Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Jan. 31 Issued 41,000 shares at $10 share. Jun. 10 Issued 150,000 shares in exchange for land with a clearly determined value of $850,000. Aug. 3 Purchased 8,000 shares of treasury stock at $8 per share. A. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Jan. 31 Cash fill in the blank 6111daf96023f8f_2 fill in the blank 6111daf96023f8f_3 Common Stock fill in the blank 6111daf96023f8f_5 fill in the blank 6111daf96023f8f_6 Additional Paid-in Capital from Common Stock fill in the blank 6111daf96023f8f_8 fill in the blank 6111daf96023f8f_9 Jun. 10 Land fill in the blank 6111daf96023f8f_11 fill in the blank 6111daf96023f8f_12 Common Stock fill in the blank 6111daf96023f8f_14 fill in the blank 6111daf96023f8f_15 Additional Paid-in Capital from Common Stock fill in the blank 6111daf96023f8f_17 fill in the blank 6111daf96023f8f_18 Aug. 3 Treasury Stock fill in the blank 6111daf96023f8f_20 fill in the blank 6111daf96023f8f_21 Cash fill in the blank 6111daf96023f8f_23 fill in the blank 6111daf96023f8f_24 B. Calculate how many shares of stock are outstanding at August 3. fill in the blank 17f3b40d7ff5fc0_1 shares

Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Jan. 31 Issued 41,000 shares at $10 share. Jun. 10 Issued 150,000 shares in exchange for land with a clearly determined value of $850,000. Aug. 3 Purchased 8,000 shares of treasury stock at $8 per share. A. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Jan. 31 Cash fill in the blank 6111daf96023f8f_2 fill in the blank 6111daf96023f8f_3 Common Stock fill in the blank 6111daf96023f8f_5 fill in the blank 6111daf96023f8f_6 Additional Paid-in Capital from Common Stock fill in the blank 6111daf96023f8f_8 fill in the blank 6111daf96023f8f_9 Jun. 10 Land fill in the blank 6111daf96023f8f_11 fill in the blank 6111daf96023f8f_12 Common Stock fill in the blank 6111daf96023f8f_14 fill in the blank 6111daf96023f8f_15 Additional Paid-in Capital from Common Stock fill in the blank 6111daf96023f8f_17 fill in the blank 6111daf96023f8f_18 Aug. 3 Treasury Stock fill in the blank 6111daf96023f8f_20 fill in the blank 6111daf96023f8f_21 Cash fill in the blank 6111daf96023f8f_23 fill in the blank 6111daf96023f8f_24 B. Calculate how many shares of stock are outstanding at August 3. fill in the blank 17f3b40d7ff5fc0_1 shares

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 5EA: Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first...

Related questions

Question

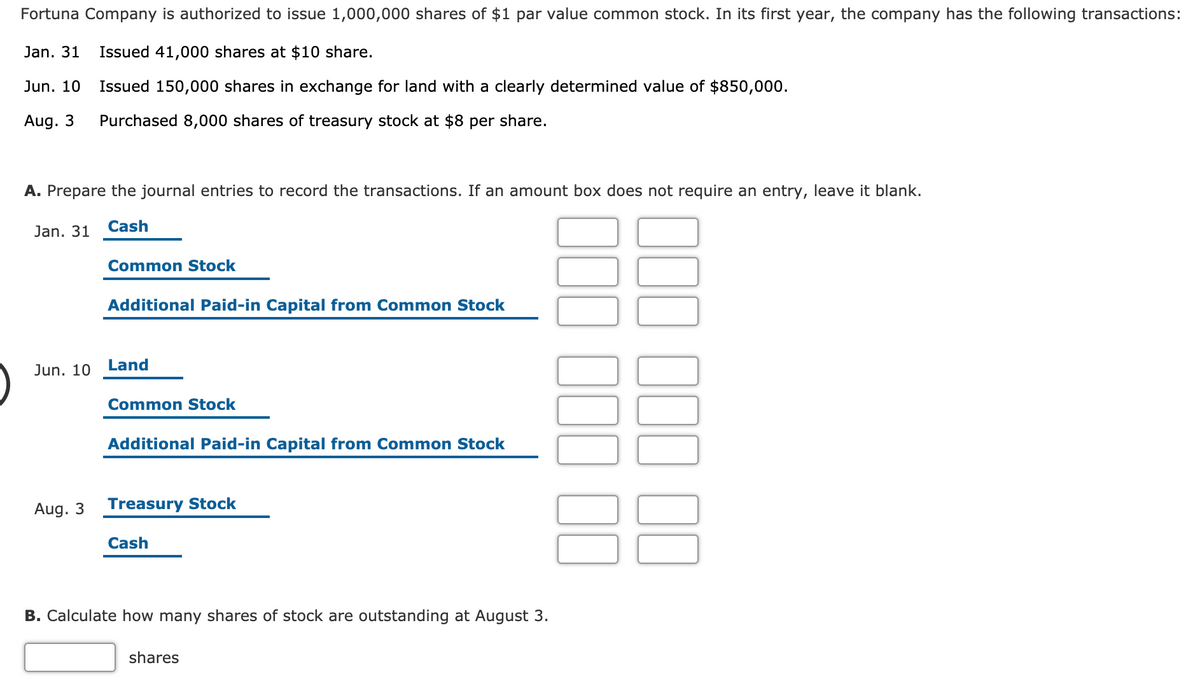

Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions:

| Jan. 31 | Issued 41,000 shares at $10 share. |

| Jun. 10 | Issued 150,000 shares in exchange for land with a clearly determined value of $850,000. |

| Aug. 3 | Purchased 8,000 shares of |

A. Prepare the

| Jan. 31 | Cash | fill in the blank 6111daf96023f8f_2 | fill in the blank 6111daf96023f8f_3 |

| Common Stock | fill in the blank 6111daf96023f8f_5 | fill in the blank 6111daf96023f8f_6 | |

| Additional Paid-in Capital from Common Stock | fill in the blank 6111daf96023f8f_8 | fill in the blank 6111daf96023f8f_9 | |

| Jun. 10 | Land | fill in the blank 6111daf96023f8f_11 | fill in the blank 6111daf96023f8f_12 |

| Common Stock | fill in the blank 6111daf96023f8f_14 | fill in the blank 6111daf96023f8f_15 | |

| Additional Paid-in Capital from Common Stock | fill in the blank 6111daf96023f8f_17 | fill in the blank 6111daf96023f8f_18 | |

| Aug. 3 | Treasury Stock | fill in the blank 6111daf96023f8f_20 | fill in the blank 6111daf96023f8f_21 |

| Cash | fill in the blank 6111daf96023f8f_23 | fill in the blank 6111daf96023f8f_24 |

B. Calculate how many shares of stock are outstanding at August 3.

fill in the blank 17f3b40d7ff5fc0_1 shares

Transcribed Image Text:Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions:

Jan. 31

Issued 41,000 shares at $10 share.

Jun. 10

Issued 150,000 shares in exchange for land with a clearly determined value of $850,000.

Aug. 3

Purchased 8,000 shares of treasury stock at $8 per share.

A. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank.

Jan. 31

Cash

Common Stock

Additional Paid-in Capital from Common Stock

Jun. 10

Land

Common Stock

Additional Paid-in Capital from Common Stock

Aug. 3

Treasury Stock

Cash

B. Calculate how many shares of stock are outstanding at August 3.

shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning