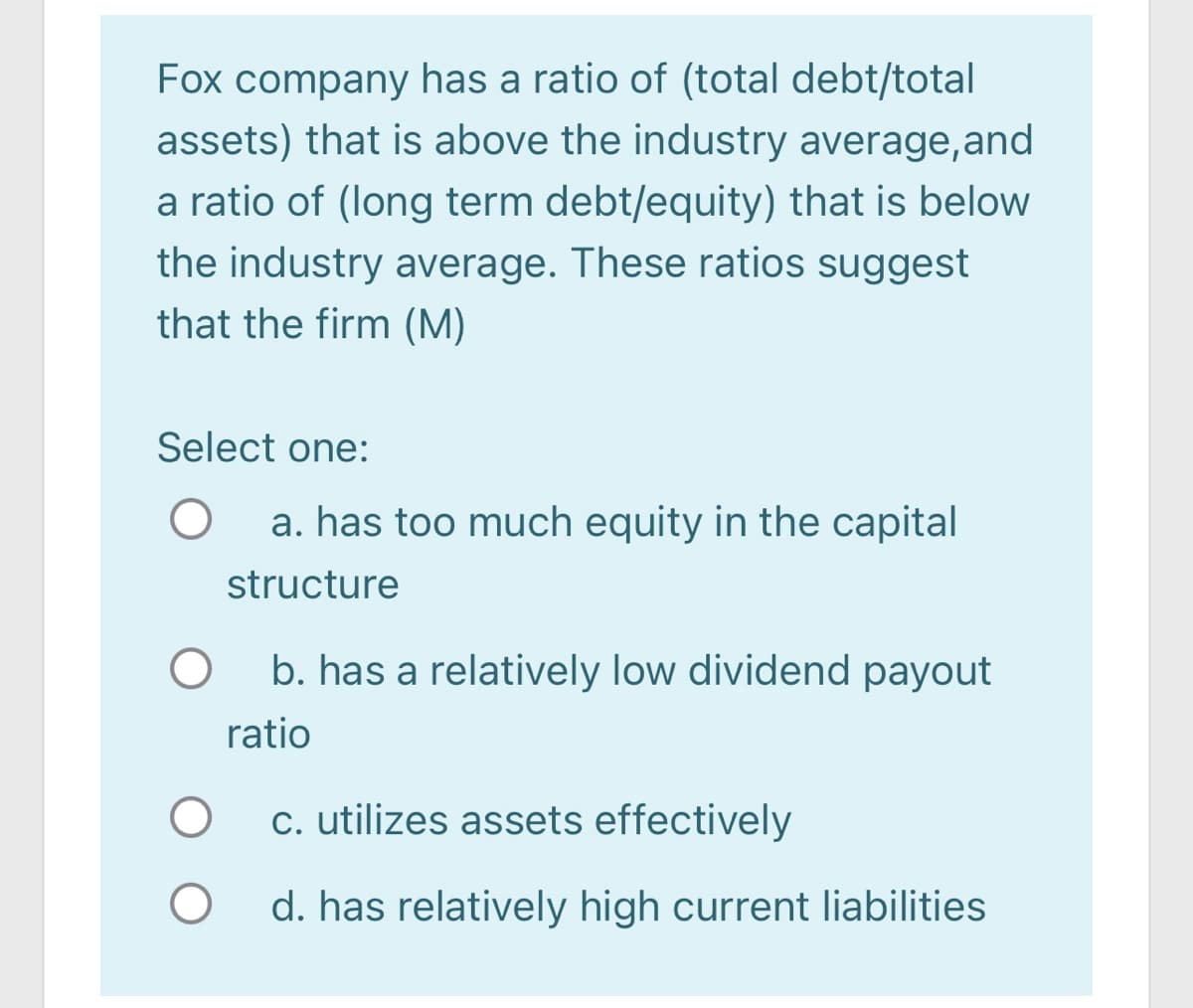

Fox company has a ratio of (total debt/total assets) that is above the industry average,and a ratio of (long term debt/equity) that is below the industry average. These ratios suggest that the firm (M)

Fox company has a ratio of (total debt/total assets) that is above the industry average,and a ratio of (long term debt/equity) that is below the industry average. These ratios suggest that the firm (M)

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 11P: The Rivoli Company has no debt outstanding, and its financial position is given by the following...

Related questions

Question

100%

Quiz Q9

Transcribed Image Text:Fox company has a ratio of (total debt/total

assets) that is above the industry average,and

a ratio of (long term debt/equity) that is below

the industry average. These ratios suggest

that the firm (M)

Select one:

a. has too much equity in the capital

structure

b. has a relatively low dividend payout

ratio

c. utilizes assets effectively

d. has relatively high current liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning