following trading investmer Investments (Trac 1,500 ordinary shares of Parl

Q: Raha company had 420,000 ordinary shares authorized and 180,000 shares outstanding at the beginning ...

A: Shares purchased by the company are not included in the shares outstanding.

Q: hen the effective cost of d

A: Cost of debts is the effective rate which is given by a company for paying on its debt.

Q: Suppose that with the advent of ATMs, a person withdraws money once every two days. Further, suppose...

A: Given information, A person withdraws money once every two days. Person spends $10 per day. Theref...

Q: Required: Prepare Merchandising Journal Entries using Perpetual and Periodic Inventory System.

A: Merchandise Inventory Journal Entry There are mainly two types of merchandise inventory system are t...

Q: Blake Green's weekly gross earnings for the week ending December 7 were $2,500, and her federal inco...

A: The net pay of an employee is his or her wage after all reductions have been made. Obligatory deduct...

Q: The Gourmand Cooking School runs short cooking courses at Its small campus. Management has Identifie...

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally...

Q: Two firms have the following marginal abatement costs: MAC 1 =300-10E1 and MAC 2= 90- 5E 2. What is ...

A: Abatement cost is a cost incurred for reducing environmental harms such as pollution. Thus, marginal...

Q: On January 1, 20x1, Mojo Co. sold transportation equipment with a historical cost of ₱20,000,000 and...

A: Total interest income = 728964 option c is correct answer

Q: Direct Materials Purchases Budget Tobin's Frozen Pizza Inc. has determined from its production budge...

A: Direct material purchase budget is a statement which is prepared in order to estimated the number of...

Q: 1.) The option is currently a.) In-the-money b.) At-the-money c.) Out-the-money 2.) In/At/Out- t...

A: Put option is option being provided to the seller of the stock or shares that it gives an option to ...

Q: deborah can choose between a monthly salary of $1800 plus 6.5% of sales or $2100 plus 4% of sales.sh...

A: A significant part of sales compensation comprises commission. It is the sum of money earned by a sa...

Q: A company reports the following sales-related information. Sales, gross Sales discounts $ 260,000 Sa...

A: The question is related to Multi-Step Income Statement (Partial). A multi-step income statement is ...

Q: Prepare journal entries to record the following transactions for a retail store. The company uses a ...

A: Journal is the book of original entry in which all the financial transactions of the business are re...

Q: 1. XYZ Corporation's most recent balance sheet and income statement appear below: XYZ Corporation St...

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts fo...

Q: Perpetual Inventory Usihg LIFO The following units of a particular item were available for sale duri...

A: Under the LIFO method, it is assumed that the goods/ inventory purchased at last is sold first.

Q: Use this problem to answer the next three questions: On January 2, year 1, ABC Company purchased 75%...

A: Consolidated statement of retained earnings: A consolidated statement of retained earnings is an ite...

Q: A contractor has been appointed to complete alterations to buildings owned by Bangkok. The contract ...

A: The Number of shares to be issued are 24,444 Shares ( (BD2,200,000 *50%) / BD45) Nominal value = 2...

Q: Why is it important for all partners in a partnership to be on the same page in regard to the method...

A: A partnership appears to be a private firm formed by two or more individuals that may or may not be ...

Q: Prepare journal entries for the City of Pudding's governmental funds to record the following transac...

A: Journal entry: Journal entry is a set of economic events that can be measured in monetary terms. The...

Q: Scoresby Incorporated tracks the number of units purchased and sold throughout each year but applies...

A:

Q: What should be the balance of the Discount on Notes Payable account on the books of ABC Company at D...

A: Note payable- A promissory note or written agreement is referred to as a note payable. The originato...

Q: 1. IDENTIFYING AND ANALYZING business documents or transaction

A: Business documents are the various documents based on which the transactions are recorded in the boo...

Q: The following data were presented for WENG company on Jan. 1, 2018: Ordinary share, par value 20, au...

A: The treasury stock includes the shares that are repurchased by the company. The treasury stock shar...

Q: On January 1, 2022, ABC Company signed a 5-year non-cancelable lease for a building. This is also th...

A: Discounting all lease payments, guaranteed residual value and estimated restoration cost: Year An...

Q: True or False 1. When there is a change in the plan to sell a held for sale asset, that asset is re...

A: Asset disposal account provides accounting of all the aspects of the sale of an asset in one place. ...

Q: 9. Preference shares has preference over ordinary shares relative to a) Dividends and voting rights ...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: Balance sheet accounts Investment in subsidiary Retained earnings Total stockholders' equity $1,320,...

A: Retained earnings is the accumulated profit and losses balance. It belongs to the owners of the comp...

Q: Wolf Creek Inc has available for issue a $3,200,000 bond due in eight years, Interest at the rate of...

A: Increase in an expense leads to debit and vice-versa, so if a company has to pay interest, the amoun...

Q: At i = 10% per year, a machine has a first cost of $9,000 and estimated operating costs and year-end...

A: Solution:- Given, i = 10% per year First machine cost = $9,000

Q: 3. & 4. Determine the balance in retained earnings at January 1, 2020 as Fieri reported using FIFO m...

A: Solution:- Given, Revenue = $390 mil Cost of goods sold FIFO = $39 mil ; Average = $54 mil Operatin...

Q: ABC would like to repurchase 50,000 of its ordinary shares. Investor X offered to sell his 20,000 sh...

A: Share buyback is the process of requisition of own shares by the company from general public. There ...

Q: Emma’s balance sheet showed an accounts receivable balance of $75 000 at the beginning of the year a...

A: We are required to calculate cash collection from debtor. For calculating that, we need to use below...

Q: Explain why is important for a business to understand their composite mix of products when calculati...

A: Sales mix is the proportion of sales in quantity with respect to total sales quantity. It is applica...

Q: Task 1 The following trial balance was extracted from the books of Zen Ltd. for the year ended 31/12...

A: An income statement is a financial report that indicates the revenue and expenses of a business. It ...

Q: possible is reflected proaches to program Active treatment

A: The answer has been mentioned below.

Q: What is the compensation expense for 2020?

A: Solution:- Given, ABC Company granted the president compensatory share to buy shares on January 1, 2...

Q: The Leto Construction Company began work on a $15,000 contract on 1/1/22. Planned completion was in ...

A: The correct answer is d. Current Liability of $875

Q: Don Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. ...

A:

Q: Question 4 of 18 Which of the following is net an acceptable balance sheet presentation of receivabl...

A: Receivables are shown in asset side of balance sheet. Mostly, they are classified as current assets....

Q: 9. How much is the utilities expense? * P2,400 debit P3,750 debit P3,750 credit P2,400 credit 10. Ho...

A: Answer - Part 9 - Correct Answer is Option A - P 2,400 Debit. If debits exceed credits, the accou...

Q: May an obligor be liable under an obligation subject to a suspensive condition although the conditio...

A: When an obligation is subject to a suspensive condition, its creation is contingent on the occurrenc...

Q: WHAT ARE THE SIGNIFICANT RISK YOU SHOULD CONSIDER UPON AUDITING CURRENT LIABILITIES AND HOW WOULD IT...

A: Current liabilities refers to the liabilities which will be due and payable by the organisation wit...

Q: Echo Amplifiers prepared the following sales budget for the first quarter of 2018: Jan. Feb. Mar....

A: Total Selling and Administrative Expenses=Total Variable Selling and Administrative Expenses+Total F...

Q: 1.) On February 2019, AOT Corporation authorized 20,000 preference shares at P 125 par value per sha...

A: The answer for the multiple choice question and relevant explanation are presented hereunder. The jo...

Q: tify the different forms of group contact and define each form and identify the two main forms of se...

A: Segregation refers to the concept of separating people or work or jobs or things from the main group...

Q: son Company prepared a cash budget by quarters for the upcoming year. Missing data amounts are indic...

A: Cash budget is used in forecasting to determine supplier payment, receipts from customers which in t...

Q: On January 1, 2018,Coley Corporation purchased $400,000 par value 4% bonds that mature on December 3...

A:

Q: Scoresby Incorporated tracks the number of units purchased and sold throughout each year but applies...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: 6. Effective communication means the transference and understanding of meaning, but you cannot know ...

A: Feedback means a response from the receiver of the message which gives the communicator an idea of a...

Q: pany is y=48x+1,500,000. The total break ev

A: Breakeven point is the point where the contribution and fixed cost are equal. There is no profit or ...

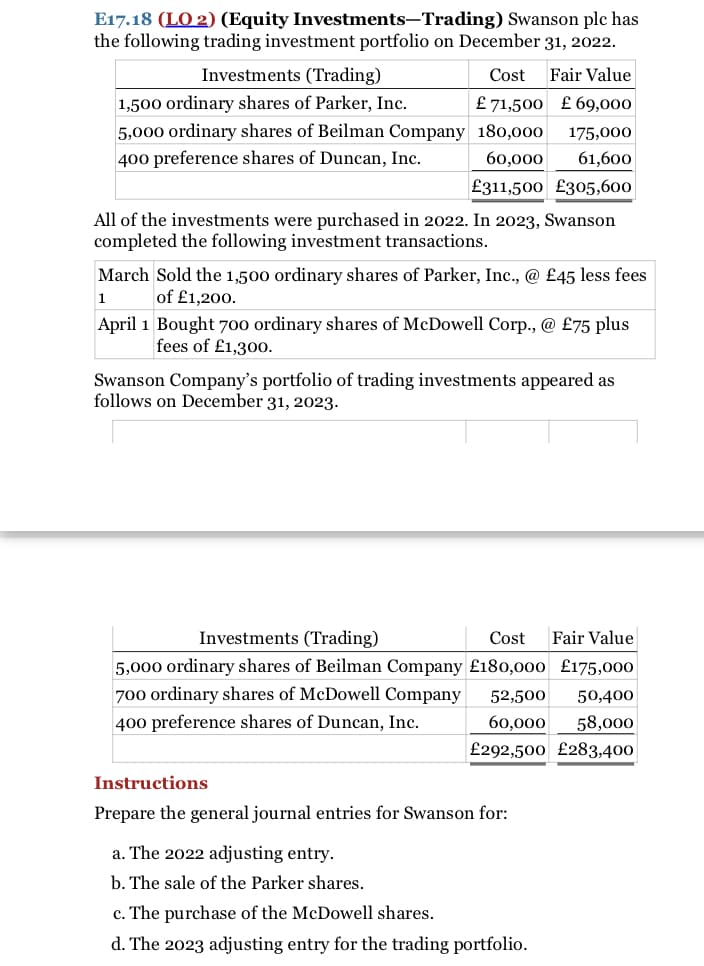

E17-18. Please show all workings clearly.

Step by step

Solved in 3 steps with 2 images

- Paul Company presented the following information pertaining to its investments in equity securities. FVPL FVOCICost P1,000,000 P1,000,000Market value December 31, 2020 1,050,000 980,000 December 31, 2019 950,000 920,000 2.What amount should Paul report as unrealized gains/losses in the shareholders' equity of its December 31, 2020 statement of financial position?Paul Company presented the following information pertaining to its investments in equity securities. FVPL FVOCICost P1,000,000 P1,000,000Market value December 31, 2020 1,050,000 980,000 December 31, 2019 950,000 920,0001. What amount should Paul Company report as unrealized gain on its 2020 profit or loss? a. P160,000 b. P110,000 c. P100,000 d. P 50,000 2.What amount should Paul report as unrealized gains/losses in the shareholders' equity of its December 31, 2020 statement of financial position? a. P60,000 credit b. P20,000 debit c. P80,000 debit d. P20,000 credit- What is the unrealized gain (loss) reported in profit or loss for the year 2021?A. P31,000B. (P31,000)C. P43,000D. (P43,000) - How much was the gain or loss on the sale of CD shares? A. P1,100 gain B. P2,000 gain C. P15,000 loss D. P15,900 loss

- 22. During 2022, Haggard Company purchased marketable equity securities for P 1,850,000 to be held as trading investments. In 2022, the entity appropriately reported an unrealized loss of P 200,000 in the income statement. There was no change during 2022 in the composition of the portfolio of trading securities. Pertinent data on December 31, 2023 are: Security Cost Market value Inc (Dec) A 600,000 700,000 100,000 B 450,000 400,000 (50,000) C 800,000 900,000 100,000 Net Increase 150,000 What amount of unrealized gain on these securities should be included in the 2021 income statement?S16-9 On January 6, 2023, Ling Corp. paid $5,000,000 for its 40 percent investment in True World Inc. Assume that on December 31 that same year, True World earned net income of $1,800,000 and paid cash dividends of $800,000. What method should Ling Corp. use to account for the investment in True World Inc.? Give your reason. Ignore any brokerage commission expenses. Post to the Investment in True World Inc. Common Shares T- account. What is its balance after all the transactions are posted? Journalize these three transactions on the books of Ling Corp. Include an explanation for each entry.At December 31, 2018, Hull-Meyers Corp. had the following investments that were purchased during 2018, itsfirst year of operations:Cost Fair ValueTrading Securities:Security A $ 900,000 $ 910,000Security B 105,000 100,000Totals $ 1,005,000 $ 1,010,000 Securities Available-for-Sale:Security C $ 700,000 $ 780,000Security D 900,000 915,000Totals $ 1,600,000 $ 1,695,000Securities to Be Held-to-Maturity:Security E $ 490,000 $ 500,000Security F 615,000 610,000Totals $ 1,105,000 $ 1,110,000No investments were sold during 2018. All securities except Security D and Security F are considered shortterminvestments. None of the fair value changes is considered permanent.Required:Determine the following amounts at December 31, 2018.1. Investments reported as current assets2. Investments reported as noncurrent assets3. Unrealized gain (or loss) component of income before taxes4. Unrealized gain (or loss) component of accumulated other comprehensive income in shareholders’ equity

- What is the total amount that should be reported in profit or loss relating to the securities during 2020?Single choice. P 640,000 P 150,000 P 190,000 P 340,000 How much is the gain or loss to be recognize on the sale of 50% of DEF shares? P 20,000 gain 0 P 10,000 loss P 190,000 gainRed Company had the following portfolio of equity securities to other comprehensive income at December 31, 2018:Security Cost Market ValueA 400,000 390,000B 700,000 660,000Total 1,100,000 1,050,000If Red Company would have to sell the securities transaction cost will be incurred as follows; P20,000 and P30,000 for security A and B, respectively. In Red's December 31, 2018 statement of financial position, how much should be reported as the carrying value of the portfolio? a. 1,050,000 b. 1,060,000 c. 1,100,000 d. 1,110,000Use the following information on a company’s investments in equity securities to answer questions 1- 2 below. The company’s accounting year ends December 31. Investment Date of acquisition Cost Fair value 12/31/16 Date sold Selling price Ajax Company stock 6/20/16 $40,000 $35,000 2/10/17 $32,000 Bril Corporation stock 5/1/16 20,000 N/A 11/15/16 26,000 Coy Company stock 8/2/16 16,000 16,500 1/17/17 23,000 1. If the above investments are categorized as trading securities, what amount is reported for gain or loss on securities, on the 2016 income statement? 2. If the above investments are categorized as trading securities, what amount is reported for gain or loss on securities, on the 2017 income statement?

- During 2021, Opulence Company purchased marketable equity securities as short-term investment to be measured at fair value through other comprehensive income. The cost and market value on December 31, 2021 were: Security Cost Market value A 1,000 shares 300,000 350,000 B 10,000 shares 1,700,000 1,550,000 C 20,000 shares 3,150,000 2,950,000 The entity sold 10,000 shares of B on January 5, 2022 for P 1,450,000 What total amount should be charged to Retained Earnings as a result of the sale of equity securities in 2022?Lexington Co. has the following securities outstanding on December 31, 2020 (its first year of operations). Cost Fair Value Greenspan Corp. stock $20,000 $19,000 Summerset Company stock 9,500 8,800 Tinkers Company stock 20,000 20,600 $49,500 $48,400 During 2021, Summerset Company stock was sold for $9,200, the difference between the $9,200 and the “fair value” of $8,800 being recorded as a “Gain on Sale of Investments.” The market price of the stock on December 31, 2021, was Greenspan Corp. stock $19,900; Tinkers Company stock $20,500. Instructions a. What justification is there for valuing equity securities at fair value and reporting the unrealized gain or loss as part of net income? b. How should Lexington Co. report this information in its financial statements at December 31, 2020? Explain. c. Did Lexington Co. properly account for the sale of the Summerset Company stock? Explain. d. Are there any additional entries necessary for…McElroy Company has the following portfolio of investment securities at September 30, 2025, its most recent reporting date. Investment Securities 1: Horton, Inc. common (5,000 shares), Cost: $215,000, Fair Value: $200,000 Investment Securities 2: Monty, Inc. preferred (3,500 shares), Cost: 133,000, Fair Value: 140,000 Investment Securities 3: Oakwood Corp. common (1,000 shares), Cost: 180,000, Fair Value: 179,000 On October 10, 2025, the Horton shares were sold at a price of $54 per share. In addition, 3,000 shares of Patriot common stock were acquired at $54.50 per share on November 2, 2025. The December 31, 2025, fair values were Monty $106,000, Patriot $132,000, and Oakwood $193,000. Instructions:Prepare the journal entries to record the sale, purchase, and adjusting entries related to the equity securities in the last quarter of 2025. None of these investments represents significant influence. The Fair Value Adjustment account has a zero balance prior to September 30, 2025.