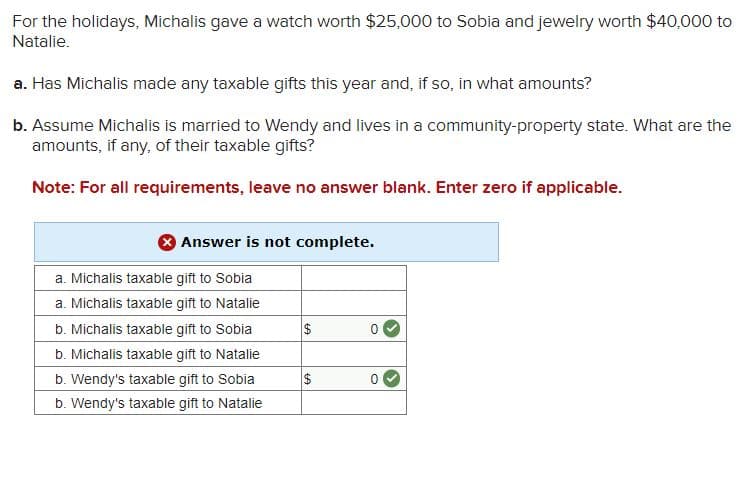

For the holidays, Michalis gave a watch worth $25,000 to Sobia and jewelry worth $40,000 to Natalie. a. Has Michalis made any taxable gifts this year and, if so, in what amounts? b. Assume Michalis is married to Wendy and lives in a community-property state. What are the amounts, if any, of their taxable gifts? Note: For all requirements, leave no answer blank. Enter zero if applicable. Answer is not complete. a. Michalis taxable gift to Sobia a. Michalis taxable gift to Natalie b. Michalis taxable gift to Sobia b. Michalis taxable gift to Natalie b. Wendy's taxable gift to Sobia $ $ b. Wendy's taxable gift to Natalie

For the holidays, Michalis gave a watch worth $25,000 to Sobia and jewelry worth $40,000 to Natalie. a. Has Michalis made any taxable gifts this year and, if so, in what amounts? b. Assume Michalis is married to Wendy and lives in a community-property state. What are the amounts, if any, of their taxable gifts? Note: For all requirements, leave no answer blank. Enter zero if applicable. Answer is not complete. a. Michalis taxable gift to Sobia a. Michalis taxable gift to Natalie b. Michalis taxable gift to Sobia b. Michalis taxable gift to Natalie b. Wendy's taxable gift to Sobia $ $ b. Wendy's taxable gift to Natalie

Chapter19: Family Tax Planning

Section: Chapter Questions

Problem 17CE

Related questions

Question

7

Transcribed Image Text:For the holidays, Michalis gave a watch worth $25,000 to Sobia and jewelry worth $40,000 to

Natalie.

a. Has Michalis made any taxable gifts this year and, if so, in what amounts?

b. Assume Michalis is married to Wendy and lives in a community-property state. What are the

amounts, if any, of their taxable gifts?

Note: For all requirements, leave no answer blank. Enter zero if applicable.

Answer is not complete.

a. Michalis taxable gift to Sobia

a. Michalis taxable gift to Natalie

b. Michalis taxable gift to Sobia

b. Michalis taxable gift to Natalie

b. Wendy's taxable gift to Sobia

$

$

b. Wendy's taxable gift to Natalie

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT