For 2019, Apple is below or is it above ? the industry average for the current and quick ratio, but is below or is it above ? the industry average for the cash ratio. However, because there is little concern about Apple’s ability to sell its inventories, the current ratio provides relatively high confidence that Apple will or will not ? be able to meet its short-term obligations.

For 2019, Apple is below or is it above ? the industry average for the current and quick ratio, but is below or is it above ? the industry average for the cash ratio. However, because there is little concern about Apple’s ability to sell its inventories, the current ratio provides relatively high confidence that Apple will or will not ? be able to meet its short-term obligations.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 8PB: The following select financial statement information from Vortex Computing. Compute the accounts...

Related questions

Question

please answer

For 2019, Apple is below or is it above ? the industry average for the current and quick ratio, but is below or is it above ? the industry average for the cash ratio. However, because there is little concern about Apple’s ability to sell its inventories, the

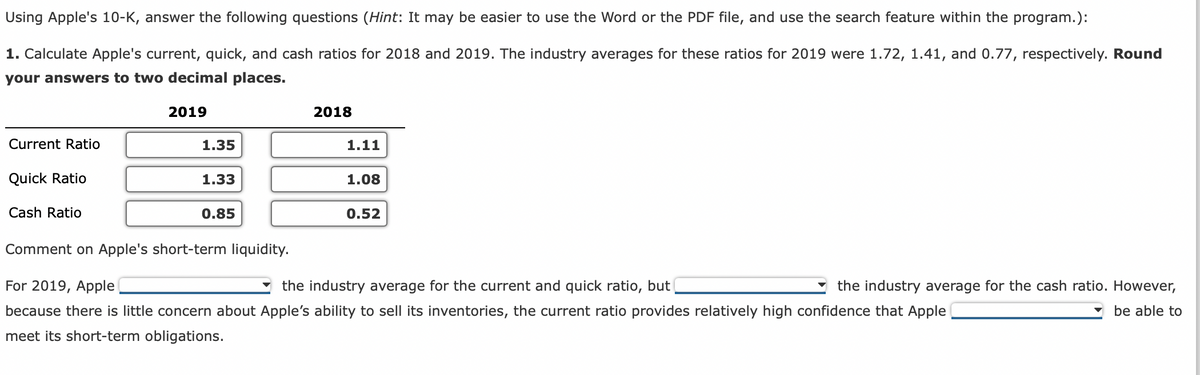

Transcribed Image Text:Using Apple's 10-K, answer the following questions (Hint: It may be easier to use the Word or the PDF file, and use the search feature within the program.):

1. Calculate Apple's current, quick, and cash ratios for 2018 and 2019. The industry averages for these ratios for 2019 were 1.72, 1.41, and 0.77, respectively. Round

your answers to two decimal places.

2019

Current Ratio

Quick Ratio

Cash Ratio

1.35

1.33

0.85

2018

1.11

1.08

0.52

Comment on Apple's short-term liquidity.

For 2019, Apple

the industry average for the current and quick ratio, but

because there is little concern about Apple's ability to sell its inventories, the current ratio provides relatively high confidence that Apple

meet its short-term obligations.

the industry average for the cash ratio. However,

be able to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning