Following is the Balance sheet of Jay Limited: Liabilities Equity Shares of Rs. 10 each Retained Earnings -VEGAAN 6% Preference Share of Rs.10 each General Reserve Debenture Redemption Fund 5% Debentures Sundry Creditors Total Liabilities Amoun Required: Calculate value per share by using following 1. Yield Method 2. Net Assets Method t 300,000 200000 Assets Fixed Assets Allowances for Depreciation 200,000 5,000 Preliminary Expenses 25,000 Unwritten Off Discount 60,000 90,000 880,000 Current assets Amoun t 600,000 (75,000) 340,000 10,000 5,000 Total Assets Current Assets include investments of Rs.50,000 market price of which is Rs.90,000. Debtors included in current assets are doubtful to the extent of Rs.25,000 for which no provision has been made so far. Debenture interest owes for two years and preference dividends are in arrear for two years. Earnings before tax is Rs.280,000 and Tax rate is 35%. The normal rate of dividend is 20%. 880,000

Following is the Balance sheet of Jay Limited: Liabilities Equity Shares of Rs. 10 each Retained Earnings -VEGAAN 6% Preference Share of Rs.10 each General Reserve Debenture Redemption Fund 5% Debentures Sundry Creditors Total Liabilities Amoun Required: Calculate value per share by using following 1. Yield Method 2. Net Assets Method t 300,000 200000 Assets Fixed Assets Allowances for Depreciation 200,000 5,000 Preliminary Expenses 25,000 Unwritten Off Discount 60,000 90,000 880,000 Current assets Amoun t 600,000 (75,000) 340,000 10,000 5,000 Total Assets Current Assets include investments of Rs.50,000 market price of which is Rs.90,000. Debtors included in current assets are doubtful to the extent of Rs.25,000 for which no provision has been made so far. Debenture interest owes for two years and preference dividends are in arrear for two years. Earnings before tax is Rs.280,000 and Tax rate is 35%. The normal rate of dividend is 20%. 880,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 54E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

please dont provide handwritten solution thank you

Transcribed Image Text:1

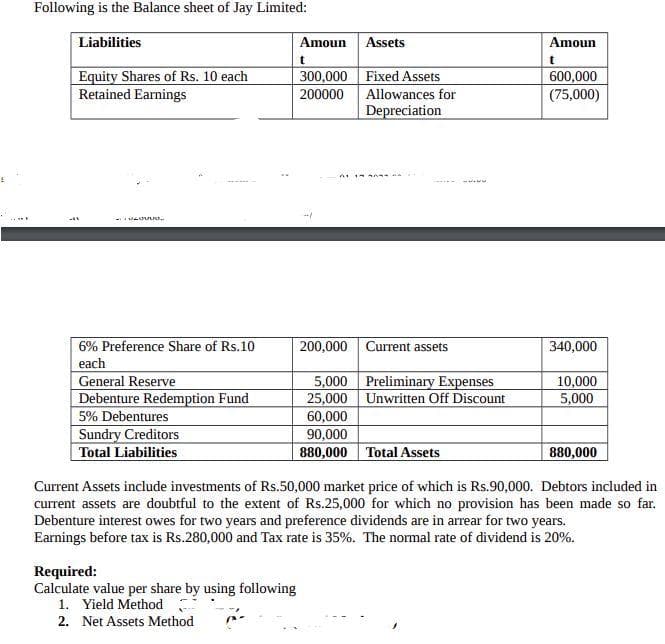

Following is the Balance sheet of Jay Limited:

Liabilities

Equity Shares of Rs. 10 each

Retained Earnings

}

VESHUR

6% Preference Share of Rs.10

each

General Reserve

Debenture Redemption Fund

5% Debentures

Sundry Creditors

Total Liabilities

Amoun

Required:

Calculate value per share by using following

1. Yield Method

2. Net Assets Method

t

300,000

200000

Assets

Fixed Assets

Allowances for

Depreciation

21 13303

90,000

880,000

200,000 Current assets

5,000 Preliminary Expenses

Unwritten Off Discount

25,000

60,000

Amoun

t

600,000

(75,000)

340,000

10,000

5,000

Total Assets

Current Assets include investments of Rs.50,000 market price of which is Rs.90,000. Debtors included in

current assets are doubtful to the extent of Rs.25,000 for which no provision has been made so far.

Debenture interest owes for two years and preference dividends are in arrear for two years.

Earnings before tax is Rs.280,000 and Tax rate is 35%. The normal rate of dividend is 20%.

880,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning