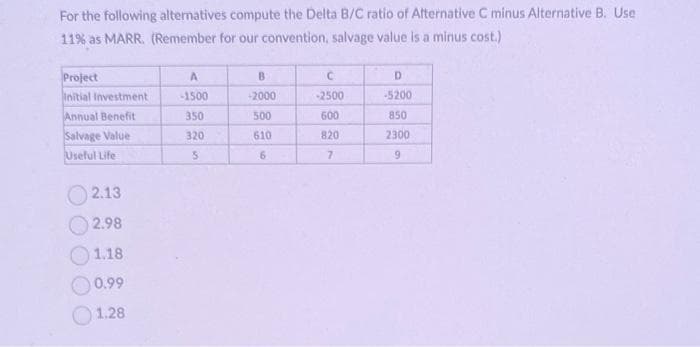

For the following alternatives compute the De 11% as MARR. (Remember for our convention, salvage value is a minus cost.) Project Initial Investment Annual Benefit Salvage Value Useful Life 2.13 2.98 1.18 0.99 1.28 A -1500 350 320 5 -2000 500 610 6 C -2500 600 820 7 D -5200 850 2300 9 B. Ust

Q: what is the effective interest rate on a 3-month noninterest-bearing note with a stated value of…

A: An effective interest rate is a real rate of return on an investment which pays a fixed income over…

Q: Accounting, 27th Edition: In the discussion of the two sources of corporate financing, your book…

A: Corporate financing comes from two main sources: debt and equity. Each has its own benefits and…

Q: Atreides International has operations in Arrakis. The balance sheet for this division in Arrakeen…

A: The balance sheet is a financial report which deposits the financial position of an entity at a…

Q: On January 8, FDN Trading sold merchandise with an invoice price of P72,000 on terms 3/10, n/30. Two…

A: Sales cash discount refers to the price reduction that is given on a product or service by the…

Q: 2 Today James purchased a house and a car worth a combined present value of $390000. To purchase the…

A: In the given problem, Combined present value of house and car has been give as $390000. Combined…

Q: 4. You are a personal injury attorney and the court orders the insurance company to pay your client…

A: Annual periodic payments are called Annuities and when they are discounted to calculate their…

Q: Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Inc.…

A: If other assets or liabilities of the acquirer are included as part of the consideration that is…

Q: Jashanpreet Industries Limited (JIL) issued $1,800,000, 8%, 20-year bonds on January 1, 2021 and…

A: JOURNAL ENTRIES FOR JIL DURING 2021 DATE…

Q: The following information relates to a joint production process for three products, with a total…

A: Split Off Point :— It is the point at which joint products are separated. Joint cost is allocated…

Q: What is the journal entry for the authorization to issue shares?

A: Shares are defined as the company’s holdings that are provided to the investors or any person who…

Q: P8-48B Goldwater Corporation experienced these five events during 2017: a. December sales totalled…

A: Current liability is the amount of obligations which is to be paid within one year from the…

Q: ABC Company borrowed $100,000 at a 6% interest rate on May 1, 20X1 for one year with interest and…

A: May 1, 20X1 to December 20X1 = 8 months Term of the note = 1 year Interest expense in 20X2 = 12 -8…

Q: investment

A: Investment decisions play a key role in deciding whether a given project is worth considering or…

Q: 1 What was the equivalent units for materials costs 2 What was the equivalent units for conversion…

A:

Q: The formula for calculating the discount rate to use in net present value (NPV) calculations is as…

A: The difference between the present value of cash inflows and the present value of cash outflows over…

Q: Explain the historical cost concept as it applies to long-term operational assets. Why is the book…

A: The cost of a fixed asset include every expenses incurred in bringing the asset into present…

Q: What are the risks in the following internal control standard if it is not followed: L. Documented…

A: A strong internal control prevent or minimize the risk. A poor internal control will create the…

Q: lease.

A: When it comes to an asset, leasing or buying comes into the scenario. You may either lease or…

Q: 2. Acme Inc. has the following information available: Actual price paid for material Standard price…

A: Variances A variance is the difference between the actual cost incurred and the budgeted or…

Q: Followed the equations and got the same however the answers are incorrect, any idea why

A: Prepaid insurance is the amount of insurance which has been paid in advance and the benefit of which…

Q: Emperor Pool Services provides pool cleaning and maintenance services to residential clients. It…

A: ANSWER:- JOURNAL ENTRIES DATE…

Q: Sunny Lane, Inc., purchases peaches from local orchards and sorts them into four categories. Grade A…

A: Joint cost means the cost incurred to produce more than one units and then joint cost need to be…

Q: Chekov Company has two support departments, Human Resources and General Factory, and two producing…

A: Human resource department is the department which manage recruiting and staffing . They make sure…

Q: Maitland Corp. is constructing a building to sell to a customer. Construction began on January 1,…

A: In accounting, the Weighted Average Cost (WAC) method of inventory valuation uses a weighted average…

Q: Assume Organic Ice Cream Company, Inc., bought a new ice cream production kit…

A: Depreciation is the reduction in the value of fixed asset over its useful life. It is deducted in…

Q: Swifty Corporation has two divisions; Sporting Goods and Sports Gear. The sales mix is 70% for…

A: Break-even point is the point at which the Total sales revenue of the company is equal to its total…

Q: Harpo Limited has traded for a number of years. financial statement of the company is as follows:…

A: Profit or loss of the noncurrent assets=Cash received from the sale noncurrent asset disposed-Book…

Q: Cameron owns all the stock of Connor Corporation, an S corporation. Cameon's basis for the 1,000…

A: S-Corps utilize the "per share per day" technique, which requires shareholders to take their…

Q: Fast Delivery is the world's largest express transportation company. In addition to the world's…

A: A journal entry is a record of the a commercial transaction in the accounting system of a company.…

Q: Use the following information: Department Cost Percentage Service Provided to S1 S2 P1 P2…

A: According to Bartleby Guidelines, we are allowed to answer only 1 question. Therefore, to answer the…

Q: Assume you can obtain an annual interest rate of 12% compounding monthly. You are going to invest…

A: The quantity of compounding periods significantly affects how compound interest is calculated. The…

Q: Harpo Ltd - Statement of Financial Position as at 31 December 2017 2016 £'000 £'000 £'000 £'000…

A: Statement of Cash Flow - Statement of Cash includes inflow and outflow of cash during the financial…

Q: The table below provides information about the profitability ratios of three hotel and resort…

A: We have to use the given accounting and financial ratios to determine the financial health of these…

Q: Required information [The following information applies to the questions displayed below.] The…

A: Bank reconciliation statement is used to determine the differences between the bank statement…

Q: repare the employer's September 30 journal entries to record salary expense and its elated payroll…

A: Payroll Payroll is the procedure for paying staff of a firm, to put it simply. It entails gathering…

Q: Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so…

A: Introduction:- Ratio analysis used identify the business performance of the company. It is used to…

Q: A company receives a special order to produce 100 units of Product X Materials required: • 2 kgs per…

A: Economic order quantity is an order quantity that is considered ideal for an organisation . In other…

Q: 1. XYZ Company issues 3000 shares of stock for $40/share. The journal entry to record this…

A: Shares means an instrument which shows that the share holder is the owner of the company . Face…

Q: Preble Company manufactures one product. Its variable manufacturing overhead is applied to…

A: Raw materials are the substances or materials that are used to make or create something. These…

Q: Credit card discounts are deducted from gross sales to calculate net sales revenue. False True

A: Discount is the amount which is deducted from the price of goods to arrive at the net amount paid by…

Q: ctures one product. Its variable manufacturing overhead is applied to production based on direct…

A: Standard hours allowed = Actual production*Standard hours per unit Variable overhead efficiency…

Q: borrowings

A: Loans and borrowings help a business to scale amid financial crunch. However, any borrowing comes…

Q: adjusting entries

A: Journal entries are the building blocks of financial statements. So, they must be recoded properly…

Q: Tully Sales uses a periodic inventory system with the weighted average method of cost assignment.…

A: Under the weighted average inventory method, total cost of goods purchased is divided by the total…

Q: ABC Company borrowed $100,000 at a 6% interest rate on January 1, 20X1 for one year with interest…

A: Total amount to be paid at the end of borrowing period is the sum of principal amount and interest…

Q: Question: Why does a company's cash at Bank account and bank statement rarely match? reqiured:…

A: The bank reconciliation statement is the statement that reconciles the difference between the bank…

Q: The Gourmand Cooking School runs short cooking courses at its small campus. Management has…

A: The income and variable costs in the planning budget must be changed to reflect what is anticipated…

Q: Juno Company purchased a 16-month insurance policy on May 1, 2022 for $5,600. On this date, the…

