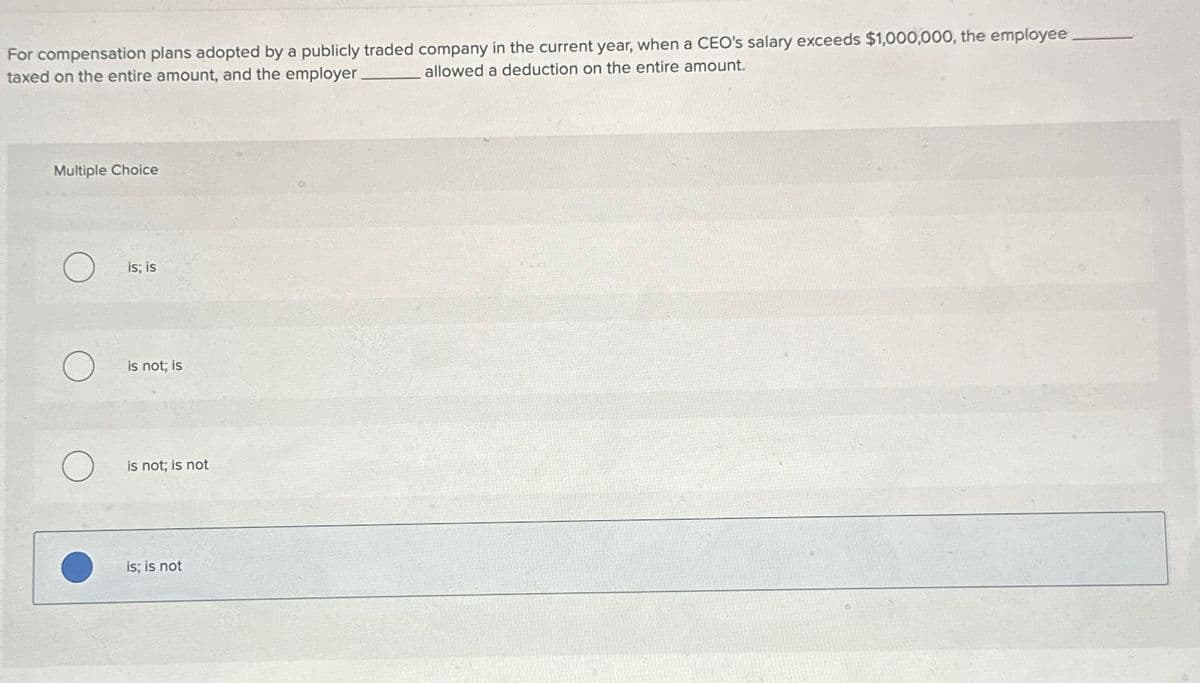

For compensation plans adopted by a publicly traded company in the current year, when a CEO's salary exceeds $1,000,000, the employee taxed on the entire amount, and the employer allowed a deduction on the entire amount. Multiple Choice О is; is is not; is is not; is not is; is not

Q: Tushar

A: Step 1: Calculation of net operating income. Income statement: Sales $830,000Less:Variable cost…

Q: Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and…

A: To compute the gross profit earned by Warnerwoods Company for each of the four costing methods…

Q: Texas Petrochemical reported the following April activity for its VC-30 lubricant, which had a…

A: To calculate the ending inventory using the LIFO method and a periodic inventory system, we need to…

Q: On November 21, 2019, Chubb Limited issued the following press release: The Board of Directors of…

A: Question 1Declaration: this is the date when it was announced that dividends will be issuedhence it…

Q: Kelley Corporation's current year income statement, comparative balance sheets, and additional…

A: General Journal EntriesBased on the information provided, here are the general journal entries for…

Q: None

A: To determine which investment alternative to recommend, compare the NPVs:3. Recommendation:If NPV_A…

Q: Alpesh

A: Sure, This Destin Company case study question.1. Estimated annual manufacturing cost savings…

Q: What amount of money needs to be deposited in an account earning 7% interest Compounded monthly so…

A: Ans 1 and Ans 2:Ans 3 and Ans 4:Ans 5:

