for the next 29 years. At a 7 percent discount rate, the present value of the lease payments totals $23 million Upon compietion, the bullding had an appraised value of $13 million and an estimated useful ife of 40 years. Required a Provide the journal entries the city should make in both the capital projects fund general journal and the governmental activities generai journal to record the lease at the date of inception. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollars, not in millons.) Fund I Governmental Activites Transaction General Journal Debit Credit 1 Record the lease at the date of inception Capital Projects Fund Govemmental Activities b. Which financial statementes) prepared at the end of the first year would show both the asset and the ability related to this capital lease? O Government wide statements of comprehensive income O Government wide statements of net position O Government wide statements of pront or loss O Government wide statements of revenue and expenditure c Would the accounting for the lease change if the lease included a cancellation clause? O ves ONo

for the next 29 years. At a 7 percent discount rate, the present value of the lease payments totals $23 million Upon compietion, the bullding had an appraised value of $13 million and an estimated useful ife of 40 years. Required a Provide the journal entries the city should make in both the capital projects fund general journal and the governmental activities generai journal to record the lease at the date of inception. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollars, not in millons.) Fund I Governmental Activites Transaction General Journal Debit Credit 1 Record the lease at the date of inception Capital Projects Fund Govemmental Activities b. Which financial statementes) prepared at the end of the first year would show both the asset and the ability related to this capital lease? O Government wide statements of comprehensive income O Government wide statements of net position O Government wide statements of pront or loss O Government wide statements of revenue and expenditure c Would the accounting for the lease change if the lease included a cancellation clause? O ves ONo

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 3P

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

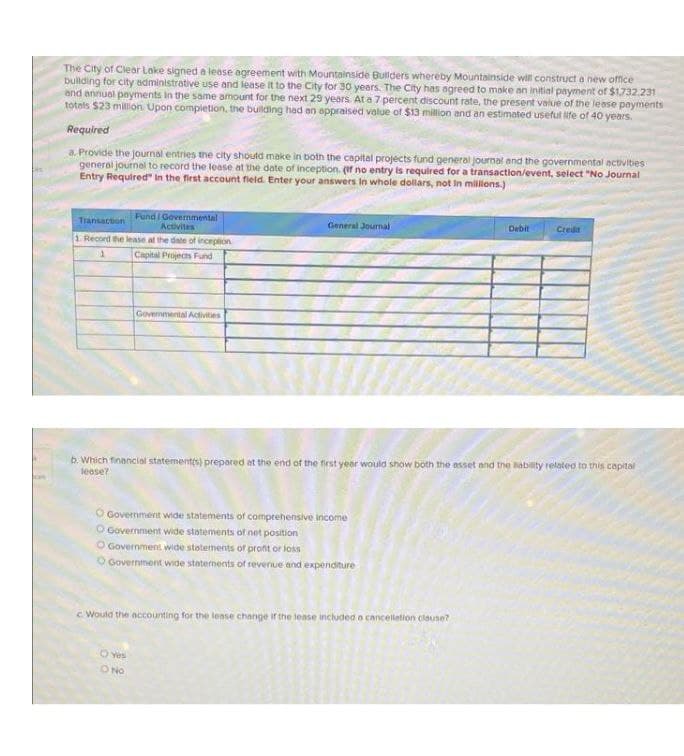

Transcribed Image Text:The City of Clear Lake signed a lease agreement with Mountainside Bullders whereby Mountainside will construct a new ofmce

bullding for city administrative use and lease It to the City for 30 years. The City has agreed to make an initial payment of $1732.231

and annual payments in the same amount for the next 29 years At a 7 percent discount rate, the present value of the lease payments

totals $23 million Upon completion, the building had an appraised value of $13 million and an estimated usefut life of 40 years.

Required

a. Provide the journal entries the city should make in both the capital projects fund general journal and the governmental activities

general journal to record the lease at the date of inception. (if no entry is required for a transaction/event, select "No Journal

Entry Required" in the first account fleld. Enter your answers In whole dollars, not in mililons.)

Fund I Govermmental

Activites

Transaction

General Journal

Debit

Credit

1. Record the lease at the date of inception

Capital Projects Fund

Govemmental Activities

b. Which financial statementts) prepared at the end of the first year would show both the asset and the lability related to this capital

lease?

O Government wide statements of comprehensive income

O Govermment wide statements of net position

O Government wide statements of pront or loss

O Government wide statements of revenue and expenditure

c Would the accounting for the lease change if the lease included o canceiletion clause?

O Yes

ONO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning