For the sinking fund, use Table 12-1 to calculate the amount (in $) of the periodic payments needed to amount to the financial objective (future value of the annuity). (Round your answer to the nearest cent.) Sinking Fund Payment Payment Frequency Time Period (years) Nominal Rate (%) Interest Compounded Future Value (Objective) $ every year 14 8 annually $450,000 TABLE 12:1is attached

For the sinking fund, use Table 12-1 to calculate the amount (in $) of the periodic payments needed to amount to the financial objective (future value of the annuity). (Round your answer to the nearest cent.) Sinking Fund Payment Payment Frequency Time Period (years) Nominal Rate (%) Interest Compounded Future Value (Objective) $ every year 14 8 annually $450,000 TABLE 12:1is attached

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

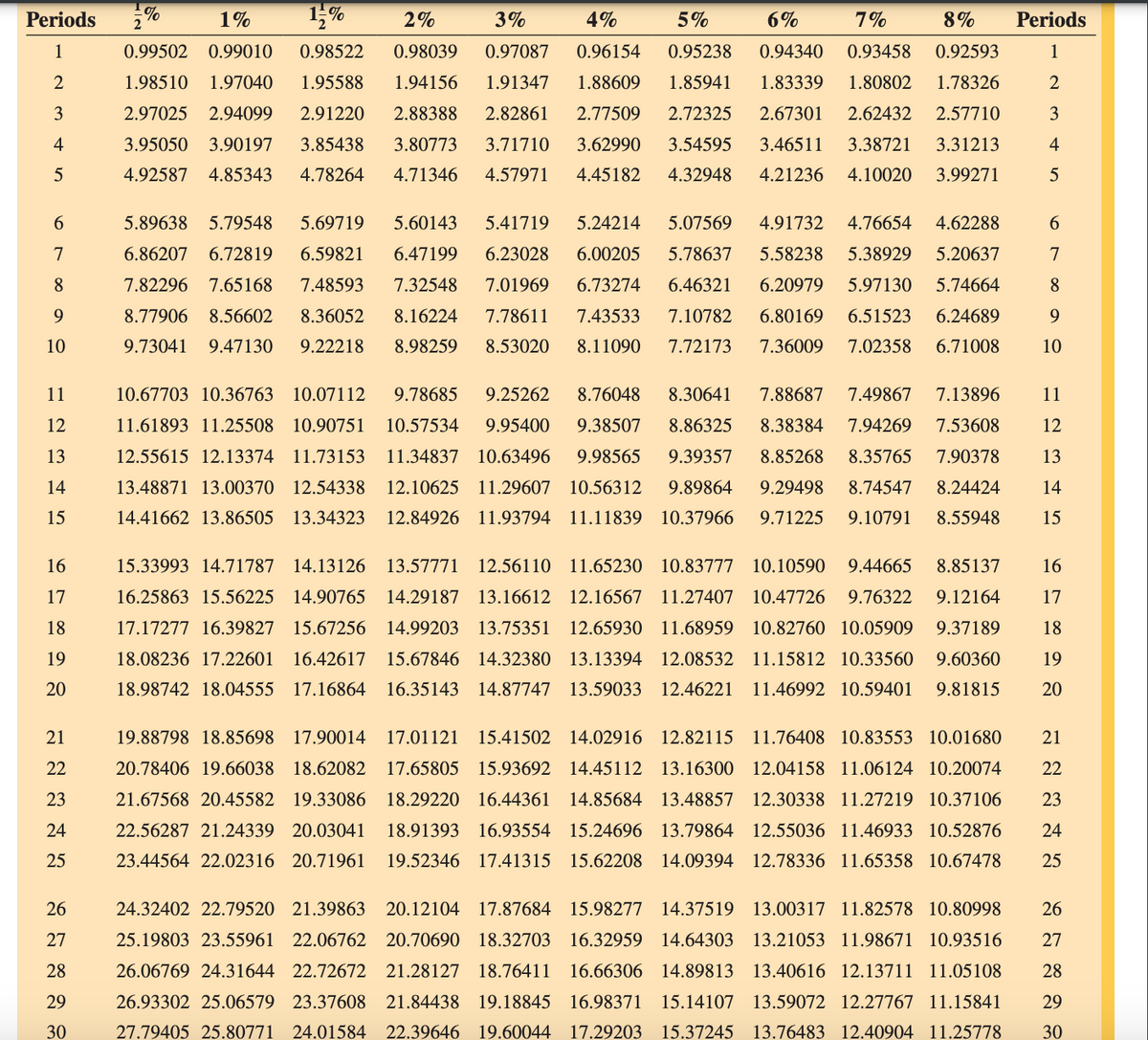

For the sinking fund, use Table 12-1 to calculate the amount (in $) of the periodic payments needed to amount to the financial objective (future value of the annuity ). (Round your answer to the nearest cent.)

| Sinking Fund Payment |

Payment Frequency |

Time Period (years) |

Nominal Rate (%) |

Interest Compounded |

Future Value (Objective) |

|---|---|---|---|---|---|

| $ | every year | 14 | 8 | annually | $450,000 |

TABLE 12:1is attached

Transcribed Image Text:Periods

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

-%

1%

1-%

2%

3%

4%

5%

6%

1.98510 1.97040

7%

0.99502 0.99010 0.98522 0.98039 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593

1.95588 1.94156 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326

2.91220 2.88388 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710

3.95050 3.90197 3.85438 3.80773 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213

4.92587 4.85343 4.78264 4.71346 4.57971 4.45182 4.32948 4.21236 4.10020 3.99271

2.97025 2.94099

2

5.41719 5.24214 5.07569 4.91732 4.76654 4.62288

5.89638 5.79548 5.69719 5.60143

6.86207 6.72819 6.59821 6.47199

6.23028

7.01969 6.73274

6.00205 5.78637

6.46321

5.58238 5.38929 5.20637

6.20979 5.97130 5.74664

7.82296 7.65168 7.48593 7.32548

8.77906 8.56602 8.36052 8.16224 7.78611 7.43533

9.73041 9.47130 9.22218 8.98259 8.53020 8.11090

7.10782 6.80169 6.51523 6.24689

7.72173 7.36009 7.02358 6.71008

8% Periods

1

2

3

4

5

19.88798 18.85698 17.90014 17.01121 15.41502 14.02916

20.78406 19.66038 18.62082 17.65805 15.93692 14.45112 13.16300

21.67568 20.45582 19.33086 18.29220 16.44361 14.85684 13.48857

22.56287 21.24339 20.03041 18.91393 16.93554 15.24696 13.79864

23.44564 22.02316 20.71961 19.52346 17.41315 15.62208

67∞a

8

24.32402 22.79520 21.39863 20.12104 17.87684 15.98277 14.37519

25.19803 23.55961 22.06762 20.70690 18.32703 16.32959 14.64303

26.06769 24.31644 22.72672 21.28127 18.76411 16.66306 14.89813

26.93302 25.06579 23.37608 21.84438 19.18845 16.98371 15.14107

27.79405 25.80771 24.01584 22.39646 19.60044 17.29203 15.37245

9

10

8.76048

7.13896

9.38507

10.67703 10.36763 10.07112 9.78685 9.25262

11.61893 11.25508 10.90751 10.57534 9.95400

12.55615 12.13374 11.73153 11.34837 10.63496 9.98565

13.48871 13.00370 12.54338 12.10625 11.29607 10.56312

14.41662 13.86505 13.34323 12.84926 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948

8.30641 7.88687 7.49867

8.86325 8.38384 7.94269 7.53608

9.39357 8.85268 8.35765 7.90378 13

9.89864 9.29498 8.74547 8.24424 14

HDBHS

11

12

16

15.33993 14.71787 14.13126 13.57771 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137

16.25863 15.56225 14.90765 14.29187 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 17

17.17277 16.39827 15.67256 14.99203 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 18

18.08236 17.22601 16.42617 15.67846 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 19

18.98742 18.04555 17.16864 16.35143 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 20

15

12.82115 11.76408 10.83553 10.01680 21

12.04158 11.06124 10.20074 22

12.30338 11.27219 10.37106 23

12.55036 11.46933 10.52876 24

14.09394 12.78336 11.65358 10.67478 25

13.00317 11.82578 10.80998 26

13.21053 11.98671 10.93516 27

13.40616 12.13711 11.05108 28

13.59072 12.27767 11.15841 29

13.76483 12.40904 11.25778 30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education