Q: Photo from XYZ

A: Detailed explanation:Cash receipt journal is a special journal where all cash receipts of the…

Q: Vushnu

A: 3. Calculate the rate:Activity Rate (Labor-Related) ≈ $34.47 per DLH (rounded to two decimal…

Q: Meman

A: Let's take a closer look at each stage of the reciprocal technique. First, create the allocation…

Q: Sparks, Inc. makes a single product with monthly fixed costs totaling $100,000 and variable costs of…

A: without change:Sales (190,000 x 12) 2,280,000.00 Variable costs (190,000 x 2)…

Q: please answer in text form and in proper format answer with must explanation , calculation for each…

A: The optimal solution for Valencia Products, determined through linear programming, is to solely…

Q: Which of the following is an irrelevant cost? Group of answer choices An avoidable cost An…

A: Irrelevant costs won't change based on what you decide. Sunk cost is one example of this. Sunk cost…

Q: Ashvinbhai

A: To calculate Henrich's income tax and net investment income tax liability for scenario c, we need to…

Q: please answer in text form with introduction , concept , explanation, computation , steps clearly…

A: Houle Furniture Company's Liquidity and Solvency Analysis (2021 vs. 2020)Introduction:This analysis…

Q: Basic Flows, Equivalent Units Thayn Company produces an arthritis medication that passes through two…

A: Let's take a closer look at the computations. 1a. Units transferred to tableting: The ending work in…

Q: ! Required information [The following information applies to the questions displayed below.] Rita is…

A: Note: The self-employment tax rate — a combination of Social Security and Medicare taxes — is 15.3%…

Q: The following data relates to Campus Goods Inc:  Required: Based on the above data determine the…

A: 8C. Operating Expenses:We cannot determine the Operating Expenses with the provided data. Operating…

Q: Blossom Corp. is thinking about opening a soccer camp in southern California. To start the camp,…

A: Answers: Initial Investment:Cost of land = $303,000Cost to build soccer fields, dorm, and dining…

Q: ParentCo and SubCo report the following items of income and deduction for the current year.…

A: Calculation of Parent co. Taxable income:Taxable income(Parent Co.)=Income from…

Q: If I turn 65 in January 2025 can I contribute the maximum amount to my hsa in 2024?

A: Health Savings Account (HSA): An HSA is a tax-advantaged savings account available to individuals…

Q: Provide answer please

A: Step 1:Q-1)To solve this problem, we need to understand the given information and the concept of…

Q: Instructions On February 14, Foster Associates Co. paid $2,400 to repair the transmission on one of…

A:

Q: provide answer with calculation

A: To determine the costs to be assigned to the units transferred out and the units in the ending work…

Q: EX 13-25 (Algo) Improving ROI (LO 13-3) The following data pertain to Dakota Division's most recent…

A: Return on investment (ROI) is an approximate measure of an investment's profitability. ROI is…

Q: [The following information applies to the questions displayed below.] On January 1 of this year,…

A: Here's the completed amortization schedule:1/1/20x1: The initial balance of the bond is…

Q: Hardev

A: To compute Terrell's income tax for the taxable year 2023, we need to follow these steps:1.…

Q: Oberon Company provides postretirement health care benefits to employees who provide at least 10…

A: 5. Amortization of Net Loss: Net Loss = $10,440,000 Amortization Period = Average remaining…

Q: Discuss the importance of fixed cost and variable cost with respect to special orders. How might…

A: Approach to Solving the Question:1. Identify Fixed Costs and Variable Costs:Understand what fixed…

Q: Answer Please

A: Let's break down the steps to find the incremental annual cash flow from operations for Ford if they…

Q: Dengar

A: To calculate the allowable depreciation for Evergreen Corporation's assets, we use the Modified…

Q: Vinubhai

A: Here's how to allocate service costs using the reciprocal method for Mack Precision Tool and…

Q: please provide correct answer

A: Let's start by computing the gross profit ratio. Divide the 2009 to 2013 gross profit over the…

Q: Contingent liabilities appear in the 1. Balance sheet 2. Chairman's report 3. Share holders notice…

A: Contingent liabilities typically appear in the Notes on accounts to the balance sheet. They're…

Q: Mastery Problem Hurst Company’s beginning inventory and purchases during the fiscal year ended…

A: Hurst Company Inventory ValuationWe will solve this problem step-by-step, calculating the cost of…

Q: Question 1 Serve Better Company had a bad year in 2023. For the first time in its history, it…

A: Approach to solving the question:For better clarity of the solution, I have provided the calculation…

Q: plz help

A: Net Sales: $545,000 Cost of Goods Sold (COGS): $245,000 Gross Profit = Net Sales − COGS = $545,000 −…

Q: None

A: **December 31, 2025:** ``` Date Account Titles and Explanation Debit Credit Dec.…

Q: Meman

A: The key information provided is:Accumulated other comprehensive income in 2023 was $75 million.In…

Q: [The following information applies to the questions displayed below.] Cardinal Company is…

A: Step 1: The calculation of the annual net cash inflows Annual net cash inflows = Net operating…

Q: Copr., Goed GreenWay is considering investing in a new machine to provide a new residential cleaning…

A: Step 1: Identify the cash flowsInitial investment: -$350,000 (cost of the machine)Annual revenue:…

Q: Hardev

A: Step 1: Calculate the Total costs under the Flexible BudgetSales = 12,550 units x $81 per unit =…

Q: of 2 Required information [The following information applies to the questions displayed below.]…

A: Step 1: Actual cost Actual cost = $9,975 (given) Step 2: Budgeted standard cost Budgeted standard…

Q: Ashvinbhai

A: Step 1: Basics:Direct Material Budget-This budget is prepared to estimate the number of units and…

Q: Smart Workout Fitness Gym has $300,000 of 20-year bonds payable outstanding. These bonds had a…

A: Let's calculate the amount of cash that Superb Entertainment Center received when it issued the…

Q: please answer in text form with introduction , concept , explanation, computation , steps clearly…

A: Let's delve deeper into the explanation of each financial ratio calculation for Weller Corporation:…

Q: None

A: To solve this problem, we need to calculate the net cost of the merchandise after applying the trade…

Q: Please check the answer and add explanation properly

A: Step 1: Calculate the annual straight-line depreciation Annual straight-line depreciation = (Cost -…

Q: None

A: In that case, if selling inventory at cost for cash guarantees a new revenue stream of at least…

Step by step

Solved in 2 steps

- Yola Corporation is required to include 15 items in their 10-K for the year ending 9/30/21. In which required item from the 10-K would this content be located? Emily Smith, Chief Product Officer Total non Equity Compensation $1,250,000 Question 28 options: a) Certain Relationships and Related Transactions b) Executive Compensation c) Business d) Security Ownership of Certain Beneficial Owners and Management and Related Stockholder MattersWhile examining the books and records in the general and administrative expense account of X Ltd., you came across the following contribution to the registered pension plan made by the Company on behalf of two key employees for the year ended December 31st.2021:- Registered Pension…………………..Employment Plan compensation,2021 President……………………………………..$15,000……………………………………….$180,000 Vice President……………………………….$14,000………………………………………..$ 95,000 The pension plan is a defined contribution(money purchase)plan. The contribution shown were matched by equal contribution made by the employees. Reconciling accounting income to to Division B income, you discover that the following portion of RPP contribution should be disallowed from being expensed by the X Ltd for tax purposes for the year ended December 31st.2021:- a. $NIL b. $13070 c. $10,000…If the employee benefits remain unpaid, how much liability shall Entity A accrue at the end of the year? A. 400,000 B. 200,000 C. 0 D. 300,000

- Kris a supervisory employee, received the following income in 2021: Gross compensation income, before contributions to SSS, PhilHealth, and HDMF totaling P124,000- P800,000 Fringe benefits-P200,000 Gain from redemption of shares in a mutual fund-P100,000 Commission income-P150,000 Gain on sale of stocks through the PSE - P400,000 Determine the total income to be reported by kris in gross income. P1,526,000 O P1,426,000 O P1,026,000 P826,000Charlotte, Inc. began business on January 1, 2021. Its pretax financial income for the first two years was as follows: 2021 $550,000 2022 590,000 The following items caused the only differences between pretax financial income and taxable income. In 2021, the company terminated a top executive and agreed to 120,000 of severance pay. The amount will be paid $40,000 per year for 2021 - 2023. The 2021 and 2022 payments were made. For financial statement purposes, the $120,000 was expensed in 2021. For tax purposes, the severance pay is deductible as it is paid. In 2021, the company reported depreciation expense in its financial statements of $82,000. Depreciation expense for tax purposes was 134,500. The difference will reverse evenly over the next three years (2022-2024) The tax rate in 2021 is 20% and no tax rate changes have been enacted that affect the years 2022 – 2024. Required: Determine taxable income for 2021…FWB plc operates a defined benefit pension plan for its employees. The directors of FWBplc have adopted the revised provisions of IAS 19 (R) Employee Benefits.At 1 April 2013 the fair value of the pension plan assets was £2,700,000 and the presentvalue of the pension plan obligations was £3,000,000.The service cost for the year ended 31 March 2014 was £650,000. On 1 April 2013 thepension plan was amended to offer additional benefits to members resulting in past servicecosts of £200,000. The relevant discount rate for the year ended 31 March 2014 wasestimated at 5% and FWB plc paid £950,000 in contributions to the plan. The pension planpaid £320,000 to retired members in the year to 31 March 2014.At 31 March 2014 the fair value of the pension plan assets was £3,600,000 and the presentvalue of the pension plan obligations was £3,800,000.REQUIRED:a) Prepare, in accordance with IAS 19 (revised) Employee Benefits, the pension extractsin the income statement and statement of financial…

- Wanda is the Chief Executive Officer of Pink corporation, a publicly traded, calendar year C corporation. For the current year, Wanda's compensation package consists of: Cash compensation $ 2,500,000 Nontaxable fringe benefits 250,000 Taxable fringe benefits 150,000 Bonus tied to company performance 2,000,000 How much of Wanda's compensation is deductible by Pink Corporation?CHOOSE THE LETTER OF THE CORRECT ANSWER What is the employee benefit expense for the current year? a. 1,180,000b. 2,100,000c. 1,850,000d. 1,050,000 What is the remeasurement gain or loss on plan assets on Dec. 31? a. 670,000 gainb. 670,000 lossc. 650,000 gaind. 650,000 lossNorma Smith is the controller of Baylor Corporation and is responsible for the preparation of the year-end financial statements. The following transactions occurred during the year. a. On December 20, 2020, a former employee filed a legal action against Baylor for $100,000 for wrongful dismissal. Management believes the action to be frivolous and without merit. The likelihood of payment to the employee is remote. b. Bonuses to key employees based on net income for 2020 are estimated to be $150,000. c. On December 1, 2020, the company borrowed $600,000 at 8% per year. Interest is paid quarterly. d. Accounts receivable at December 31, 2020, is $10,000,000. An aging analysis indicates that Baylor’s expense provision for doubtful accounts is estimated to be 3% of the receivables balance. e. On December 15, 2020, the company declared a $2.00 per share dividend on the 40,000 shares of common stock outstanding, to be paid on January 5, 2021. f. During the year, customer…

- In 2019, Magnum Corp, a publicly traded company, adopted a compensation plan that paid its CEO in excess of $1,000,000. The CEO _______ taxed on the entire amount, and Magnum_________ allowed a deduction on the entire amount. Question 21 options: is not; is not is not; is is; is not is; isOn January 31, 2022, RUBY Company agreed to pay the former president P300,000 under a deferred compensation arrangement. RUBY should have recorded this expense in 2021 but did not do so. The income tax expense would have been P70,000 lower in 2021 had it properly accrued this deferred compensation. What is the adjustment of retained earnings on January 1, 2022? A. ₱ 230,000 debit B. ₱ 300,000 credit C. ₱ 230,000 credit D. ₱ 370,000 debitStatement 1: For a rank and file employee, excess de minimis benefits shall form part of his taxable regular compensation. Statement 2: For a managerial employee, excess de minimis benefits shall form part of his 13th month pay and other benefits. A. Both statements are true B. Both statements are false C. Only statement 1 is true D. Only statement 2 is true