A: The prepaid expenses are an asset of the company because the company paid future expenses during the…

Q: Wildhorse Company produces desk lamps. The information for June indicated that the selling price was…

A: The margin of safety is a notion in investing that states that investors should only buy assets when…

Q: ADD a single-line rule above the totals and a double-line rule below the totals to indicate that the…

A: All the transactions have been recorded according to the example shown in the image. Cash balance…

Step by step

Solved in 4 steps with 2 images

- Calculate the modified benefit-cost ratio for the alternative: Initial Investment Cost : 350000 Revenues : 150000 Costs : 55000 Salvage : 120000 n : 7 MARR : 0.1 a.1.4599 b.1.4101 c.1.6035 d.1.7354 e.1.6480Use the following alternatives to develop an incremental analysis choice table and answer the following questions. Alternative A Initial Cost - $15,000 Annual Revenue (Year 1-15) - $2500 Salvage Benefit (Year 15) - $2000 Alternative B Initial Cost - $25,000 Annual Revenue (Year 1-15) - $3500 Salvage Benefit (Year 15) - $5000 1. Determine the incremental rate of return IRRHigh-Low. Provide your answer as a percentage and round to the nearest hundredth. 2. Determine the internal rate of return for the higher cost alternative IRRHigh. Provide your answer as a percentage and round to the nearest hundredth. 3. Determine the internal rate of return for the lower cost alternative IRRLow. Provide your answer as a percentage and round to the nearest hundredth. Please answer all 3.Calculate the modified benefit-cost ratio for the alternative: Initial Investment Cost 350000 Revenues 150000 Costs 55000 Salvage 120000 n 7 MARR 0.1 Select one: a. 1.4599 b. 1.4101 c. 1.7354 d. 1.6035 e. 1.6480

- Calculate the conventional benefit-cost ratio for the alternative: Initial Investment 150000 Revenues 50000 Costs 20000 Salvage Value 50000 Useful life 10 MARR 0.1 Select one: a. 1.2114 b. 1.3130 c. 1.4659 d. 1.3681 e. 1.2960Use the incremental ROR analysis to select the one economically best project for a 10% MARR. Project A B C D Initial Cost -200,000 -275,000 -190,000 -350,000 Salvage Value +22,000 +35,000 +19,500 +42,000 Life 5 5 5 5Consider a project with the following information: Initial fixed asset investment = $515,000; straight-line depreciation to zero over the 4-year life; zero salvage value; price = $47; variable costs = $29; fixed costs = $207,000; quantity sold = 102,000 units; tax rate = 21 percent. How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Change in OCF/ Change in Q =?

- The accounting rate of return on the average cost of investment (ARRAC) is 19%. The project has a salvage value of P 8,000. The average cost of investment is P326,000 What is the accounting rate of return on the original cost of investment (ARROC)?a. 9.1%b. 9.3%c. 9.6%d. 9.9%A project is estimated to cost P120T, last 8 years & have a salvage value of P20T. The annual gross income is expected to average P50k & annual expenses is P5T. If capital is earning 10% determine if this is a desirable investment using annual cost method, what is the net cost. : a. 24,255.598 b. P24,756.951 c. 25,245.598 d. P27,535.412Consider a project with the following information: Initial fixed asset investment = $515,000; straight-line depreciation to zero over the 4-year life; zero salvage value; price = $47; variable costs = $29; fixed costs = $207,000; quantity sold = 102,000 units; tax rate = 21 percent. How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) find the change in OCF/Change in Q

- Pitt Company is considering two alternative investments. The company requires a 12% return from its investments. Neither option has a salvage value. Compute the IRR for both projects and recommend one of them. For further instructions on internal rate of return in Excel, see Appendix C.The following data have been estimated for two feasible investments, A and B, for which revenues as well as costs are known and which have different lives. If the minimum attractive rate of return is 10%, solve to find which feasible alternative is more desirable by using equivalent annual worth methods. Use the repeatability assumption. A B Investment(First) cost, Rs 3,500 5,000 Annual Revenue, Rs 1,900 2,500 Annual Cost, Rs 645 1,383 Useful life(years) 4 8 Salvage value 0 0A public works project has an initial cost of P2M, benefits with a present worth ofP3M and disbenefits with a present worth of P500,000.a.) What is the excess of benefits over costb.) Benefits to cost ratio?