For each of the following annuities, find the best matching description (given that each answer should only be used once). Every week from March 28 to August 15 a farmer receives a payment of $1,000.00 if there was no rain that week. Sam receives a housing allowance of $1,250.00 at the beginning of every month to help pay rent. Devi pays $1,179.50 at the end of every month for child support. Ife settles a lawsuit and will receive 39 quarterly payments of $171.97. Choose... Choose... Contingent annuity Annuity immediate Annuity certain Annuity due Choose...

For each of the following annuities, find the best matching description (given that each answer should only be used once). Every week from March 28 to August 15 a farmer receives a payment of $1,000.00 if there was no rain that week. Sam receives a housing allowance of $1,250.00 at the beginning of every month to help pay rent. Devi pays $1,179.50 at the end of every month for child support. Ife settles a lawsuit and will receive 39 quarterly payments of $171.97. Choose... Choose... Contingent annuity Annuity immediate Annuity certain Annuity due Choose...

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 51P

Related questions

Question

8. math of interest. please solve correctly. Not graded question

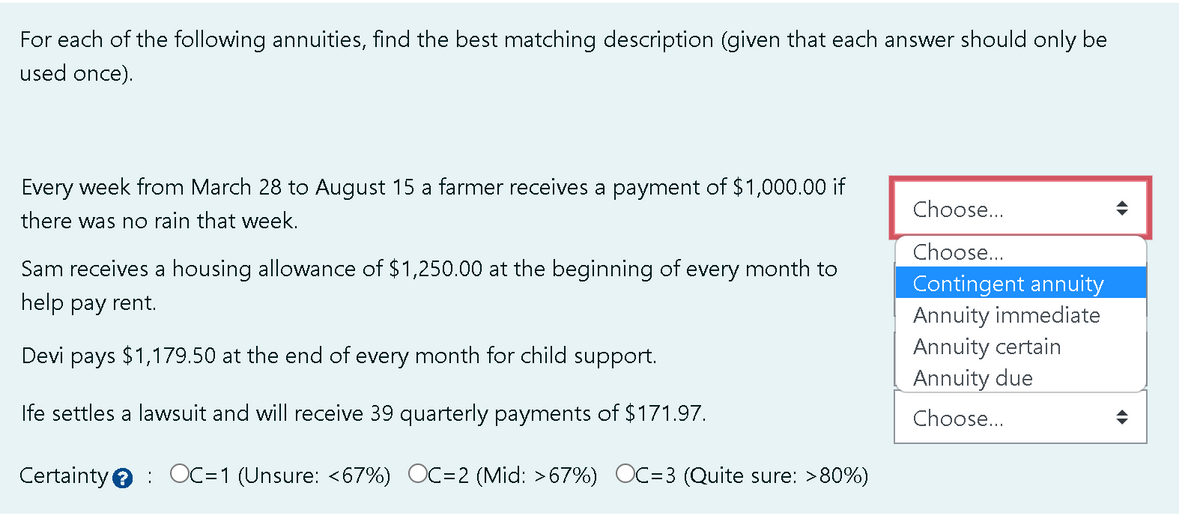

Transcribed Image Text:For each of the following annuities, find the best matching description (given that each answer should only be

used once).

Every week from March 28 to August 15 a farmer receives a payment of $1,000.00 if

there was no rain that week.

Sam receives a housing allowance of $1,250.00 at the beginning of every month to

help pay rent.

Devi $1,179.50 at the end of every month for child support.

pays

Ife settles a lawsuit and will receive 39 quarterly payments of $171.97.

Certainty OC=1 (Unsure: <67%) OC=2 (Mid: >67%) OC=3 ( Quite sure: >80%)

Choose...

Choose...

Contingent annuity

Annuity immediate

Annuity certain

Annuity due

Choose...

◆

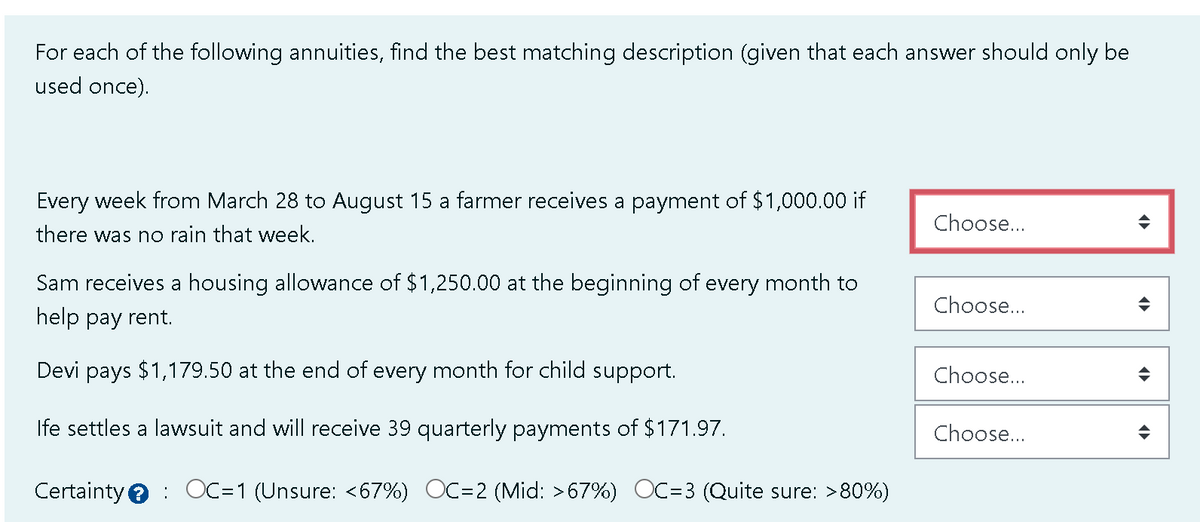

Transcribed Image Text:For each of the following annuities, find the best matching description (given that each answer should only be

used once).

Every week from March 28 to August 15 a farmer receives a payment of $1,000.00 if

there was no rain that week.

Sam receives a housing allowance of $1,250.00 at the beginning of every month to

help pay rent.

Devi

pays $1,179.50 at the end of every month for child support.

Ife settles a lawsuit and will receive 39 quarterly payments of $171.97.

Certainty OC=1 (Unsure: <67%) OC=2 (Mid: >67%) OC=3 ( Quite sure: >80%)

Choose...

Choose...

Choose...

Choose...

◆

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT