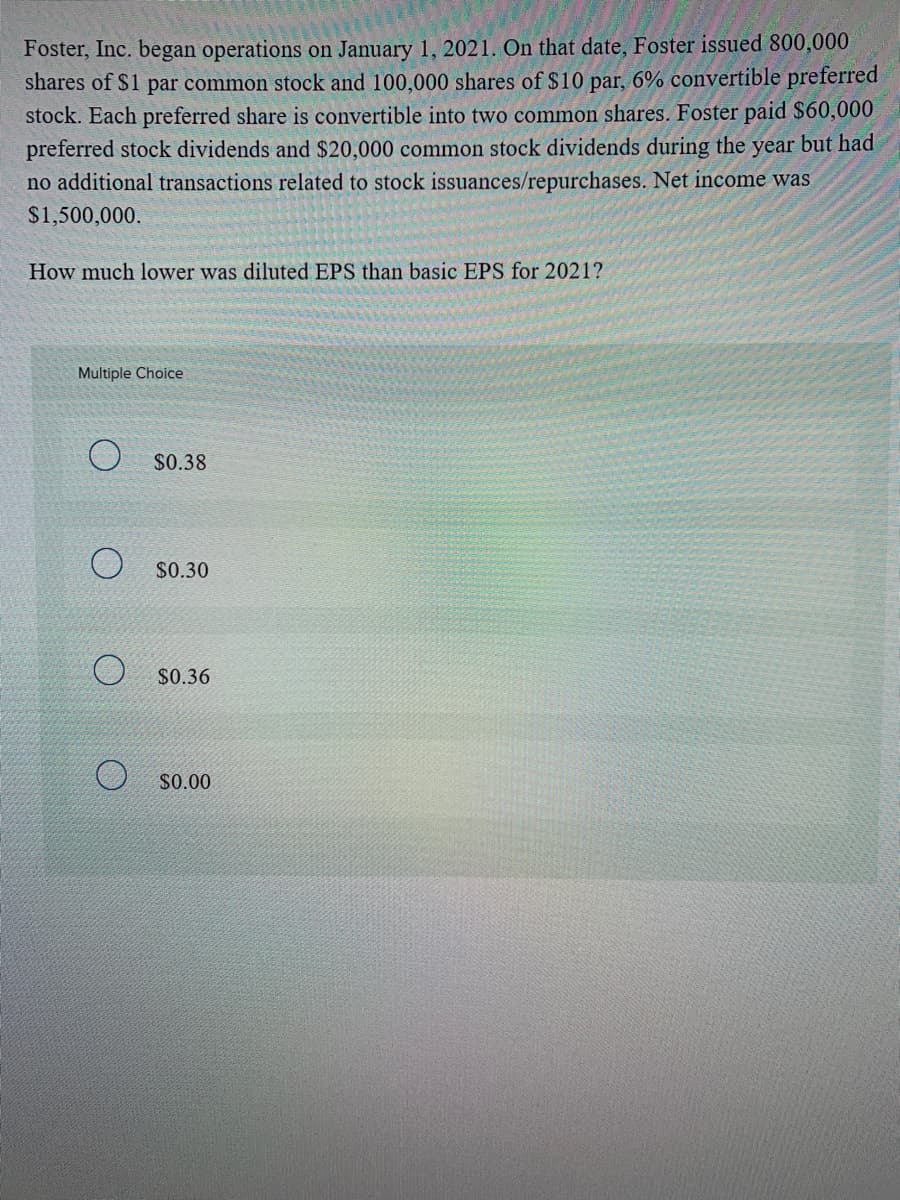

Foster, Inc. began operations on January 1, 2021. On that date, Foster issued 800,000 shares of S1 par common stock and 100,000 shares of $10 par, 6% convertible preferred stock. Each preferred share is convertible into two common shares. Foster paid $60,000 preferred stock dividends and $20,000 common stock dividends during the year but had no additional transactions related to stock issuances/repurchases. Net income was S1,500,000. How much lower was diluted EPS than basic EPS for 2021? Multiple Choice $0.38 $0.30 S0.36 O s0.00

Foster, Inc. began operations on January 1, 2021. On that date, Foster issued 800,000 shares of S1 par common stock and 100,000 shares of $10 par, 6% convertible preferred stock. Each preferred share is convertible into two common shares. Foster paid $60,000 preferred stock dividends and $20,000 common stock dividends during the year but had no additional transactions related to stock issuances/repurchases. Net income was S1,500,000. How much lower was diluted EPS than basic EPS for 2021? Multiple Choice $0.38 $0.30 S0.36 O s0.00

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 1R: Chen Corporation began 2012 with the following stockholders equity balances: The following selected...

Related questions

Question

Transcribed Image Text:Foster, Inc. began operations on January 1, 2021. On that date, Foster issued 800,000

shares of S1 par common stock and 100,000 shares of $10 par, 6% convertible preferred

stock. Each preferred share is convertible into two common shares. Foster paid $60,000

preferred stock dividends and $20,000 common stock dividends during the year but had

no additional transactions related to stock issuances/repurchases. Net income was

$1,500,000.

How much lower was diluted EPS than basic EPS for 2021?

Multiple Choice

O $0.38

$0.30

$0.36

$0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning