BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence. April 16 Purchased 4,500 shares of OnPoint Company stock at $30 per share. July 7 Purchased 3,000 shares of Eco Company stock at $55 per share. July 20 Purchased 1,400 shares of Lafayette Company stock at $22 per share. August 15 Received an $1.10 per share cash dividend on the OnPoint Company stock. August 28 Sold 2,700 shares of OnPoint Company stock at $33 per share. October 1 Received a $5.20 per share cash dividend on the Eco Company shares. December 15 Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. December 31 Received a $4.60 per share cash dividend on the Eco Company shares.

BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence. April 16 Purchased 4,500 shares of OnPoint Company stock at $30 per share. July 7 Purchased 3,000 shares of Eco Company stock at $55 per share. July 20 Purchased 1,400 shares of Lafayette Company stock at $22 per share. August 15 Received an $1.10 per share cash dividend on the OnPoint Company stock. August 28 Sold 2,700 shares of OnPoint Company stock at $33 per share. October 1 Received a $5.20 per share cash dividend on the Eco Company shares. December 15 Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. December 31 Received a $4.60 per share cash dividend on the Eco Company shares.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 3PA: The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the...

Related questions

Question

100%

Based on the following infromation what would the general

BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence.

| April 16 | Purchased 4,500 shares of OnPoint Company stock at $30 per share. |

|---|---|

| July 7 | Purchased 3,000 shares of Eco Company stock at $55 per share. |

| July 20 | Purchased 1,400 shares of Lafayette Company stock at $22 per share. |

| August 15 | Received an $1.10 per share cash dividend on the OnPoint Company stock. |

| August 28 | Sold 2,700 shares of OnPoint Company stock at $33 per share. |

| October 1 | Received a $5.20 per share cash dividend on the Eco Company shares. |

| December 15 | Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. |

| December 31 | Received a $4.60 per share cash dividend on the Eco Company shares. |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

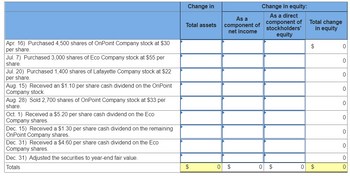

For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the

How would I complete the table?

Transcribed Image Text:Apr. 16) Purchased 4,500 shares of OnPoint Company stock at $30

per share.

Jul. 7) Purchased 3,000 shares of Eco Company stock at $55 per

share.

Jul. 20) Purchased 1,400 shares of Lafayette Company stock at $22

per share.

Aug. 15) Received an $1.10 per share cash dividend on the OnPoint

Company stock.

Aug. 28) Sold 2,700 shares of OnPoint Company stock at $33 per

share.

Oct. 1) Received a $5.20 per share cash dividend on the Eco

Company shares.

Dec. 15) Received a $1.30 per share cash dividend on the remaining

OnPoint Company shares.

Dec. 31) Received a $4.60 per share cash dividend on the Eco

Company shares.

Dec. 31) Adjusted the securities to year-end fair value.

Totals

Change in

Total assets

$

Change in equity:

As a direct

As a

component of component of Total change

net income

in equity

stockholders'

equity

0 $

0 $

$

0 $

0

0

0

0

0

0

0

000

Solution

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning