For the nonconventional net cash flow series shown, the external rate of return per year using the MIRR method, with an investment rate of 20% per year and a borrowing rate of 8% per year, is closest to: Year 1 4. NCF, $ -40,000 +16,594 -29,000 +25,000 +58,045

Q: Consider the following three cash flow series: End of Year Cash Flow Series A Cash Flow Series B…

A: given, r=13% year cashflow B 0 -2500 1 2770 2 2470 3 2170 4 1870 5 1570 npv 5388.66…

Q: An arithmetic cash flow gradient series equals $500 in year 1, $600 in year 2, and amounts…

A: Computation:

Q: QUESTION 3 For the nonconventional net cash flow series shown, the external rate of return per year…

A: MIRR is techniques under Capital budgeting which is used to assess the cost and profitability of a…

Q: For the cash flows shown, determine the equivalent future worth in year 10 at an interest rate of…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: What is the present value of the following set of cash flows, discounted at 15.2% per year?…

A: Given:

Q: For the net cash flow series, find the external rate of return (EROR) using the MIRR method with an…

A: The given problem can be solved using MIRR function in excel.

Q: Consider the following three cash flow series: Determine the values of X and Y so that all three…

A: Cash flow for the series is computed using excel: Result is:

Q: Find the present worth of the following estimated cash flows. As indicated, some are expressed in…

A: Nominal interest rate is the rate of return which an investment yield to the investor. When the…

Q: please solve the question in detail and without using excel sheets or equations rather use…

A: The modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the…

Q: Problem 07.037 - MIRR calculation For the net cash flow series, find the external rate of return…

A: given information the investment rate = 16% borrowing rate = 11%

Q: The present worth in year 10 of a decreasing geometric gradient series was calculated using…

A: a

Q: For the nonconventional net cash flow series shown, the external rate of return per year using the…

A: Computation:

Q: A manufacturer projects the cash flows shown below. Determine the rate of return if the cash flows…

A: Rate of return at which the Present value of future cash flows is 0.

Q: Find the Modified Internal Rate of Return (MIRR) for the following annual series of cash flows,…

A: Modified internal rate of return assumes that positive cash flows are invested at a firm’s cost of…

Q: Consider the following cash flows over a 5-year period: −$100,000 @ t = 0;$35,000 @ t = 1; $45,000 @…

A: Net cash flows and cumulative cash flows Year Net Cash Flow Cumulative Cash Flow 0 -100,000…

Q: Apply the ERR method with ∈=12% per year to the following series of cash flows. Is there a single,…

A: ERR is the economic rate of return which measures the rate of profitability of a revenue-generating…

Q: Consider the following cash flow diagram. Compute the equivalent annual worth at i-12% $5,000 $6,000…

A: Cash-Flow diagram depicts amount of cash that is either received (inflows) or paid (outflows) over…

Q: For the nonconventional net cash flow series shown, the external rate of return per year using the…

A: Modified internal rate of return (MIRR) : help to determine the attractiveness of an investment.…

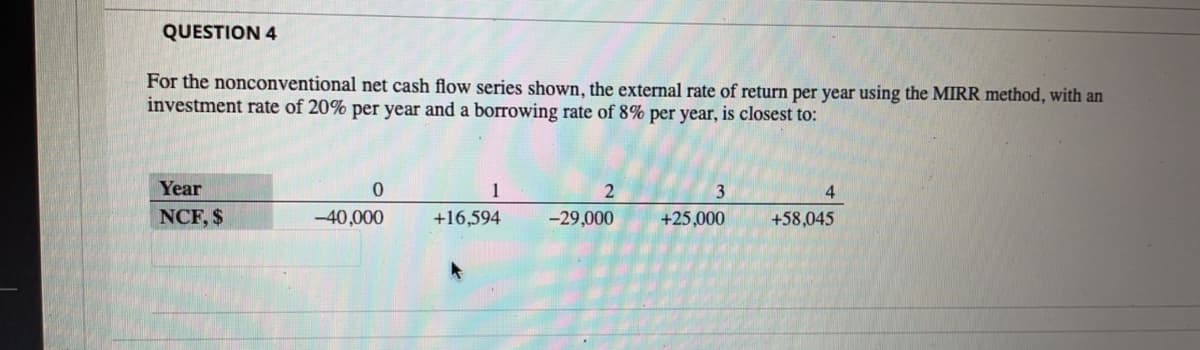

Q: QUESTION 4 For the nonconventional net cash flow series shown, the external rate of return per year…

A: MIRR is used to calculate the attractiveness of an investment. Modified internal rate of return…

Q: A cutting-edge product had the following net cash flow series during its first 5-year period on the…

A: Modified Internal Rate of Return (MIRR) is the financial measure which is used in capital budgeting…

Q: what is the simple payback period of following investment End of year Cash flow $ -26000 1 -3000 2-5…

A: The capital budgeting is a technique that helps to analyze the profitability of the project and…

Q: For the nonconventional net cash flow series shown, the ex return per year using the MIRR method,…

A: The MIRR is the modified rate of internal rate which assumes that reinvestment is different from the…

Q: For the cash flow shown below. Find the external rate of return (EROR) using rate of return approach…

A: Cash Flow Statement is a part of the Financial Statement of a company. It literally means a…

Q: The projected annual net cash flows associated with an investment opportunity are shown below in…

A: Here,

Q: Find the net present value (NPV) for the following series of future cash flows, assuming the…

A: NPV is the method under which cash inflows that are received during the lifetime of a project are…

Q: What is the net present value (NPV) of your proposed expansion into the Canada? Assume that the cash…

A: Required rate of return = 0.204 or 20.4% Net present value (NPV) is the difference between present…

Q: QUESTION 3 For the nonconventional net cash flow series shown, the external rate of return per year…

A:

Q: Compute the rate of return on an investment having the following cash flow. Year Cash Flow -S 1000…

A: To Find: Rate of return:

Q: For the nonconventional net cash flow series shown, the extermal rate of retum per year using the…

A: Excel Spreadsheet:

Q: According to Descartes' rule of signs, how many possible i values are there for the cash flows…

A: Information provided: Year Cashflows 0 -9000 1 4100 2 -2000 3 -7000 4 12000 5 700…

Q: For the nonconventional net cash flow series shown, the extermal rate of retum per year using the…

A: Excel Spreadsheet:

Q: Determine the rate of return per year for the cash flow series shown below. Year Cash Flow, $…

A: IRR is the rate at which the NPV is zero.

Q: quivalent worth for the annual cash flow series at an interest rate of 10% per year compounded…

A: The given problem can be solved using PV function in excel. PV function computes present worth for…

Q: Determine the rate of return per year for the cash flow series shown below. Year Cash Flow, $…

A: Internal rate of return is one of the modern techniques of capital budgeting that take into…

Q: nce of annual cash flows starting at the EOY zero, the value of A0 is $1,304.35 (which is a cash…

A: The present value of cash flow can be converted into equivalent uniform annual equivalent cash flow…

Q: Dalvi Incorporated is considering a new Investment. The table below lists the cash flows. Year Cash…

A: The payback period is the time period in which the Initial amount is fully recovered from future…

Q: Consider the following three cash flow series: End of Year Cash Flow Series A Cash Flow Series B…

A: NPV or net present value of any investment is calculated in order to know the present value of…

Q: flows for an investment with an economic life of 5 years are as follows: k0 = -10000, k1 = k2 = k3 =…

A: The net present value is the difference between the present value of cash flow and initial…

Q: Calculate the equivalent AW at i 10% per year for the following net cash flow: Year Cash flow, $…

A: Given: Year Cash flows 0 1 -$2,000.00 2 -$2,000.00 3 -$2,000.00 4 $5,000.00 5…

Q: Assuming a 1-year, money market account investment at 2.51 percent (APY), a 1.1% inflation rate, a…

A: After tax rate of return will be calculated to get the exact return a person earn from investment…

Q: Find teh present value of the streams of cash flows shown in the following table. Assume that…

A: Opportunity cost = 14%

Q: Consider a loan of $10,000 and the following pattern of cash flows. a. What is the interest rate…

A: IRR is the rate of return a project generates through its lifetime expressed in annual terms. It is…

Q: An arithmetic cash flow gradient series equals $350 in year 1, $450 in year 2, and amounts…

A: The cash flows that decrease or increase by the same amount is known as arithmetic cash flows.

Q: what is the simple payback period of following investment End of year Cash flow $ -26000 -3000 2-5…

A: Simple payback period is that period which shows the time in which initial investment can be…

Q: Find the present value of the stream of cash flows shown in the follwing tables. Assume that the…

A: Opportunity cost = 15%

Q: For the nonconventional net cash flow series shown, the external rate of return per year using the…

A: Given: Borrowing rate/finance rate = 8% Investment rate/re-invetsment rate = 20% When the cash flows…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Brook Corporation’s free cash flow for the current year (FCF0) was $3.00 million. Its investors require a 13% rate of return on (WACC = 13%). What is the estimated value of operations if investors expect FCF to grow at a constant annual rate of (1) −5%, (2) 0%, (3) 5%, or (4) 10%?Year Cash Inflow1 14,0002 19,0003 31,0004 05 06 07 130,000 what is the future value of this cash flow at 3%, 11%, and 18% interest rates at the end of year 7Exercise A3-17Present Values Use Present Value Tables or your calculator to complete the requirements below. Required: a. Determine the present value of a single $14,000 cash flow in 7 years if the interest (discount) rate is 8% per year. Round your answer to the nearest cent.$fill in the blank 1 b. Determine the number of periods for which $5,820 must be invested at an annual interest (discount) rate of 7% to produce an investment balance of $10,000. Round your answer to the nearest whole number of periods.fill in the blank 2 periods c. Determine the size of the annual cash flow for a 25-year annuity with a present value of $49,113 and an annual interest rate of 9%. One payment is made at the end of each year. Round your answer to the nearest cent.$fill in the blank 3 d. Determine the annual interest rate at which an investment of $2,542 will provide for a single $4,000 cash flow in 4 years. Round your answer to the nearest whole percentage rate (for example, 10.6% rounds to…

- Question content area top Part 1 Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of…Assuming a 1-year, money market account investment at 5.315.31 percent (APY), a 3.413.41 percent inflation rate, a 2828 percent marginal tax bracket, and a constant $70 comma 00070,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 5.315.31% (APY), a 2828% marginal tax bracket, and a constant $ 70 comma 000$70,000 balance, the after-tax rate of return is enter your response here%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 5.315.31% (APY), a 2828% marginal tax bracket, and a constant $ 70 comma 000$70,000 balance, the after-tax monetary return is $enter your response here. (Round to the nearest dollar.) Part 3 Given an after-tax return of 3.823.82% and an inflation rate of…Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…

- Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…a) An investment has the following cash flows: Time (years) Investment (outflow) Return (inflow) 0 RM1,000 1 RM250 2 RM250 3 RM250 4 RM250 5 RM250 10 RMX i) In order for the investment to return at an effective rate of interest of 9.5% per annum, what is ii) Suppose now that , and is paid at time , what is the effective annual rate of interest earned on this investment, to the nearest one decimal place? b) Aida Kamilia won RM1,000,000 in a contest, to be paid in twenty RM50,000 payments at yearly intervals. The first payment paid at the time of the contest. (Of course, the present value of her winnings is less than RM1,000,000). Aida Kamilia decided to keep each year to spend and deposit the remaining into account earning an annual effective rate of 5%. She chose the value of to be as large as possible so that at the moment of the 20th deposit, the account would have grown to such a size that it would provide Aida Kamilia at least per year in…

- What is the present value of the following cash flow stream at a rate of 15.0%? Years: 0 1 2 3 4 CFs: $0 $1,500 $3,000 $4,500 $6,000 Select one: a. $10,261 b. $12,453 c. $12,154 d. $10,859 e. $9,962Year Cash Flow 1 $ 1,375 2 1,495 3 1,580 4 1,630 If the discount rate is 8 percent, what is the future value of the cash flows in year 4? If the discount rate is 11 percent, what is the future value of the cash flows in year 4? If the discount rate is 24 percent, what is the future value of the cash flows in year 4?Year 0 1 2 3 4 5 6 Cash Flow -110000 30000 40000 20000 50000 20000 20000 Given the cash flows in the table above, calculate the payback period assuming the cash flows in years 1 to 4 occur evenly throughout the year. The required rate of return is 12%. Answer in years accurate to two decimal places.