation of final accounts is recording journals.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub