For the fiscal year ending May 31, 2014, how much is the net income? * Given the following unadjusted ledger balances on fiscal year ending May 31, 2014:

For the fiscal year ending May 31, 2014, how much is the net income? * Given the following unadjusted ledger balances on fiscal year ending May 31, 2014:

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 1PB: Identify whether each of the following accounts would be considered a permanent account (yes/no) and...

Related questions

Question

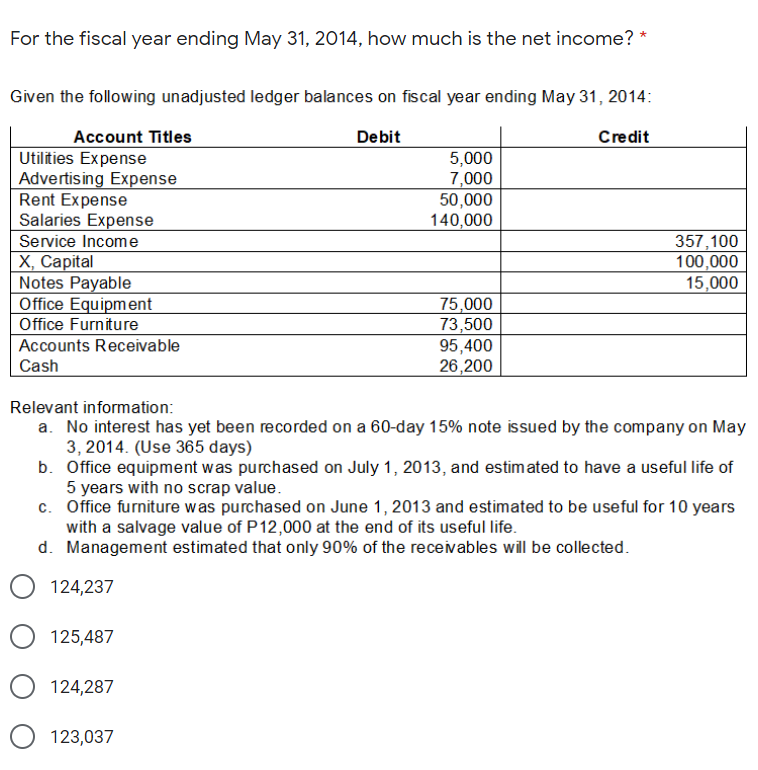

Transcribed Image Text:For the fiscal year ending May 31, 2014, how much is the net income? *

Given the following unadjusted ledger balances on fiscal year ending May 31, 2014:

Account Titles

Debit

Credit

Utilities Expense

Advertising Expense

Rent Expense

Salaries Expense

Service Income

X, Capital

Notes Payable

Office Equipment

5,000

7,000

50,000

140,000

357,100

100,000

15,000

75,000

73,500

95,400

26,200

Office Furniture

Accounts Receivable

Cash

Relevant information:

a. No interest has yet been recorded on a 60-day 15% note issued by the company on May

3, 2014. (Use 365 days)

b. Office equipment was purchased on July 1, 2013, and estimated to have a useful life of

5 years with no scrap value.

c. Office furniture was purchased on June 1, 2013 and estimated to be useful for 10 years

with a salvage value of P12,000 at the end of its useful life.

d. Management estimated that only 90% of the receivables will be collected.

124,237

125,487

124,287

123,037

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning