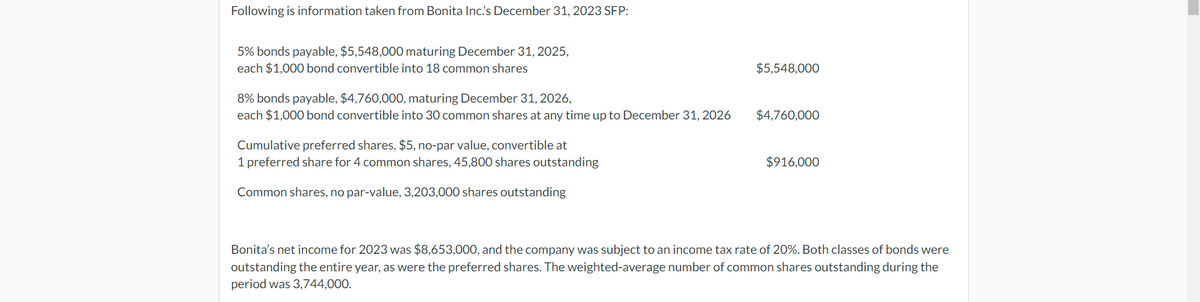

Following is information taken from Bonita Inc's December 31, 2023 SFP: 5% bonds payable, $5,548,000 maturing December 31, 2025, each $1,000 bond convertible into 18 common shares 8% bonds payable, $4,760,000, maturing December 31, 2026, each $1,000 bond convertible into 30 common shares at any time up to December 31, 2026 Cumulative preferred shares, $5, no-par value, convertible at 1 preferred share for 4 common shares, 45,800 shares outstanding Common shares, no par-value, 3,203,000 shares outstanding $5,548,000 $4,760,000 $916,000 Bonita's net income for 2023 was $8,653,000, and the company was subject to an income tax rate of 20%. Both classes of bonds were outstanding the entire year, as were the preferred shares. The weighted-average number of common shares outstanding during the period was 3,744,000.

Following is information taken from Bonita Inc's December 31, 2023 SFP: 5% bonds payable, $5,548,000 maturing December 31, 2025, each $1,000 bond convertible into 18 common shares 8% bonds payable, $4,760,000, maturing December 31, 2026, each $1,000 bond convertible into 30 common shares at any time up to December 31, 2026 Cumulative preferred shares, $5, no-par value, convertible at 1 preferred share for 4 common shares, 45,800 shares outstanding Common shares, no par-value, 3,203,000 shares outstanding $5,548,000 $4,760,000 $916,000 Bonita's net income for 2023 was $8,653,000, and the company was subject to an income tax rate of 20%. Both classes of bonds were outstanding the entire year, as were the preferred shares. The weighted-average number of common shares outstanding during the period was 3,744,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 14P

Related questions

Question

PLEASE DO NOT GIVE SOLUTION IN IMAGE FORMAT

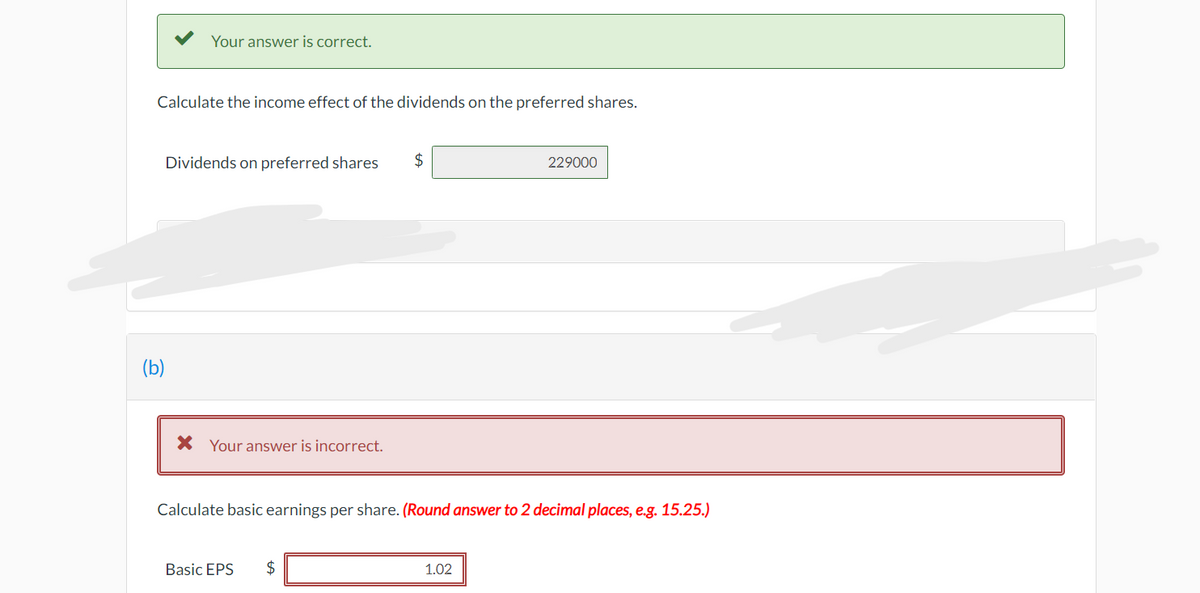

Transcribed Image Text:Your answer is correct.

Calculate the income effect of the dividends on the preferred shares.

Dividends on preferred shares

(b)

* Your answer is incorrect.

$

Basic EPS $

Calculate basic earnings per share. (Round answer to 2 decimal places, e.g. 15.25.)

229000

1.02

Transcribed Image Text:Following is information taken from Bonita Inc.'s December 31, 2023 SFP:

5% bonds payable, $5,548,000 maturing December 31, 2025,

each $1,000 bond convertible into 18 common shares

8% bonds payable, $4,760,000, maturing December 31, 2026,

each $1,000 bond convertible into 30 common shares at any time up to December 31, 2026

Cumulative preferred shares, $5, no-par value, convertible at

1 preferred share for 4 common shares, 45,800 shares outstanding

Common shares, no par-value, 3,203,000 shares outstanding

$5,548,000

$4,760,000

$916,000

Bonita's net income for 2023 was $8,653,000, and the company was subject to an income tax rate of 20%. Both classes of bonds were

outstanding the entire year, as were the preferred shares. The weighted-average number of common shares outstanding during the

period was 3,744,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning