For examples 1 and 2, assume the net cash flow is 2,000,000, the tax rate is 40% and the cost of common equity is 10% which is computed using the CAPM equation. Explain in a few sentences what each example means.

For examples 1 and 2, assume the net cash flow is 2,000,000, the tax rate is 40% and the cost of common equity is 10% which is computed using the CAPM equation. Explain in a few sentences what each example means.

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 7P

Related questions

Question

For examples 1 and 2, assume the net cash flow is 2,000,000, the tax rate is 40% and the cost of common equity is 10% which is computed using the CAPM equation.

Explain in a few sentences what each example means.

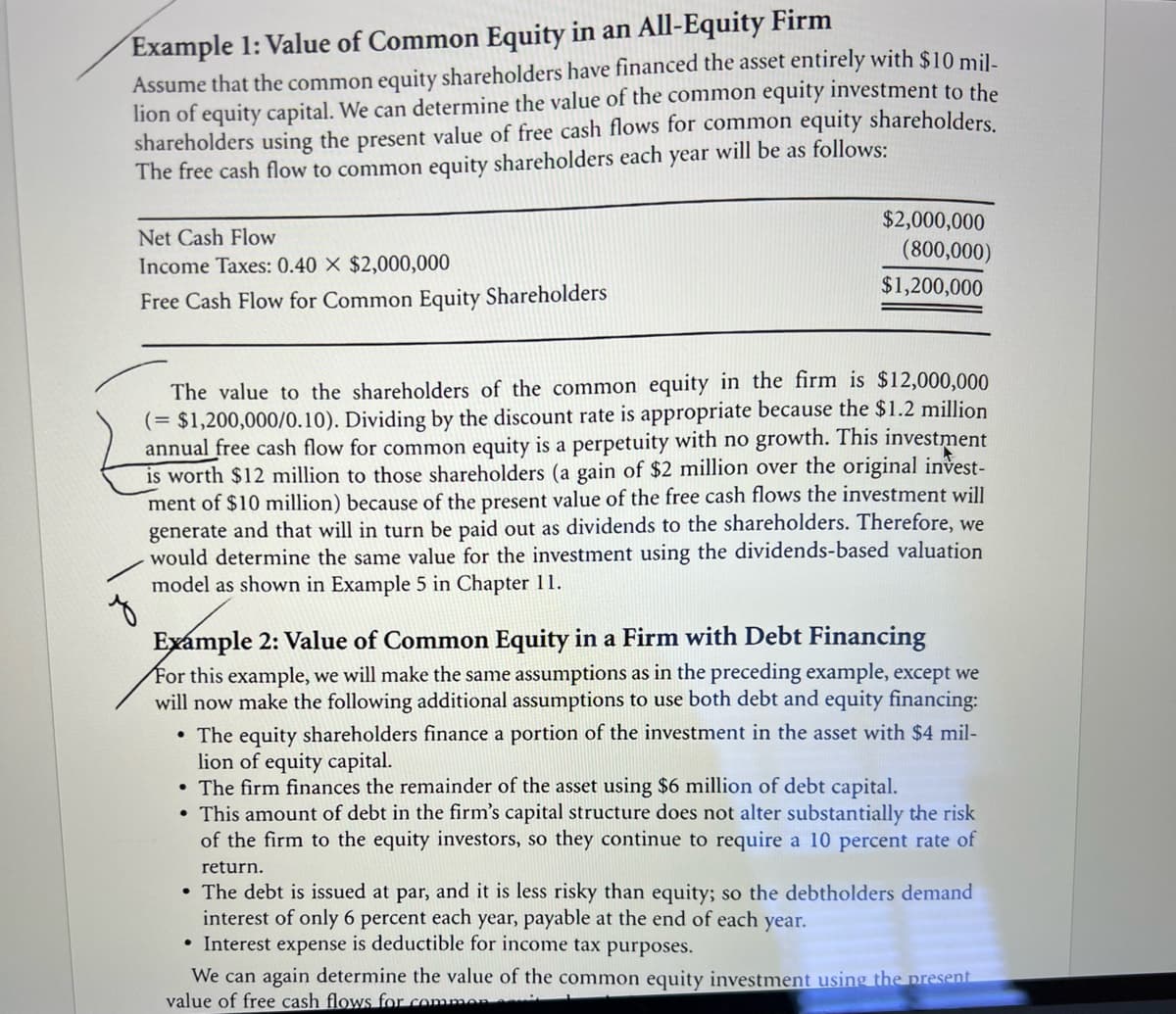

Transcribed Image Text:Example 1: Value of Common Equity in an All-Equity Firm

Assume that the common equity shareholders have financed the asset entirely with $10 mil-

lion of equity capital. We can determine the value of the common equity investment to the

shareholders using the present value of free cash flows for common equity shareholders.

The free cash flow to common equity shareholders each year will be as follows:

Net Cash Flow

Income Taxes: 0.40 X $2,000,000

Free Cash Flow for Common Equity Shareholders

$2,000,000

(800,000)

$1,200,000

The value to the shareholders of the common equity in the firm

(= $1,200,000/0.10). Dividing by the discount rate is appropriate because the $1.2 million

annual free cash flow for common equity is a perpetuity with no growth. This investment

is worth $12 million to those shareholders (a gain of $2 million over the original invest-

ment of $10 million) because of the present value of the free cash flows the investment will

generate and that will in turn be paid out as dividends to the shareholders. Therefore, we

would determine the same value for the investment using the dividends-based valuation

model as shown in Example 5 in Chapter 11.

$12,000,000

z

Example 2: Value of Common Equity in a Firm with Debt Financing

For this example, we will make the same assumptions as in the preceding example, except we

will now make the following additional assumptions to use both debt and equity financing:

• The equity shareholders finance a portion of the investment in the asset with $4 mil-

lion of equity capital.

• The firm finances the remainder of the asset using $6 million of debt capital.

• This amount of debt in the firm's capital structure does not alter substantially the risk

of the firm to the equity investors, so they continue to require a 10 percent rate of

return.

• The debt is issued at par, and it is less risky than equity; so the debtholders demand

interest of only 6 percent each year, payable at the end of each year.

• Interest expense is deductible for income tax purposes.

We can again determine the value of the common equity investment using the present

value of free cash flows for commen

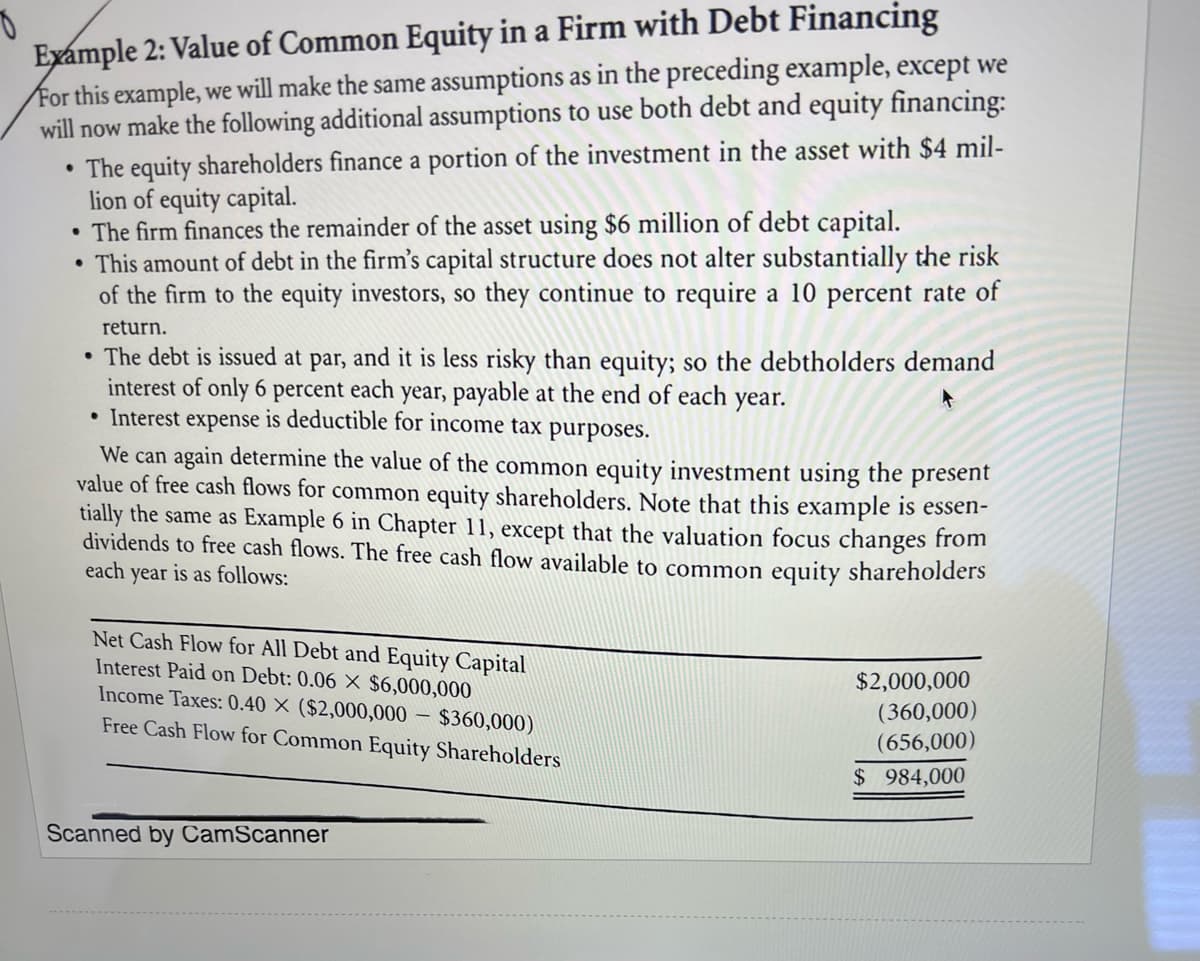

Transcribed Image Text:Example 2: Value of Common Equity in a Firm with Debt Financing

For this example, we will make the same assumptions as in the preceding example, except we

will now make the following additional assumptions to use both debt and equity financing:

• The equity shareholders finance a portion of the investment in the asset with $4 mil-

lion of equity capital.

• The firm finances the remainder of the asset using $6 million of debt capital.

This amount of debt in the firm's capital structure does not alter substantially the risk

of the firm to the equity investors, so they continue to require a 10 percent rate of

return.

• The debt is issued at par, and it is less risky than equity; so the debtholders demand

interest of only 6 percent each year, payable at the end of each year.

• Interest expense is deductible for income tax purposes.

We can again determine the value of the common equity investment using the present

value of free cash flows for common equity shareholders. Note that this example is essen-

tially the same as Example 6 in Chapter 11, except that the valuation focus changes from

dividends to free cash flows. The free cash flow available to common equity shareholders

each year

is as follows:

Net Cash Flow for All Debt and Equity Capital

Interest Paid on Debt: 0.06 X $6,000,000

Income Taxes: 0.40 X ($2,000,000

$360,000)

Free Cash Flow for Common Equity Shareholders

Scanned by CamScanner

$2,000,000

(360,000)

(656,000)

$984,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning