For the next (5) five questions: On September 1, 2022, when the prevailing market rate on similar instruments was at 5%, DEF Corporation acquired P5,000,000 bonds of Y Company. The bonds will be accounted as a financial asset at fair value through other comprehensive income. The bonds pay interest of 6% every March 1 and September 1 and will mature on September 1, 2027. The fair value of the bonds (dirty price) at year-end are presented below: December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 107 105 103 104 101 5. What is the total interest income to be recognized on the investment in bonds in 2023? 6. What is the amount of adjustment to the Unrealized Gain or Loss – OCI account to update the fair value of the investment on December 31, 2023? (Indicate if debit or credit) 7. Prepare the journal entry to record the receipt of interest on March 1, 2024. 8. What is the carrying value of the investment in bonds on December 31, 2024? 9. Bonds with face value of P2,000,000 were sold at fair value on December 31, 2025. After updating the related investment's fair value, what is the balance of Unrealized Gain or Loss – OCI to be “recycled" to the income statement in 2025? (Indicate if debit or credit)

For the next (5) five questions: On September 1, 2022, when the prevailing market rate on similar instruments was at 5%, DEF Corporation acquired P5,000,000 bonds of Y Company. The bonds will be accounted as a financial asset at fair value through other comprehensive income. The bonds pay interest of 6% every March 1 and September 1 and will mature on September 1, 2027. The fair value of the bonds (dirty price) at year-end are presented below: December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 107 105 103 104 101 5. What is the total interest income to be recognized on the investment in bonds in 2023? 6. What is the amount of adjustment to the Unrealized Gain or Loss – OCI account to update the fair value of the investment on December 31, 2023? (Indicate if debit or credit) 7. Prepare the journal entry to record the receipt of interest on March 1, 2024. 8. What is the carrying value of the investment in bonds on December 31, 2024? 9. Bonds with face value of P2,000,000 were sold at fair value on December 31, 2025. After updating the related investment's fair value, what is the balance of Unrealized Gain or Loss – OCI to be “recycled" to the income statement in 2025? (Indicate if debit or credit)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 6RE: Refer to the information in RE13-5. Assume that on June 30, Aggie received interest on the Smith...

Related questions

Question

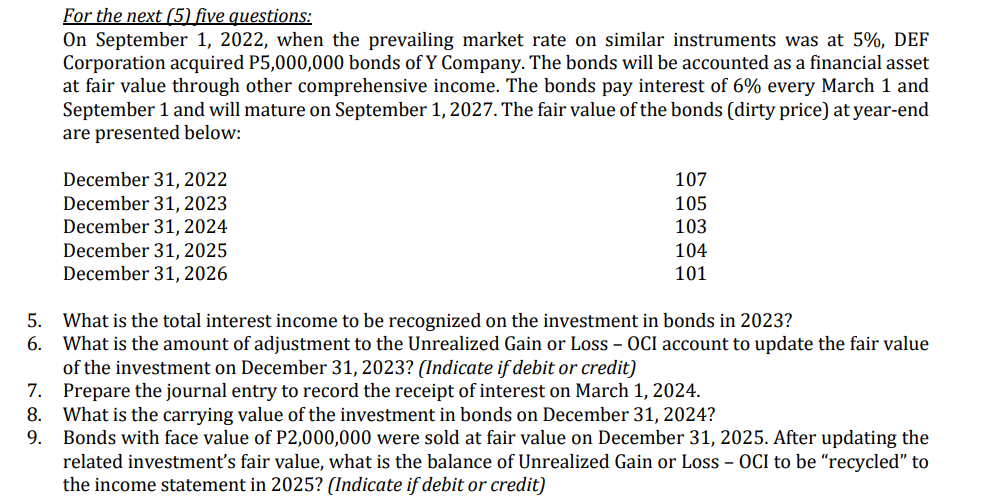

Transcribed Image Text:For the next (5) five questions:

On September 1, 2022, when the prevailing market rate on similar instruments was at 5%, DEF

Corporation acquired P5,000,000 bonds of Y Company. The bonds will be accounted as a financial asset

at fair value through other comprehensive income. The bonds pay interest of 6% every March 1 and

September 1 and will mature on September 1, 2027. The fair value of the bonds (dirty price) at year-end

are presented below:

December 31, 2022

December 31, 2023

December 31, 2024

December 31, 2025

December 31, 2026

107

105

103

104

101

5. What is the total interest income to be recognized on the investment in bonds in 2023?

6. What is the amount of adjustment to the Unrealized Gain or Loss – OCI account to update the fair value

of the investment on December 31, 2023? (Indicate if debit or credit)

7. Prepare the journal entry to record the receipt of interest on March 1, 2024.

8. What is the carrying value of the investment in bonds on December 31, 2024?

9. Bonds with face value of P2,000,000 were sold at fair value on December 31, 2025. After updating the

related investment's fair value, what is the balance of Unrealized Gain or Loss – OCI to be “recycled" to

the income statement in 2025? (Indicate if debit or credit)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College